Summer Tyme, Inc., is considering a new 3-year expansion project that requires an initial fixed asset investment of $682,103. The fixed asset will be depreciated straight-line to 63,154 over its 3-year tax life, after which time it will have a market value of $94,960. The project requires an initial investment in net working capital of $69,719. The project is estimated to generate $203,451 in annual sales, with costs of $141,729. The tax rate is 0.27 and the required return on the project is 0.09. What is the aftertax salvage value in year 3? (Make sure you enter the number with the appropriate +/- sign)

Answers

Summer Tyme, Inc., is considering a new 3-year expansion project that requires an initial fixed asset investment of $682,103. The fixed asset will be depreciated straight-line to 63,154 over its 3-year tax life, after which time it will have a market value of $94,960. The project requires an initial investment in net working capital of $69,719. The project is estimated to generate $203,451 in annual sales, with costs of $141,729. The tax rate is 0.27 and the required return on the project is 0.09.The after-tax salvage value in year 3 is $94,960.

To calculate the after-tax salvage value in year 3, we need to consider the tax implications when selling the asset. The after-tax salvage value is the amount received from selling the asset minus the taxes owed on the capital gain.

The formula to calculate the after-tax salvage value is as follows:

After-Tax Salvage Value = Market Value - Tax on Capital Gain

Given information:

Market Value = $94,960

Tax Rate = 0.27

To calculate the tax on the capital gain, we need to determine the difference between the market value and the book value (the remaining depreciable amount) of the asset.

Book Value = Initial Fixed Asset Investment - Accumulated Depreciation

Book Value = $682,103 - $63,154 = $618,949

Capital Gain = Market Value - Book Value

Capital Gain = $94,960 - $618,949 = -$523,989

Since the capital gain is negative, indicating a loss, there is no tax liability. Therefore, the tax on capital gain is zero.

After-Tax Salvage Value = Market Value - Tax on Capital Gain

After-Tax Salvage Value = $94,960 - $0 = $94,960

The after-tax salvage value in year 3 is $94,960.

To learn more about capital gain visit-

https://brainly.com/question/28513905

#SPJ11

Related Questions

Unit contribution margin divided by the constrained resource per unit is the formula for computing:

a. The optimal number of units that should be manufactured.

b. Degree of operating leverage.

c. Contribution margin per unit of constrained resource.

d. Sales mix

Answers

Unit contribution margin divided by the constrained resource per unit, which is used for computing the contribution margin per unit of constrained resource. The correct option is c.

The formula "Unit contribution margin divided by the constrained resource per unit" is used to calculate the contribution margin per unit of the constrained resource. The constrained resource is the resource that limits the production of a product or service, such as a machine, labor, or raw material.

By calculating the contribution margin per unit of the constrained resource, a business can determine which products or services generate the highest profit contribution for each unit of the constrained resource used. This information can be used to make decisions about how to allocate the constrained resource among different products or services, to maximize profitability.

The optimal number of units that should be manufactured would require additional information beyond the formula given. The degree of operating leverage is calculated by dividing the contribution margin by the operating income, and the formula given does not include any information about operating income. Sales mix refers to the relative proportion of different products or services sold and is not related to the formula provided.

The correct option is c.

Learn more about Contribution margin: https://brainly.com/question/24881206

#SPJ11

Which of the following should employers prevent in order to ensure the safety and health of workers in regards to machine guarding?

A) Providing employees with safe tools and equipment

B) Providing employees with personal protective equipment

C) Allowing workers to use a machine without training

D) Ensuring employees are trained in hazard recognition

———————————————

Which of the following types of machine guard is generally preferred because of its simplicity and durability?

A) Interlocked

B) Fixed

C) Self-adjusting

D) Adjustable

Answers

Answer:

1st C 2nd one B

Explanation:

Answer:

1.) C 2.) B

Explanation:

Suppose a manger and a worker interact as follows. The manager decides whether to hire (h) or not to hire (n) the worker. If the manager does not hire the worker, then the game ends. When hired, the worker chooses to exert either high effort (H) or low effort (L). On observing the workers effort, the manager chooses to retain (r) or fire (f) the worker. Under the formal definition of a strategy in a sequential game, does n (not hire) describe a strategy for the manager? Explain.

