Risk assessment is a process A. That assesses the quality of internal control throughout the year. B. That establishes policies and procedures to accomplish internal control objectives. C. Designed to identify potential events that may affect the entity. D. Of identifying and capturing information in a timely fashion.

Answers

Answer:

C. Designed to identify potential events that may affect the entity.

Explanation:

Risk assessment means the total method in which the hazard or the factors related to the risk that result in damage or harm something. It could be analyzed and evaluated with the analysis of the risk and the evaluation of the risk.

It is to be designed in order to identify the events that could impact the entity

Therefore the option c is correct

Related Questions

In terms of morality, which do you believe is more important -- the intention of an action or the consequences of an action? Explain, using the ethical reasoning of Kant or utilitarianism to support your view. Share an example that illustrates your point. Make sure you fully demonstrate that you understand the theory you are using.

Answers

Whereas utilitarianism places more emphasis on results, Kantism places more emphasis on intention. The decision between these two ethical systems ultimately comes down to personal values and views.

According to Kantianism, an action's morality is determined by its purpose rather than by its outcomes. Kant felt that the categorical imperative, which states that we should only act in ways that we could wish to be universal standards, should serve as a guide for our action. Wgere utilitarianism, a consequentialist ethical philosophy, holds that an action's morality is determined by its effects. According to utilitarianism, a decision is morally right if it leads to the greatest amount of happiness for the largest number of people.

To learn more about utilitarianism refer here:

https://brainly.com/question/28148663

#SPJ1

Question Help

The table gives information about a nations labor force.

What’s is the unemployment rate?

The employment rate is_____percent

Answers

What's is the unemplyment rate?

The unemployment rate soared from a 50-year low of 3.5 percent to 14.8 percent in April 2021 at the beginning of the CVID-19 pandemic, and then fell faster than many forecasters anticipated, to 6.3 percent in January 2021

The employment rate is_____percent

The employment-population ratio represents the proportion of the civilian non-institutional population that is employed. In 2021, the U.S. employment rate stood at 56.8 percent.

What are the top 5 mortgage brokers in Sydney?

Answers

Here are some top mortgage brokers in Sydney: Aussie Home Loans, Mortgage Choice, Smartline Personal Mortgage Advisers, Loan Market, and Mortgage House.

1. Aussie Home Loans: With over 25 years of experience in the industry, Aussie Home Loans has established itself as one of the most trusted and reliable mortgage brokers in Sydney. They have a team of expert brokers who can help you find the right home loan that suits your needs.2. Mortgage Choice: Mortgage Choice is another popular mortgage broker in Sydney that can help you find the right home loan to suit your budget and requirements. They have access to a wide range of lenders, which means they can help you find the best deal available.3. Smartline Personal Mortgage Advisers: Smartline is a leading mortgage broker in Sydney that provides personalized advice and support to help you find the right home loan. They have a team of experienced brokers who can guide you through the home loan process from start to finish.4. Loan Market: Loan Market is another popular mortgage broker in Sydney that provides a range of home loan options to suit your needs. They have a team of brokers who can help you find the best deal available from a range of lenders.5. Mortgage House: Mortgage House is a Sydney-based mortgage broker that can help you find the right home loan to suit your budget and requirements. They offer a range of home loan options, including fixed and variable rate loans, low deposit loans, and more.In summary, these are some of the best mortgage brokers in Sydney that you can consider for your mortgage needs. When choosing a mortgage broker, it's important to consider their experience, reputation, and range of services offered to ensure that you get the best deal possible.For more questions on mortgages

https://brainly.com/question/21336679

#SPJ8

define electronic communication

Answers

Answer:

this is any information sent between particular parties over a phone line or internet connection. This includes phone calls, faxes, text messages, video messages, emails and internet messaging.

BRAINLY FOR THE BEST ANSWER AND 55 POINTS FOR WHOEVER THAT ANSWER!!

