Answers

Answer:

$14,434

Explanation:

The question is asking to find the future value of making a payment of $7,000 every year for two years

The formula for finding future value =

FV = A x annuity factor

Annuity factor = {[(1+r) ^N ] - 1} / r

A = amount = $7,000

R = interest rate = 6.2%

N = 2

[(1.062) ^2 - 1 ] / 0.062 = 2.062

2.062 x $7,000 = $14,434

I hope my answer helps you

Answer: $14429

Explanation:

For this question, we will use the annuity formula to solve. The future value of an annuity is given as:

= C × ([(1+i)^n - 1] / i)

where,

C = The Cash flow per period

= $7000

i = the interest rate

= 6.2%

n = number of years

= 2

Future value of annuity will now be:

= 7000 × ([(1+0.062)²- 1]/0.062)

= 7000 × ([1.062)² - 1]/0.062)

= 7000 × [(1.1278 - 1)/0.062)]

= 7000 × (0.1278/ 0.062)

= 7000 × 2.0613

= $14429

The answer is $14429

Related Questions

Which of the following is a benefit to investing in a Mutual Fund? (3)

1. Most small investors don't buy or sell enough stock to be able to justify the sales commissions on their trades which makes diversification unrealistic.

2. Most small investors want to be able to invest relatively small amounts of money on a regular basis.

3. Most small investors don't have the time, knowledge or desire to do the research necessary to purchase individual stocks.

Answers

The following is a benefit to investing in a Mutual Fund:

1. Diversification

2. Professional management

3. Low minimum investment amount

A mutual fund is an investment vehicle that pools the money of many investors and invests it in a variety of different securities, such as stocks, bonds, and money market instruments. Mutual funds allow individual investors to invest in a diversified portfolio of securities with a relatively small amount of money. Mutual funds are managed by a professional fund manager who makes all of the investment decisions. The fund manager is responsible for selecting the securities that make up the fund, monitoring the performance of the investments, and managing the day-to-day operations of the fund. Mutual funds provide investors with a variety of benefits, including diversification, liquidity, and professional management. Mutual funds are a popular choice for investors looking for a simple, low-cost way to diversify their portfolios and access professional management.

To learn more about Mutual Fund

https://brainly.com/question/29837697

#SPJ4

I wonder why a company would issue new shares if the stocks when their intrinsic value is low.

Answers

When there is strong investment demand, the market value is usually higher than the intrinsic value, resulting in possible overvaluation. If there is a lack of investment demand, the company may be undervalued.

What exactly is intrinsic value?An asset's intrinsic value is a measure of its worth. This metric is determined by an objective calculation or a complex financial model. The intrinsic value of an asset differs from its current market price. Comparing it to the current price, on the other hand, can help investors determine whether the asset is undervalued or overvalued.

Cash flow is used in financial analysis to determine the intrinsic, or underlying, value of a company or stock. In option pricing, intrinsic value is defined as the difference between the option's strike price and the current market price of the underlying asset.

Learn more about intrinsic value with the help of the given link:

brainly.com/question/17054246

#SPJ1

I usually do not experience sudden intuitive thoughts.

Disagree

Agree

Answers

Answer:

Disagree

Explanation:

Steve Reese is a well-known interior designer in Fort Worth, Texas. He wants to start his own business and convinces Rob O’Donnell, a local merchant, to contribute the capital to form a partnership. On January 1, 2016, O’Donnell invests a building worth $130,000 and equipment valued at $140,000 as well as $60,000 in cash. Although Reese makes no tangible contribution to the partnership, he will operate the business and be an equal partner in the beginning capital balances.

To entice O'Donnell to join this partnership, Reese draws up the following profit and loss agreement:

- O'Donnell will be credited annually with interest equal to 10 percent of the beginning capital balance for the year

- O'Donnell will also have added to his capital account 15 percent of partnership income each year (without regard for the preceding interest figure) or $7,000, whichever is larger. All remaining income is credited to Reese.