Answers

In the context of a sequential game, a strategy is a plan of action that a player will take based on the actions of other players and the information available to them at each step of the game.

In the scenario described, the manager has two potential strategies: to hire (h) or not to hire (n) the worker. If the manager decides not to hire the worker, the game ends and the worker has no opportunity to take any further actions.

Therefore, in this case, "n" (not hire) can be considered a strategy for the manager as it represents a plan of action that the manager will take based on the information available to them and their assessment of the situation.

The manager has decided that, based on their evaluation of the worker and the situation, it is not in their best interest to hire the worker.

To learn more about sequential game refer here

https://brainly.com/question/14182842#

#SPJ11

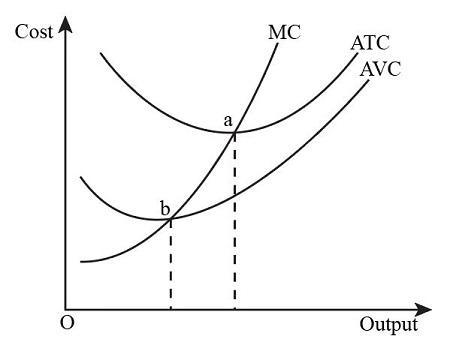

Please I need support with the following Economics questions:

You are manager of a firm with the following short-run production function: Q = L1/3. Fixed costs are R160 000, the wage rate is R10.

(1) Graphically illustrate and explain the marginal cost, average variable cost and average total cost curves of your firm, given the information above.

(2) Based on the answer in (1), graphically illustrate and explain the supply curve of the firm.

(3) Suppose the firm faces the following demand curve: P = 14000 - 100Q, graphically illustrate and explain the market equilibrium faced by the firm.

(4) At what point would you set the production target and price for the firm? Graphically illustrate how far, in terms of price and output, would the firm deviate from economic efficiency.

(5) Suppose you intend to increase your revenue. Would you cut prices, given the information above?

Answers

(1) MC (marginal cost), AVC (average variable cost), and ATC (average total cost) curves: MC intersects AVC and ATC at their minimums.

(2) Supply curve: Portion of MC above AVC curve.

(3) Market equilibrium: Intersection of demand and supply curves.

(4) Production target and price: Intersection of MC and demand curves.

(5) Cutting prices: Depends on elasticity, cost structure, and market conditions.

(1) Graphically illustrating the cost curves:

To find the marginal cost (MC) curve, we need to take the derivative of the total cost (TC) function with respect to quantity (Q).

Total Cost (TC) = FC + VC = R160,000 + (W × L)

Given the wage rate (W) of R10 and the production function \(Q = L^{(1/3)\), we can rewrite the cost function as:

\(TC = R160,000 + (R10 * L^{(1/3)})\)

To find the marginal cost, we take the derivative of TC with respect to Q:

\(MC = dTC/dQ = d/dQ (R160,000 + R10 * L^{(1/3)})\)

Differentiating the above expression, we get:

\(MC = R10/(3Q^{(2/3)})\)

The average variable cost (AVC) is given by the variable costs (VC) divided by the quantity (Q):

\(VC = W * L = R10 * L^{(1/3)}\)

\(AVC = VC/Q = (R10 * L^{(1/3)})/Q = R10/(Q^{(2/3)})\)

The average total cost (ATC) is given by the total cost (TC) divided by the quantity (Q):

\(ATC = TC/Q = (R160,000 + R10 * L^{(1/3)})/Q\)

The graph will show three cost curves: MC, AVC, and ATC. The MC curve will intersect the AVC and ATC curves at their minimum points. The AVC curve will be U-shaped, and the ATC curve will be U-shaped as well but slightly above the AVC curve due to the inclusion of fixed costs.

(2) Graphically illustrating the supply curve:

A firm's supply curve is represented by the portion of the MC curve above the average variable cost (AVC) curve. The supply curve will be the portion of the MC curve that lies above the AVC curve. It will intersect the AVC curve at the minimum point of the AVC curve and will be upward sloping.