Explain and define what is:

1) Gross profit margin

2) Net profit margin

(IF NOT WELL ANSWERED I WILL REPORT YOUR ANSWER IF MY POINTS ARE MIS-USED

Answers

#→ Gross margin is the difference between revenue and cost of goods sold (COGS), divided by revenue. Gross margin is expressed as a percentage. Generally, it is calculated as the selling price of an item, less the cost of goods sold (e. g. production or acquisition costs, not including indirect fixed costs like office expenses, rent, or administrative costs), then divided by the same selling price. "Gross margin" is often used interchangeably with "gross profit", however the terms are different: "gross profit" is technically an absolute monetary amount and "gross margin" is technically a percentage or ratio.

•→ Net Profit Margin •→#→ The net profit margin, or simply net margin, measures how much net income or profit is generated as a percentage of revenue. It is the ratio of net profits to revenues for a company or business segment. Net profit margin is typically expressed as a percentage but can also be represented in decimal form.

I Hope This Helps You...Select the correct answer. When organizing paragraphs within the body of your essay: A. Present the paragraphs in order from most important to least. B. Choose a pattern of organization that will guide the reader through the argument. C. Find the most convincing argument in your outline and present this paragraph first.

Answers

The correct option is B. Choose a pattern of organization that will guide the reader through the argument.

When organizing paragraphs within the body of an essay, it is important to choose a pattern of organization that effectively presents and supports the main argument or thesis statement. This pattern should guide the reader through the logical flow of ideas and evidence.

Option A, presenting paragraphs in order from most important to least, may not always be the most appropriate approach. The significance of each paragraph can vary depending on the specific essay and argument. It is often more effective to arrange paragraphs in a way that builds upon previous points and leads the reader towards a convincing conclusion.

Option C, presenting the most convincing argument first, may also not be the best choice. The order of paragraphs should be determined by the logical progression of ideas rather than the individual strength of each argument. By following a clear pattern of organization, the essay can present a cohesive and coherent argument that is easy for the reader to follow and understand. Hence the correct answer is B. Choose a pattern of organization that will guide the reader through the argument.

For more questions on organization

https://brainly.com/question/25922351

#SPJ11

As a general rule: _____________

a. Income from property is taxed to the person who owns the property.

b. Income from services is taxed to the person who earns the income.

c. The assignee of income from property must pay tax on the income.

d. The person who receives the benefit of the income must pay the tax on the income.

Answers

Answer:

a. Income from property is taxed to the person who owns the property.

b. Income from services is taxed to the person who earns the income.

Explanation:

Taxation can be defined as the involuntary or compulsory fees levied on individuals or business entities by the government to generate revenues used for funding public institutions and activities.

The different types of tax include the following;

1. Income tax: it's a type of tax levied on the amount of money made by workers in the state. It is typically paid by employees with respect to the amount of money they receive as their wages or salary.

2. Property tax: it's a type of tax that is typically based on the value of a person's assets such as a home or business. Thus, it is mainly taxed on physical assets or properties such as land, building, cars, business, etc.

3. Sales tax: it's a type of tax that is taxes as a percentage of the price of goods sold in retail stores. Thus, it is being paid by the consumers (buyers) of finished goods and services and then, transfered to the appropriate authorities by the seller.

As a general rule in the taxation of citizens:

a. Income from any property is levied or taxed to the owner i.e the person who owns the property.

b. Income from services taken is taxed to the person who earns the income i.e the service provider.

Cheer, Inc., wishes to expand its facilities. The company currently has 8 million shares outstanding and no debt. The stock sells for $34 per share, but the book value per share is $42. Net income for Teardrop is currently $4.7 million. The new facility will cost $50 million and will increase net income by $800,000. The par value of the stock is $1 per share. Assume a constant price-earnings ratio.

a-1.

Calculate the new book value per share. Assume the stock price is constant. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

a-2. Calculate the new total earnings. (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.)

a-3. Calculate the new EPS. Include the incremental net income in your calculations. (Do not round intermediate calculations and round your answer to 4 decimal places, e.g., 32.1616.)

a-4. Calculate the new stock price. Include the incremental net income in your calculations. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

a-5. Calculate the new market-to-book ratio. (Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161.)

b. What would the new net income for the company have to be for the stock price to remain unchanged? (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.)