- Neither partner is allowed to withdraw funds from the partnership during 2013. Thereafter, each can draw $5,000 annually or 20 percent of the beginning capital balance for the year, whichever is larger.

The partnership reported a net loss of $8,000 during the first year of its operation. On January 1, 2014, Terri Dunn becomes a third partner in this business by contributing $10,000 cash to the partnership. Dunn receives a 20 percent share of the business's capital. The profit and loss agreement is altered as follows:

- O'Donnell is still entitled to (1) interest on his beginning capital balance as well as (2) the share of partnership income just specified.

- Any remaining profit or loss will be split on a 5:5 basis between Reese and Dunn, respectively.

Partnership income for 2014 is reported as $64,000. Each partner withdraws the full amount that is allowed. On January 1, 2015, Dunn becomes ill and sells her interest in the partnership (with the consent of the other two partners) to Judy Postner. Postner pays $75,000 directly to Dunn. Net income for 2015 is $64,000 with the partners again taking their full drawing allowance On January 1, 2016, Postner withdraws from the business for personal reasons. The articles of partnership state that any partner may leave the partnership at any time and is entitled to receive cash in an amount equal to the recorded capital balance at that time plus 10 percent

a. Prepare journal entries to record the preceding transactions on the assumption that the bonus (or no revaluation) method is used. Drawings need not be recorded, although the balances should be included in the closing entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest dollar amount.)

b. Prepare journal entries to record the previous transactions on the assumption that the goodwill (or revaluation) method is used. Drawings need not be recorded, although the balances should be included in the closing entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest dollar amount.)

Answers

Entrepreneurs generally think differently about resources than do employee-managers in which of the following ways?

Answers

Managers want larger budgets; entrepreneurs work to do more with less.

How do entrepreneurs approach resources differently from employee-managers?Entrepreneurs have a distinct mindset when it comes to resources compared to employee-managers. While managers often seek larger budgets to accomplish their goals, entrepreneurs tend to focus on doing more with less.

This difference in perspective stems from the inherent nature of entrepreneurship which involves taking calculated risks and maximizing efficiency in resource allocation.

Entrepreneurs understand that resources, such as capital, time, and manpower, are limited and valuable. They recognize that acquiring substantial budgets may not always be feasible, especially in the early stages of a venture.

Read more about Entrepreneurs

brainly.com/question/29733441

#SPJ1

Marriage between individuals who have similar social characteristics

Answers

Homogamy is the marriage between individuals who have similar social characteristics.

What is homogamy?Homogamy is the practice that involves individuals marrying each other because they have similar characteristics. It involves marriage between individuals who are, in some culturally important way, similar to each other.

The similar characteristics in homogamy include:

Race/ethnicityReligious backgroundAgeEucation backgroundSocial backgroundTherefore, marriage between individuals who have similar social characteristics is know as homogamy.

Learn more about homogamy here : https://brainly.com/question/25626127

What is the approximate yield to maturity and the exact yield to maturity (use a calculator) for the $1,000 semi-annual bond? Assume this is issued in the United States: 10 years to maturity, 6 percent coupon rate, current price is $950.

Answers

Answer:

6.67% and 6.694%

Explanation:

The computation of the approximate yield to maturity and the exact yield to maturity is shown below:

For Approximate yield to maturity it is

= 2 × ((Face value - current price) ÷ (2 × time period) + face value × coupon rate ÷ 2) ÷ (Face value + current price) ÷ 2)

=2 × (($1,000 - $950) ÷ (2 × 10) + $1,000 × 6% ÷ 2) ÷ (($1,000 + $950) ÷ 2)

= 6.67%

Now

the Exact yield to maturity is

= RATE(NPER,PMT,-PV,FV)

= RATE (10 × 2, 6% × $1000 ÷ 2,-$950,$1,000) × 2

= 6.694%

In QuickBooks Online, where do you go to see all a company's categories organized into account types?

Answers

Answer:

The answer is "Chart of Accounts".