(3) Graphically illustrating the market equilibrium:

The graph will show the demand curve and the supply curve. The market equilibrium is the point where the demand curve intersects the supply curve. At this point, the quantity demanded and the quantity supplied are equal, establishing the equilibrium price and quantity.

(4) Setting the production target and price for the firm:

The graph will show the demand curve, the MC curve, and the point of intersection. The quantity and price at the point of intersection represent the production target and price for the firm. The firm deviates from economic efficiency when the MC is not equal to the market price (P) at the equilibrium quantity. The difference between MC and P represents the inefficiency or deviation from economic efficiency.

(5) Cutting prices to increase revenue:

Based on the given information, the firm's cost structure and demand curve, cutting prices may not necessarily lead to increased revenue. Lowering prices could lead to higher demand, but it may also result in lower profit margins if the decrease in price is not offset by a sufficient increase in quantity sold. A thorough analysis of the market conditions, competitors, and cost-revenue relationships would be necessary to make an informed decision about cutting prices to increase revenue.

To learn more about marginal follow the link:

https://brainly.com/question/7781429

#SPJ4

The weekly Kroger advertisement states that five-pound chubs of ground chuck are available for eighty-nine cents per pound. Arlene sees the advertisement; she realizes that ground chuck has not been priced this low in quite some time, so she hurries to the store to purchase some. Arlene loads seven chubs of ground chuck in her shopping cart. When she goes to the checkout to pay, however, the cashier informs Arlene that the price in the advertisement is a typo and that the correct price is $1.89 per pound. Arlene insists that the store must honor the price listed in the advertisement, because it is an offer that she has just accepted. The cashier calls the store manager for a decision. The store manager will likely explain to Arlene:_________.

i. that the advertisement is a valid offer because it is in writing.

ii. that the advertisement is a valid offer, and the store must honor the price in the advertisement.

iii. that advertisements are not offers, but merely a request for offers.

iv. that the advertisement is a valid offer because its terms are definite.

Answers

The manager would likely explain to Arelene that advertisements are not offers, but merely a request for offers.

What is an offer?In business, an offer is defined as a formal proposal to be part of a contract. In the case of stores, they offer products but the customer needs to express the proposal or make the offer by showing he/she wants to buy this product. Afterward, the store can accept the offer if the price is convenient for it.

What happens when the price in the advertisement is wrong?In the U.S. there are no laws that force stores to sell the product at an incorrect price displayed in the advertising. This is because there is a contract between the store and the customer only if the store accepts the money the customer is willing to pay.

Based on this, the store does not have the obligation to honor the price in the advertising as advertisements are only requests for offers.

Learn more about advertising in: https://brainly.com/question/25556823

which of the following is a result of controlling?

Answers

The end result of controlling is "Managers make sure the organization's sources are being used as planned and that the employer is meeting its goals for great and safety."

Controlling entails monitoring and comparing the agency's sports to make sure that they align with the installed plans and targets. By correctly controlling, managers can affirm that assets which include human, financial, and bodily belongings are utilized correctly and correctly.

They additionally make sure that the corporation is on the right track to gain its dreams for excellence and safety. Through ordinary assessment and corrective moves, managers keep a scientific management machine that facilitates in optimizing overall performance and minimizing deviations from the desired results.

This permits the agency to function easily and beautify its overall effectiveness and competitiveness.

To know more about controlling,

https://brainly.com/question/30761857

#SPJ4

The correct question is:

"Which of the following is a result of controlling? Managers create an organizational chart by identifying business functions and establishing reporting relationships. Managers make sure the organization's resources are being used as planned and that the organization is meeting its goals for quality and safety Managers motivate workers to come to work and execute top management's plans by doing their jobs. Managers analyze current situations, anticipate the future, determine objectives, and decide on what types of activities in which the company will engage. Managers assemble and coordinate the human, financial, physical, informational, and other resources needed to achieve goals. "

Allison corporation acquired 90 percent of bretton on January 1, 2016. Of Brettons total acquisition date fair value, $60000 was allocated to undervalued equipment

Answers

Answer:

Hello your question is incomplete attached below is the complete question

answer : consolidated Total sales = $1008000

Explanation:

Determine the consolidated totals for sales

to get the consolidated totals for sales we have to add up the two book values then subtract $92000 ( which is the entity transfers )

Consolidated Total sales = ($70000 + $400000 ) - $92000

= $1100000 - $92000 = $1008000

many companies take advantage of banking opportunities in the cayman islands where there are low taxes and less strict banking regulations. the banking centers in the cayman islands are an example of

Answers

Many firms profit from banking options in the Cayman Islands due to the low taxes and weak banking regulations. For instance, the financial club in the Cayman Islands is a tax haven.

In a politically and economically secure climate, a tax haven is a nation that imposes little or no taxes on foreign companies and individuals for their bank accounts. They provide tax benefits to businesses and the extremely rich, and it is clear that they might be abused in tax avoidance schemes.

Tax havens could provide tax breaks or other financial incentives to draw in foreign investment. Guam, Bermuda, Taiwan, and Jersey are a few examples of nations that rank well in secrecy and have minimal to no taxes.

To learn more about tax havens

https://brainly.com/question/29821811

#SPJ4

A business receives $5 000 for Rent

Revenue and deposits this amount into its

Bank account. How will this transaction

be recorded?

Answers

Answer: Dr Bank $5 000; Cr Rent Revenue $ 5 000

Explanation:

From the information given in the question, we are informed that a business receives $5 000 for Rent

Revenue and deposits this amount into its bank account, this transaction will be recorded thus:

Debit Bank $5000

Credit Rent Revenue $5000

The correct journal entry is written above with regards to the transaction.

Another reason fueling the boom in fast-growing technology services is _____, which, when done right, can virally spread awareness of a firm with nary a dime of conventional ad spending.

Answers

Available options are:

A. Esako and M-Pesa

B. Big data and Business analytics

C. Social media

D. Sproxil

Answer:

Social media

Explanation:

Social media is an internet-based or online platform that allows different registered users to share various forms of information and content, among other users, from anywhere across the globe.

Hence, given the available options, Another reason that is fueling the boom in fast-growing technology services is SOCIAL MEDIA, which, when done right, can virally spread awareness of a firm with nary a dime of conventional ad spending.

ow would you feel if your family had “telling of feelings” after dinner every night?

Answers

That evening, after dinner, Jonas's family his father, mother, and sister Lily, seven participated in a custom known as “telling of feelings.” Each participant talks with others about a certain emotion they had throughout the day.

Since then, the term "catharsis" has been used in the mental health community to refer to the process of expressing one's feelings, which is crucial for expressing one's needs, wants, and emotions.

Talking about your emotions confirms that what you're going through is genuine and important to you. You care about something if you are angry about it. You would be discrediting your experience and your ideals if you attempted to disregard that emotion.

Rather than denying your emotions, accept them. Avoid passing judgment on others or yourself.

To learn more about telling feelings

https://brainly.com/question/22066462

#SPJ9

The number of on-time deliveries would be an example of measuring which perspective?A.FinancialB.CustomerC.Internal businessD.Learning and growth

Answers

The number of on-time deliveries would be an example of measuring the Customer perspective of the balanced Scorecard. Thus, option B is correct.

The Customer view of the balanced Scorecard concentrates on gauging client pleasure, commitment, and retention. It is essential for firms to keep their clients satisfied and dedicated to providing long-term wins. Gauging on-time deliveries is one method to track client happiness and confirm that the business is meeting its conditions and anticipations.

The number of on-time deliveries is a key version indicator that allows evaluation of how well the organization is fulfilling. It is important for firms to focus on fulfilling client needs and expectations to ensure long-term success and profit gains.

To learn more about a balanced Scorecard

brainly.com/question/30049918

#SPJ4

The complete question is-

The number of on-time deliveries may be an example of measuring which perspective of the balanced Scorecard? A) Customer B) Financial C) Internal business D) Learning and growth

Cage Company had net income of $353 million and average total assets of $2,010 million. Its return on assets (ROA) is:

Answers

Based on the information given its return on assets (ROA) is: 17.56%.