Answers

Answer:

Explanation:

Solution :- (A)

(1) :- Book value per share = Total Assets / Total Number of Shares

Total Assets = ( $42 * 8,000,000 ) + $50,000,000 = $386,000,000

Total No. of Shares = ( $50,000,000 / 34 ) + 800,000 = 9,470,588.24

Book Value per share = $386,000,000 / 9,470,588.24

= $40.76

(2)

New Total Earnings = Current Net Income + Additional Income

= $4,700,000 + 800,000

= $5,500,000

(3)

New EPS = New Earnings / New total number of shares

= $5,500,000 / 9,470,588.24

= $0.581

(4)

New Price of Stock =

Old EPS = 4,700,000 / 8,000,000 = 0.5875

New Price = P/E Ratio * New EPS

= ( 34 / 0.5875 ) * 0.5807

= $33.61

(5) New Market to Book Ratio

= Market price / Book Value

= $33.61 / $40.76

= 0.825 times

(b)

Net Income = EPS old * Total New number of shares

= $0.5875 * 9,470,588

= $5,563,970.45

Why is it important to understand the advantages and disadvantages of different ways to pay for

expenses? Give specific examples.

Entry (350-500 words)*

Answers

The essay on understanding the advantages and disadvantages of different ways to pay for expenses is given below.

What benefits and loss do payment methods offer?It streamlines the payment process, boosts security and convenience, happens in real-time, is incredibly handy for everyone, gives the firm a more modern appearance, spans boundaries, enhances the likelihood that budgets will be converted into sales, swiftly digitizes any business,

Accepting a paperless system with electronic payments, however, is comparatively easy. The advantages of digital payment systems include speed, safety, ease of collection, and lower costs for the company.

Making money is the entire reason a firm is established. And only if your company allows clients to make payments is the entire concept of profitability viable. Online payments have grown in importance as a result of recent technology breakthroughs in the e-commerce sector.

Offering consumers a variety of payment alternatives is advantageous for the business as well because customers are more likely to pay quickly and fully given the simplicity of payment than they would be if they only had a few options.

Lastly, Some Problems with Payments are:

Technical difficulties.password dangers.The cost of fraud.Security worries.technological ignorance.time and resource restrictions.contested transactionsLearn more about expenses from

https://brainly.com/question/14697297

#SPJ1

What is the first step in QuickBooks Online that must be completed prior to recording the deposit? +New > Invoice +New> Journal entry +New> Receive payment +New > Make deposit

Answers

The first step in QuickBooks Online that must be completed prior to recording the deposit is Option C. +New > Receive payment.

The first step in QuickBooks Online that must be completed prior to recording the deposit is +New > Receive payment. It is recommended that you document each payment you receive from your clients or customers as a deposit to ensure that the transaction is accurately reflected in your QuickBooks Online account.

To record a deposit in QuickBooks Online, follow these steps:

Go to QuickBooks online and sign in to your account. Select the +New button, which is located in the upper-left corner of the screen. Choose Receive Payment from the drop-down menu. Enter the name of the customer who is making the payment in the Receive Payment From field. From the Payment Method drop-down menu, select the payment method that the customer is using. Enter the amount of the payment that was received in the Payment Amount field, along with any fees or discounts that may apply. If there are any notes you'd like to include with the transaction, you can add them to the Memo field. Click on Save and close.To summarize, when recording a deposit in QuickBooks Online, the first step that must be completed is to choose the +New button and select Receive Payment from the drop-down menu. Therefore, the correct option is C.

The question was incomplete, Find the full content below:

What is the first step in QuickBooks Online that must be completed prior to recording the deposit?

A. +New > Invoice

B. +New> Journal entry

C. +New> Receive payment

D. +New > Make deposit

Know more about QuickBooks Online here:

https://brainly.com/question/24441347

#SPJ8

A bank is preparing a financial asset for trading in the over-the-counter market. It most nearly sounds as though they are _____. securitizing securitizing collateralizing a loan collateralizing a loan creating a derivative creating a derivative offsetting negative risk

Answers

A bank is preparing a financial asset for trading in the over-the-counter market. It most nearly sounds as though they are a derivative offsetting negative risk. The correct option is D.