Explanation:

The chart of a financial report is the index of the general ledger of its financial accounts. In short, this is an organization tool that offers a digestible overview between subgroups of any money transfers performed by either a company in such an accounting period. It also using accounting graphs in Quickbooks to see those sections of a company grouped through account forms.

13. Because her standard deduction is greater than the amount she made, it turns out that

Susan never owed taxes. How large of a refund should she expect from the Federal

government if she follows through on filing her 1040 form?

Answers

Susan should not expect any refund from the Federal government since she never owed taxes.

What is Federal government taxes?Generally, Federal government taxes are taxes collected by the government from individuals and businesses to fund government services.

This simply means that the job of the federal government is sponsored by the business and individual that work within it, hence the payment asked of them is known as taxes.

These taxes can include incoame taxes, payroll taxes, corporate taxes, as well as excise, estate, and gift taxes.

Read more about taxes

https://brainly.com/question/16423331

#SPJ1

Hey guys i dont know who to vote for plz give me suggestions and reasons why

Answers

Answer:

me ig im just trying to get more points and brainliest

Explanation:

also im nice :) when people are not rude to me

3. Which of the following is NOT something you need to find out about in career planning?

a. the age of workers in an occupation

b. wages paid

c. education and training required

d. duties performed

Answers

Answer:

D

Explanation:

Sandra’s Purse Boutique has the following transactions related to its top-selling Gucci purse for the month of October. Sandra's Purse Boutique uses a periodic inventory system.

Date Transactions Units Unit Cost Total Cost

October 1 Beginning inventory 6 $ 790 $ 4,740

October 4 Sale 4

October 10 Purchase 5 800 4,000

October 13 Sale 3

October 20 Purchase 4 810 3,240

October 28 Sale 7

October 30 Purchase 8 820 6,560

$ 18,540

3. Using LIFO, calculate ending inventory and cost of goods sold at October 31

Answers

The cost of goods sold (COGS) was $17,260, and the ending inventory was $3,160 using the LIFO method.

The LIFO method (last-in, first-out) of inventory valuation requires that the most recent purchases of inventory be used first in the cost of products sold and ending inventory calculations. The ending inventory and cost of products sold at the end of October will be calculated using the LIFO method, based on the data given in the table.Based on the data given, the total units sold is 14, and the total units purchased is 17. Here's how to calculate the ending inventory and cost of products sold using the LIFO method:Step 1: The last purchase of 8 units at a cost of $820 each on October 30 is deducted from the inventory count, leaving 9 units.Step 2: The previous purchase of 4 units at a cost of $810 each on October 20 is deducted from the inventory count, leaving 5 units.Step 3: The next purchase of 5 units at a cost of $800 each on October 10 is deducted from the inventory count, leaving 0 units.Step 4: Based on the LIFO method, the cost of the ending inventory is the sum of the cost of the oldest units remaining in stock, which is 4 units at a cost of $790 each on October 1, totaling $3,160.Step 5: Based on the LIFO method, the cost of goods sold (COGS) is calculated by adding the total cost of units sold, which is 14 units at a cost of $820 each on October 30, 4 units at a cost of $810 each on October 20, and 5 units at a cost of $800 each on October 10, totaling $17,260.Therefore, the cost of goods sold (COGS) was $17,260, and the ending inventory was $3,160 using the LIFO method.For more questions on cost of goods sold (COGS)

https://brainly.com/question/24561653

#SPJ8

the risk of contracting some illness can be avoided by ?

Answers

if you have 2 children, ages 2 snd 4, how much should you record in step 3 of form w-2

Answers

Data related to the expected sales of laptops and tablets for Tech Products Inc. for the current year, which is typical of recent years, are as follows: Products Unit Selling Price Unit Variable Cost Sales Mix Laptops $1,000 $500 40% Tablets 600 300 60% The estimated fixed costs for the current year are $3,192,000. Required: 1. Determine the estimated units of sales of the overall (total) product, E, necessary to reach the break-even point for the current year.