Return on assetsUsing this formula

Return on Assets = Net Income/Average Total Assets

Where:

Net Income=$353 million

Average Total Assets=$2,010 million

Let plug in the formula

Return on Assets = $353 million/$2,010 million×100

Return on Assets=17.56%

Inconclusion its return on assets (ROA) is: 17.56%.

Learn more about return on assets (ROA) here:https://brainly.com/question/4973152

what is the importance of clay in human life

Answers

Answer: Fun Fact: Clay is an important part of soil because it contains nutrients that are essential to plant growth

Explanation:

Baxter is looking over his monthly budget. Specifically, he's considering the direct deposits that came through this week from his job with a biotech company and from the tenant who rents a small condo that he owns. What kind of money is Baxter reviewing?

A. income

B. inflation

C. personal risk

D. opportunity cost

Answers

Answer:

A, "Income"

Explanation:

Gradpoint

What does the Federal Reserve help regulate?

A. The economy

Ο Ο Ο

B. Food

C. Clothing

O D. Music

Answers

hope this helped

the+interest+on+a+$25000,+6%,+30-day+note+receivable+is+(use+360+days+for+calculation.)

Answers

To calculate the interest on a $25,000, 6%, 30-day note receivable using a 360-day calculation, we can use the formula: Interest = Principal x Rate x Time. In this case, the principal is $25,000, the rate is 6%, and the time is 30 days.

First, we need to convert the time from days to years since the interest rate is an annual rate. We divide 30 days by 360 days to get 0.0833 years.

Next, we plug in the values into the formula: Interest = $25,000 x 0.06 x 0.0833.

Calculating this, we find that the interest on the note receivable is approximately $124.98.

Therefore, the interest on the $25,000, 6%, 30-day note receivable using a 360-day calculation is approximately $124.98. This represents the cost of borrowing the principal amount for the given time period at the specified interest rate.

To know more about Interest visit-

brainly.com/question/14295570

#SPJ11

2022 altima’s xtronic cvt includes adaptive ratio control, which ________.

Answers

Considering the automobile analysis, the 2022 Altima's X-Tronic CVT includes adaptive ratio control, which "varies transmission response depending on the driving situation."

The 2022 Altima's X-Tronic CVT2022 Altima's X-Tronic CVT is one of the latest brand vehicles made by the Nissan manufacturer. The vehicle is finely designed to give users modern features and functions.

The 2022 Altima's X-Tronic CVT comes with adaptive ratio control, which "varies transmission response depending on the driving situation, "enhancing the ease of navigation system when driving through the road.

Hence, in this case, it is concluded that the correct answer is "varies transmission response depending on the driving situation."

Learn more about automobile features here: https://brainly.com/question/25981194

Q1 Enum and Case Structure 1 Point The case structure shown below must have a Default case. True False Q2 Ring and Case Structure Point The case structure shown below must have a Default case. True False Q3 Control Editor 1 Point You are creating an enumerated control that you wish to use in multiple different VIs in your application. You wish to make a master copy of this control so that all instances of the control will update when you edit the ∗

.ctl file associated with the master copy. In some locations you wish to display the control with large, bold, and colored text, but in other locations you plan to display it with standard, regular size and color text. When editing the *.ctl file for the enumerated control you should save the file as a: Custom Control Type Definition Strict Type Definition

Answers

Q1: True. Yes, the case structure shown below must have a Default case. A default case executes when none of the cases are true. If you don’t include a default case in the structure and none of the other cases are true, the structure doesn’t execute.

Q2: False. No, the case structure shown below doesn’t have to have a default case. The case structure shown below will only execute if either ring has a value of 1 or if the Boolean value is True. If neither of these conditions is true, the structure does not execute. Therefore, a default case is not required.

Q3: The answer is Custom Control Type Definition. When you are creating an enumerated control that you wish to use in multiple different VIs in your application, and you want to make a master copy of this control so that all instances of the control will update when you edit the *.ctl file associated with the master copy, then you should save the file as a Custom Control Type Definition. In this case, the custom control can be changed by editing the original .ctl file so that all instances of the control update. This makes it a lot easier to edit multiple instances of the control that are spread throughout your code.