What are over-the-counter financial instruments?OTC securities are those that are not listed on a national securities exchange. The majority of these securities are traded on Alternative Trading Systems (ATSs), which are quotation mediums that may include electronic interdealer quotation systems that show quotes from broker-dealers for many OTC securities.

In over-the-counter markets, trading is done electronically rather than in a physical location. An auction market system is very dissimilar from this. Dealers serve as market makers in OTC markets by quoting prices at which they will buy and sell securities, currencies, or other financial products.

Thus, the ideal selection is option D.

Learn more about over-the-counter here:

https://brainly.com/question/25320089

#SPJ1

On December 31, 2021, L Inc. had a $2,000,000 note payable outstanding, due July 31, 2022. L borrowed the money to finance construction of a new plant. L planned to refinance the note by issuing long-term bonds. Because L temporarily had excess cash, it prepaid $550,000 of the note on January 23, 2022. In February 2022, L completed a $3,500,000 bond offering. L will use the bond offering proceeds to repay the note payable at its maturity and to pay construction costs during 2022. On March 13, 2022, L issued its 2021 financial statements. What amount of the note payable should L include in the current liabilities section of its December 31, 2021, balance sheet

Answers

Answer:

$550,000

Explanation:

Based on the information given we were told that the company temporarily had excess cash in which the company prepaid the amount of $550,000 of the note because the company had planned to refinance the note by issuing long-term bonds which means that the amount of the note payable that the company should include in the current liabilities section of its December 31, 2021, balance sheet will be the amount of $550,000 which represent the prepaid amount reason been that any amount that was been excluded as current Liabilities amount due to refinancing cannot in any way be greater than the amount that was actually refinanced in the nearest future.

If the elasticity of demand for college textbooks is -0.1, and the price of textbooks increases by 20%, how much will the quantity demanded change, and in what direction

Answers

Answer:

The quantity demanded will decrease by 2%.

Explanation:

This can be determined using the elasticity formula as follows:

e = Percentage change in quantity demanded change / Percentage change in price ........ (1)

Where;

e = elasticity of demand for college textbooks = -0.1

Percentage change in quantity demanded change = ?

Percentage change in price = 20%

Substituting the values into equation (1) and solve for Percentage change in quantity demanded change

-0.1 = Percentage change in quantity demanded change / 20%

Percentage change in quantity demanded change = -0.1 * 20% = -0.02, or -2%

Since the Percentage change in quantity demanded change is negative 2%, it implies that the quantity demanded will decrease by 2%.

g Within the context of corporation law, the concept of double taxation means that: Question 20 options: the government taxes both management salaries and dividends to managers the tax rate for corporations is double that of individuals the government taxes both earnings to corporations and dividends to individual shareholders the government taxes both earnings and retained earnings of the corporation

Answers

Answer: the government taxes both earnings to corporations and dividends to individual shareholders

Explanation:

Double taxation occurs when an income, asset, good or any other financial transaction is being taxed twice.

Within the context of corporation law, the concept of double taxation means that the government taxes both earnings to corporations and dividends to individual shareholders.

A company reports the following: Sales $3,150,000 Average accounts receivable (net) 210,000 Determine (a) the accounts receivable turnover and (b) the number of days' sales in receivables. Round interim calculations to the nearest dollar and final answers to one decimal place. Assume a 365-day year. a. Accounts receivable turnover fill in the blank 1 b. Number of days' sales in receivables

Answers

Answer:

a. Account Receivables turnover = Sales / Average Account Receivables

Account Receivables turnover = $3,150,000 / $210,000

Account Receivables turnover = 15

b. Number of days sales in receivables = 365 / Account Receivables turnover

Number of days sales in receivables = 365 days / 15

Number of days sales in receivables = 24.33 days

PLEASE HURRY

If you are paid according to a rate of $15 per hour, what is your type of payment?

a. Commission

b Salary

C Wage

d. Pension

Please select the best answer from the choices provided

A

оооо

С

Answers

Answer:

C Wage

Explanation:

Wage is compensation paid per hour worked. The term wage is most applicable to piecemeal jobs. Wage is usually paid per hour, per day, per week, or a piece of work completed.