Answers

Answer:

Break-even point (units)= 8,400

Explanation:

Giving the following information:

Laptops $1,000 $500 40%

Tablets 600 300 60%

Fixed costs= $3,192,000

To calculate the break-even point for the whole company, we need to use the following formula:

Break-even point (units)= Total fixed costs / Weighted average contribution margin

Weighted average contribution margin= (weighted average selling price - weighted average unitary variable cost)

Weighted average contribution margin= (0.4*1.000 + 0.6*600) - (0.4*500 + 0.6*300)

Weighted average contribution margin= $380

Break-even point (units)= 3,192,000 / 380

Break-even point (units)= 8,400

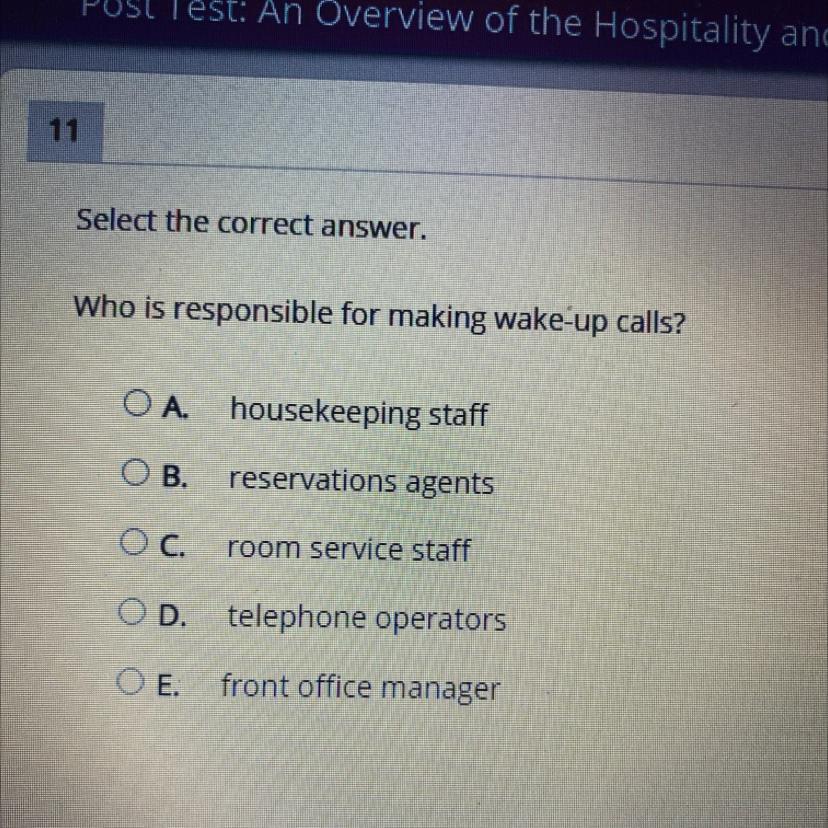

Select the correct answer.

Who is responsible for making wake-up calls?

O A. housekeeping staff

OB. reservations agents

Oc.

room service staff

OD. telephone operators

O E.

front office manager

Answers

Answer:

room service should be responsible for that.

Answer:

Telephone operators

Explanation:

The Reminder wakeup call or follow up call or 2nd Wake-up call need to be performed by the Front desk staff or the telephone operator. Once the 2nd wakeup call is completed ticket mark that reservation on the report and update the remarks section on the report. If the Guest does not answer to the 2nd reminder call then try again after 5 minutes.

What may make a small business loan challenging to obtain? List at least two potential obstacles.

Answers

Answer:

credit

work history

Explanation:

hope this helps

Can anyone please write a summery of everything that happened in the Great depression?