Learn more about a Default case: https://brainly.com/question/13149329

#SPJ11

give the two main Problem statements often have three elements:

Answers

Answer:

what subject is this for

Explanation:

Explain the importance of leisure activities.

Answers

Answer:

leisure activities improve the productivity of people

Explanation:

if you feel stressed and then go to a water park, you will get less stressed right?

Kendra is trying to decide whether to go to Abby's house to watch a movie or to go to Samuel's house to play board games. They live about the same

distance away, and there is no cost for either event. If she chooses to go to Abby's house, what is the opportunity cost? (1 point)

There is no opportunity cost because there is not cost associated with either option.

Economics do not apply to this kind of decision.

The difference in value to Kendra of the two options.

The net value to Kendra of going to Abby's house to watch a movie

The net value to Kendra of going to Samuel's house to play games

Answers

Answer: The net value to Kendra of going to Samuel's house to play games

Kendra decision to go to Samul

The person named Kendra is trying to decide whether she should go to her abbeys house or whether to watch a movie. The first the option of going to the Samul house and playing a board game and can also go for a movie as she stays at the same distance. There are no costs involved in both events.

Thus answer is the net value to Kendra of going to Samuel's house for playing games.

The concept of the opportunity cost can be seen when the loss of a valve product for the cost of another more valuable item or an important product is considered to benefit. It often gives us a much higher value.Thus the option C is correct.Learn more about the decision whether.

brainly.com/question/17562424.

"According to Gartner Research, the data analytics market has split into two segments: the traditional _____ market and the newer __________ market. "

Answers

Answer: BI; data discovery

Explanation:

According to Gartner Research, the data analytics market has split into two segments: the traditional BI market and the newer data discovery market.

Data analytics is when raw materials are being analyzed scientifically in order to derive conclusions about a particular information.

Data analytics tools and technologies are data discovery, data visualization, and also geospatials.

When a corporation repurchases its bonds from the bondholders, the corporation the bonds.

Answers

These bonds are called retired bonds. The bonds are referred to be retired bonds when a corporation repurchases them from the bondholders. They are called so because they have been repurchased from the investors.

- More about retired bonds :

- Repurchasing previously issued bonds from investors is referred to as retired bonds. At the time of the instruments' scheduled maturity, the issuer retires the bonds. Another method of retirement is for the issuer to repurchase the bonds sooner if the bonds are callable.

- In the case of bonds, it means that the corporation is effectively returning the principal to the investors who purchased loans from them and discharging its debt obligations. Retired securities are those that have undergone this type of purchase back.

To know more about retired bonds, kindly click on the link below :

https://brainly.com/question/18568171?referrer=searchResults

#SPJ4

- The complete question is :

When a corporation repurchases its bonds from the bondholders, the bonds are called ____ bonds.

on january 1, year 1, stuart company had a balance of $111,500 in its common stock account. during year 1, stuart paid $18,100 to purchase treasury stock. treasury stock is accounted for using the cost method. the balance in the common stock account on december 31, year 1, was $136,500. assume that the common stock is no par stock.requireddetermine the cash inflow from the issue of common stock.prepare the financing activities section of the year 1 statement of cash flows.

Answers

The cash inflow from the issue of common stock cannot be determined from the given information as there is no mention of any new issuance of common stock during year 1.

The balance in the common stock account on January 1, year 1, was $111,500. This represents the initial capital raised by Stuart Company through the issuance of common stock. However, there is no information provided about any new issuance of common stock during year 1. Therefore, we cannot determine the cash inflow from the issue of common stock.

1. Determine the increase in the common stock account balance:

Ending balance (Dec 31, Year 1) - Beginning balance (Jan 1, Year 1)

$136,500 - $111,500 = $25,000

2. Calculate the net change in common stock, including the treasury stock purchase:

Increase in common stock account balance + Treasury stock purchase

$25,000 + $18,100 = $43,100

To know more about stock visit:

https://brainly.com/question/31940696

#SPJ11

Use the data from the GDP graph to complete each sentence.