Wage differs from salary in that salary is a fixed amount of compensation paid after the lapse of an agreed time, mostly monthly. Wage is not a fixed amount but depends on the hours worked or the amount of work done.

Answer:

C

Explanation:

i took test 80% -w- lol

who is sus? pink or blue im playing among us

Answers

Answer:

pink smh

Explanation:

Answer:

Its blue i have photographic evidence

Explanation:

Small business commonly employ what type departmentalization

Answers

Answer:

line departmentalization

Explanation:

Hope this helps:)

~Kisame'sAbs

Maisie Taft started her own consulting firm, Maisie Consulting, on May 1, 2020. The following transactions occurred during the month of May.

May 1 Maisie invested $7,000 cash in the business.

2 Paid $900 for office rent for the month.

3 Purchased $800 of supplies on account.

5 Paid $125 to advertise in the County News.

9 Received $4,000 cash for services performed.

12 Withdrew $1,000 cash for personal use.

15 Performed $6,400 of services on account.

17 Paid $2,500 for employee salaries.

20 Made a partial payment of $600 for the supplies purchased on account on May 3.

23 Received a cash payment of $4,000 for services performed on account on May 15.

26 Borrowed $5,000 from the bank on a note payable.

29 Purchased equipment for $4,200 on account.

30 Paid $275 for utilities.

Questions:

A. Prepare an income statement for the month of May.

B. Prepare a balance sheet at May 31, 2020.

Answers

Answer:

A. NET INCOME $6,600

B. TOTAL ASSETS $22,000

TOTAL LIABILITIES AND EQUITY $22,000

Explanation:

A. Preparation of income statement for the month of May.

Maisie Taft INCOME STATEMENT for May 2020

Service Revenue $10,400

($4,000 + $6,400)

Less: Expenses

Rent expense ($900)

Advertising expense ($125)

Salaries expense ($2,500)

Utilities expense ($275)

NET INCOME $6,600

Therefore the Net income on the income statement for the month of May 2020 will be $6,600

B. Preparation of balance sheet at May 31, 2020

Maisie Taft BALANCE SHEET at May 31, 2020

ASSETS:

Cash $14,600

Accounts receivable $2,400

Supplies $800

Equipment $4,200

TOTAL ASSETS $22,000

(14,600+2,400+800+4,200)

LIABILITIES:

Accounts payable $4,400

Notes payable $5,000

Total liabilities $9,400

($4,400+$5,000)

EQUITY:

Owner's equity $7,000

Retained earnings $5,600

($6,600 - $1,000)

Total equity $12,600

($7,000+$5,600)

TOTAL LIABILITIES AND EQUITY $22,000

($9,400 + $12,600)

CASH

May 1 Cash $7,000

2 Paid Office rent ($900)

5 Paid to advertise ($125)

9 Cash Received $4,000

12 Cash Withdrew ($1,000)

17 Paid employee salaries ($2,500)

20 Supplies purchased ($600)

23 Cash payment $4,000

26 Note payable $5,000

30 Utilities ($275)

CASH $14,600

ACCOUNT RECEIVABLES

May 15 $6,400

May 23 ($4,000)

ACCOUNT RECEIVABLES $2,400

ACCOUNT PAYABLE

May 3 $800

May 20 ($600)

May 29 $4,200

ACCOUNT PAYABLE $4,400

Therefore the Total asset on the balance sheet at May 31, 2020 will be $22,000 and the Total liabilities and equity on the balance sheet at May 31, 2020 will be $22,000

using a scale: Three boys Isaac ,Alex and Ken are standing in different parts of a field .Isaac is 100 metres north of Alex and Ken is 120 metres east of Alex .Find the compass bearing of Ken from Isaac

Answers

Answer:

156 m South East of Isaac

Explanation:

This is going to be solved by using Pythagoras theorem

We have the adjacent of the triangle as the Eastern distance between Ken and Alex, and that is 120 m. We have the opposite side to be the Northern distance between Isaac and Alex to be 100 m

If so, then we know that the hypotenuse side is the distance between Isaac and Ken. Using Pythagoras, we know that

100² + 120² = x²

x² = 10000 + 14400

x² = 24400

x =√24400

x = 156.2 m

The compass bearing of Ken, from Isaac then is,

Ken is 156.2 m South East of Isaac

Outline and describe the different forms of Communication and further explain how they are important in an organization. Provide practical example to support your discussion.