Answers

Acellus

Help Resources

If a corporation makes $20 million in one year,

after taxes are paid (at 35%), that company

will have a net income of

million

A $7

B. $10

C. $13

Answers

Answer:

A) 7 million

Explanation:

20 000 000 X 35÷100 = 7 million

Water Technology, Inc. Incurred the following costs during 20xt. The company sold all f ts products manufactured during the year

Direct material $5,000,000

Direct labor 2,400,000

Manufacturing overheadr

Utilities (primarily electricity) 120,000

Depreciation on plant and equipment 220,000

Insurance 150,000

Supervisory salaries 400,000

Property taxes 230,000

Selling costs

Advertising 165,000

Sales commissions 80,000

Administrative costs

Salaries of top management and staft 372,000

Office supplies 45,000

Depreciation on building and equipment 80,000

During 20x1, the company operated at about half of its capacity, due better. Jared Lowes, the marketing manager, forecasts a 20 percent growth in sales over the 20xt level.

Required Categorize each of the costs listed below as to whether it is most likely variable or fixed. Forecast the 20x2 cost amount for each of the cost items listed

Answers

Answer:

Part 1

Variable Costs

Direct material $5,000,000

Direct labor $2,400,000

Fixed Costs

$

Utilities (primarily electricity) 120,000

Depreciation on plant and equipment 220,000

Insurance 150,000

Supervisory salaries 400,000

Property taxes 230,000

Salaries of top management and staff 372,000

Office supplies 45,000

Depreciation on building and equipment 80,000

Part 2

Forecast the 20x2 cost amount for each of the cost items listed

Direct material ($5,000,000 x 1.20) $6,000,000

Direct labor (2,400,000 x 1.20) $2,880,000

Utilities (primarily electricity) $120,000

Depreciation on plant and equipment $220,000

Insurance $150,000

Supervisory salaries $400,000

Property taxes $230,000

Salaries of top management and staff $372,000

Office supplies $45,000

Depreciation on building and equipment $80,000

Explanation:

Variable Costs vary with the level of production. Examples are Direct Materials and Direct labor.

Fixed Costs remain constant for any production level. Examples are Depreciation and Utilities such as electricity.

A growth in Sales will affect the Variable Costs only. As production increases to meet the 20 percent growth in sales so do these costs since they vary in direct proportion to the level of production.

Jordan took a business trip from New York to Denver. She spent two days in travel, conducted business for nine days, and visited friends for five days. She incurred the following expenses:

Airfare $540

Lodging $3400

Meals $850

Entertainment of clients $680

How much of these expenses can Jordan deduct?

Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar value.

Answers

Total expenses = airfare + lodging + meals + entertainment of clients

Total expenses = $540 + $3400 + $850 + $680

Total expenses = $5470

Jordan can deduct the expenses she incurred during the nine days of business, which is calculated as:

Deductible expenses = (9/16) x total expenses

Deductible expenses = (9/16) x $5470

Deductible expenses = $3078.94

Therefore, Jordan can deduct $3079 of her expenses.

The deductible expenses include airfare, lodging, meals, and entertainment of clients incurred during those business days.

Calculating the deductible expenses:

Airfare: $540 (100% deductible)

Lodging: $3400 (allocated based on 9 business days out of the total 16 days)

Meals: $850 (allocated based on 9 business days)

Entertainment of clients: $680 (50% deductible)

The total deductible expenses can be calculated by adding the deductible portions of each expense. Jordan can deduct the sum of these expenses from her business trip.

To learn more about Deductible expenses, click here.

https://brainly.com/question/29612313

#SPJ2

"Group decision making is better". Do you agree or disagree with the statement? Give 3 reasons why do you say so?

Answers

Answer:

I agree because it make the group bring out more ideals

sometimes group decision make some people to voice out their problems

group decision help organization and firms to operate in good aims

Suppose you would like to make a global change to the font type and font color for all slides with the comparison layout. Which of the following would be the most efficient way to make this change?

Use Format Painter.

Use Animation Painter.

Use font commands on the Home tab.

Use slide master.

Answers

Answer:

D. Use slide master.

Explanation:

Edge

The brand changes form part of a strategic plan the group conceived in September last year called Ekuseni (the Zulu word for “dawn”)”

“Pick n Pay and its new CEO are taking the fight to competitors in a strategy..”