Between 2007 and 2008, market growth ________.

Between 2008 and 2009, the GDP _______.

In 2008, GDP nearly reached_______.

Answers

Answer:

increased

decreased

50,000

Explanation:

Answer:

increased

decreased

50,000

Explanation:

As marketing manager for BoomBees Industries, you should be aware that legislation affecting business around the world will continue to

A. Exist

B. Increase

cremain steady

O D. Decrease

E threaten the Ghanaian domestic economy

Reset selection

Answers

As marketing manager for BoomBees Industries, legislation affecting business around the world will continue to increase.

Who is a manager?A manager simply means an individual who controls and guides other staffs in the organization to achieve a common goal.

In this case, as a marketing manager for BoomBees Industries, legislation affecting business around the world will continue to increase.

Learn more about manager on:

https://brainly.com/question/24553900

Which of the following marketing fundamentals applies solely to the hospitality and tourism industry? A.interdependence of organizations B.sequential steps in marketing C.key role of marketing research D.continuous nature of marketing

Answers

Answer:

key role of marketing research

Answer:

interdependence of organizations

Explanation:

Edge 2021 :)

What incentives do private prisons have to keep people incarcerated/locked up?

Answers

the yield to maturity on oak corp's bonds is 13%. if their marginal tax rate is 38%, what is oak corp's after-tax cost of debt?

Answers

After-tax cost of debt is 8.06%

What Is the Cost of Debt?The cost of debt is the actual interest rate that a company pays on its debts, including bonds and loans. Either the before-tax cost of debt, which is the amount owing by the business before taxes, or the after-tax cost of debt may be used to indicate the cost of debt. The majority of the difference between the cost of debt before and after taxes can be attributed to the fact that interest expenses are tax deductible.

The cost of debt is the effective interest rate that a business pays on its debt, such as bonds and loans.

The main distinction between the pretax cost of debt and the after-tax cost of debt is that interest expense is tax deductible.

• The capital structure of a corporation consists of two parts: equity and debt.

The average interest rate paid on all of a company's obligations must be determined in order to calculate the cost of debt.

How the Cost of Debt Works?

A company's capital structure, which also contains equity, includes debt as one component. A company's capital structure describes how it uses a variety of financial sources, including debt in the form of bonds or loans, to fund its overall operations and growth.

Understanding the entire rate that a company pays to use different kinds of debt financing is made easier with the help of the cost of debt measure. Due to the fact that riskier businesses typically have higher loan costs, the metric can also provide investors with a sense of how risky the company is in comparison to others.

Impact of Taxes on Cost of DebtThe interest paid on the debt less any income tax savings from deducting interest payments is the after-tax cost of debt. To determine a company's cost of debt after taxes, divide its effective tax rate by one and multiply the result by the cost of debt. Instead of using the company's marginal tax rate, the effective tax rate is calculated by combining the state and federal tax rates.

A company's pretax cost of debt, for instance, is 5% if all of its debt is represented by bonds it has issued at a 5% interest rate. If the effective tax rate is 30%, the difference between the two is 70%, which is 3.5% of the 5%. The cost of debt after taxes is3.5%

This computation is justified by the tax benefits the corporation experiences by deducting interest as a business expense. 2 Using the previous example as a guide, suppose the business issued $100,000 in bonds at a 5% interest rate. It has a $5,000 yearly interest payment. It declares this sum as an expense, which reduces the business's revenue by $5,000. The corporation writes off its interest, which results in a $1,500 tax savings because it pays a 30% tax rate. As a result, the business only effectively settles its debt for $3,500. This amounts to an interest rate on its debt of 3.5 percent.

BREFING:The initial cost of debt is the after-tax cost of debt, which has been modified to account for the impact of the marginal income tax rate. It is calculated by deducting the company's incremental tax rate from 100 percent and multiplying the result by the debt's interest rate. The equation is:

Before-tax cost of debt x (100% - incremental tax rate)

= After-tax cost of debt

SOLUTION OF QUESTION=

13%*(100%-38%)=8.06%

To know more about Cost of Debt visit:

https://brainly.com/question/14241273

#SPJ4