“Pick n Pay yesterday launched a new strategic plan…”

Evaluate the proposed strategy that Pick n Pay is planning to implement, including in your evaluation, the potential risks attached to the proposed new strategy

Answers

Pick n Pay's proposed strategy, known as Ekuseni, aims to implement changes in their brand and take the fight to competitors. The strategy, conceived in September last year, focuses on strategic planning and was launched recently. While the strategy holds potential for success, there are risks associated with its implementation.

1. Pick n Pay's proposed strategy, called Ekuseni, includes changes to their brand and a competitive approach to rivals. This strategic plan was conceived in September last year, with the term Ekuseni referring to "dawn" in Zulu.

2. The strategy aims to revamp the brand image and position Pick n Pay as a strong competitor in the market. By taking the fight to competitors, the company intends to gain a competitive edge and attract more customers.

3. The launch of the new strategic plan indicates that Pick n Pay is committed to implementing this strategy and achieving its goals. It demonstrates the company's intention to adapt and stay relevant in the evolving market.

4. However, like any strategic plan, there are potential risks associated with its implementation. These risks include customer resistance to changes in the brand, increased competition from rivals, and potential financial strains due to the cost of rebranding and marketing efforts.

5. Customer resistance is a common risk when brands undergo significant changes. If the proposed strategy doesn't resonate with Pick n Pay's target market, it could lead to a decline in customer loyalty and affect sales.

6. Additionally, taking the fight to competitors may trigger retaliatory actions from rival companies. This could result in intensified competition, price wars, and potential market share loss for Pick n Pay.

7. Finally, implementing a new strategic plan involves financial investments. The cost of rebranding, marketing campaigns, and operational changes may strain the company's resources, potentially impacting its financial stability.

In conclusion, while Pick n Pay's proposed strategy holds promise for the company's growth and competitiveness, there are risks involved. Proper planning, market research, and effective execution will be crucial to mitigating these risks and ensuring the success of the strategy.

For more such questions on strategy, click on:

https://brainly.com/question/28561700

#SPJ8

Consider a firm redesigning its logistics network. What are the advantages of having a small number of centrally located warehouses? What are the advantages of having a larger number of warehouses closer to the end customers?

Answers

Small centrally located warehouses offer cost efficiency and simplified inventory management, while larger warehouses closer to customers provide faster delivery, better customer service, and cost savings in shipping.

Having a small number of centrally located warehouses offers several advantages in a firm's logistics network:

Cost Efficiency: Centralized warehouses can lead to cost savings in terms of inventory management, transportation, and operational overheads. With fewer warehouses, the firm can benefit from economies of scale in procurement, storage, and distribution.

Simplified Inventory Management: Managing inventory becomes more streamlined when there are fewer warehouses. It allows for better control and visibility over stock levels, reducing the risk of stockouts or overstocking.

Faster Transit Times: With centrally located warehouses, products can be shipped more quickly to various regions since they are closer to major transportation hubs. This reduces lead times and improves overall customer satisfaction.

Improved Coordination: Centralized warehouses facilitate better coordination and synchronization of supply chain activities. It becomes easier to manage inbound and outbound logistics, optimize transportation routes, and consolidate shipments.

On the other hand, having a larger number of warehouses closer to end customers provides the following advantages:

Faster Delivery: Proximity to end customers enables faster order fulfillment and delivery. Products can reach customers more quickly, reducing transit times and improving responsiveness.

Enhanced Customer Service: Local warehouses allow for better customization and personalization of service. They can cater to specific regional preferences, offer faster response times to customer queries, and handle returns or exchanges more efficiently.

Lower Shipping Costs: By locating warehouses closer to customers, transportation costs can be reduced as products travel shorter distances. This can lead to cost savings in shipping expenses.

Flexibility and Redundancy: Having multiple warehouses distributed geographically provides redundancy and flexibility in the supply chain. It mitigates the risk of disruptions, such as natural disasters or transportation issues, as the firm can rely on alternative warehouse locations.

In summary, a small number of centrally located warehouses offer cost efficiency and streamlined inventory management, while a larger number of warehouses closer to end customers provide faster delivery, improved customer service, lower shipping costs, and increased flexibility.

For more question on warehouses visit:

https://brainly.com/question/23941356

#SPJ8

plants are in threatened state and getting rare. Discuss in the class and prepare a list of causes of rareness of animals and plants. 5.3.1 Rare Animals

Answers

A group of creatures that are extremely rare, scarce, or infrequently encountered is referred to as a rare species.

Even though extinctions happen naturally, the pace of plant and animal extinctions today is substantially higher than it was previously. The main factor contributing to greater extinction rates is habitat loss.

The introduction of harmful nonnative species, pollution, disease transmission, and habitat changes are some additional causes. Overexploitation of wildlife for commercial gain is another. Species that are in risk of going extinct include those plants and animals that have become so scarce.

Animals and plants that are threatened with extinction across all or a sizable portion of their range are those that are very likely to do so in the near future. The most species are in danger from overuse of natural resources, such as overfishing, overhunting, and deforestation of forests. The extension of land for agriculture, cattle, wood, and aquaculture is another significant industry in the world.

To know more about Species visit:

https://brainly.com/question/2434932

#SPJ9

How do patents help promote competition?

A. They support people who wish to copy and profit from registered inventions

B. Knowing inventions can be protected and encourages people to create new things

C. The owner of the patent can prevent other people and businesses from innovation

D. A patent can discourage businesses from offering new or improved goods and services

Answers

Gotta make the answer longer

The answer is B. Knowing inventions can be protected and encourages people to create new things. Please give the other person Brainliest. They deserve it.

Hope this helps! :)

[Tutorial] 888^210^2883 Fix Login Problems of QuickBooks Online on Chrome & Mac

Answers

Answer:

what is this can you explain?

82) At the current price of $2, how much does the firm want to produce?

83) At the current price of $2 what is the surplus or shortage in this industry?

84) At what price will the market be in equilibrium?

85) What will be the quantity supplied by each firm at this equilibrium?

86) What will the firms profit be at equilibrium?

87) In the long-run will the industry stay at this equilibrium?

Answers

Answer:

84) The equilibrium is the only price where quantity demanded is equal to quantity supplied. At a price above equilibrium, like 1.8 dollars, quantity supplied exceeds the quantity demanded, so there is excess supply.

85) The equilibrium price and quantity are where the two curves intersect. The equilibrium point shows the price point where the quantity that the producers are willing to supply equals the quantity that the consumers are willing to purchase. This is the ideal quantity to supply

86) The existence of economic profits attracts entry, economic losses lead to exit, and in long-run equilibrium, firms in a perfectly competitive industry will earn zero economic profit.

87) The industry is in long-run equilibrium when a price is reached at which all firms are in equilibrium (producing at the minimum point of their LAC curve and making just normal profits). Under these conditions there is no further entry or exit of firms in the industry, given the technology and factor prices.

Explanation:

i dont know 82 or 83 sorry

in preparation of standard cost we consider what situation macroeconomics or microeconomics???

Answers

When preparing standard costs, we primarily consider microeconomics, which is the study of the behavior of individual consumers, firms, and industries. Standard cost is the estimated cost of producing a unit of product or service, based on historical data and budgeted costs.

It is used as a benchmark to compare actual costs with expected costs and to analyze the variances between them. In order to determine standard costs, we need to consider the cost of each individual input such as direct materials, direct labor, and overheads. This analysis is done at the microeconomic level because it involves the behavior and decision-making of individual firms and their interactions with suppliers, customers, and competitors.

The macroeconomic factors such as inflation, interest rates, and unemployment rates may also have an impact on the cost of production but these are generally outside the scope of standard cost analysis. Therefore, while macroeconomics can indirectly influence the cost of production, the focus of standard cost analysis remains on the microeconomic factors that affect the cost of individual inputs.

Overall, standard cost preparation involves a detailed microeconomic analysis to determine the estimated cost of producing a product or service, which is then compared with the actual costs to identify any variances and improve the cost efficiency of the firm.

For more such questions on standard costs

https://brainly.com/question/17177941

#SPJ11