Answers

La comunicación desempeña un papel fundamental en el funcionamiento de una organización, ya que permite la transmisión de información, ideas, instrucciones y retroalimentación entre los miembros del equipo. Existen varias formas de comunicación que se utilizan en un entorno organizacional. A continuación, describiré algunas de las formas más comunes:

Comunicación verbal: Es el uso de palabras habladas para transmitir información. Puede ser en forma de reuniones, conversaciones cara a cara, llamadas telefónicas o videoconferencias. La comunicación verbal es rápida y permite una interacción directa entre las personas, lo que facilita la clarificación de dudas y la resolución de problemas en tiempo real. Por ejemplo, durante una reunión de equipo, los miembros pueden discutir ideas, compartir actualizaciones y tomar decisiones conjuntas.

Comunicación escrita: Implica el uso de palabras escritas para transmitir información. Esto incluye correos electrónicos, mensajes de texto, informes, memorandos y documentos formales. La comunicación escrita es útil cuando se requiere un registro permanente de la información y proporciona la oportunidad de revisar y editar antes de enviar el mensaje. Por ejemplo, un gerente puede enviar un correo electrónico detallando las metas y objetivos del proyecto a su equipo para asegurarse de que todos estén al tanto de las expectativas.

Comunicación no verbal: Se refiere a la transmisión de información sin el uso de palabras. Incluye gestos, expresiones faciales, lenguaje corporal y tono de voz. A menudo, la comunicación no verbal puede transmitir emociones y actitudes que pueden complementar o contradecir el mensaje verbal. Por ejemplo, durante una presentación, el lenguaje corporal de un orador puede transmitir confianza y entusiasmo, lo que refuerza su mensaje.

Comunicación formal: Se lleva a cabo a través de canales oficiales y estructurados dentro de la organización. Esto incluye comunicaciones descendentes, como anuncios y políticas de la gerencia hacia los empleados, así como comunicaciones ascendentes, como informes de estado y retroalimentación de los empleados hacia los superiores. La comunicación formal es importante para establecer líneas claras de autoridad y responsabilidad, así como para garantizar la coherencia en la información transmitida.

Comunicación informal: Se produce a través de interacciones sociales no estructuradas entre los miembros de la organización. Esto puede incluir conversaciones informales en el lugar de trabajo, interacciones en las pausas para el café o discusiones en grupos de chat en línea. La comunicación informal es valiosa para fomentar la camaradería, construir relaciones y facilitar el intercambio de ideas no convencionales. Por ejemplo, en un entorno de trabajo abierto, los empleados pueden compartir ideas innovadoras durante una conversación informal en la sala de descanso.

La importancia de estas formas de comunicación en una organización radica en que permiten la colaboración efectiva, la toma de decisiones informada, la resolución de problemas, la coordinación de tareas y la creación de un ambiente de trabajo positivo. Una comunicación clara y efectiva evita malentendidos, reduce los errores, mejora la productividad y fortalece la cohesión del equipo.

Un ejemplo práctico podría ser una empresa de desarrollo de software. En este caso, la comunicación verbal sería esencial para que los miembros del equipo discutan los requisitos del proyecto, compartan actualizaciones diarias y resuelvan problemas en las reuniones diarias de puesta al día (stand-up meetings). La comunicación escrita sería crucial para documentar los requisitos, especificaciones técnicas y cronogramas del proyecto, así como para enviar correos electrónicos y mensajes de chat con actualizaciones y solicitudes de retroalimentación. La comunicación no verbal también tendría un papel importante, ya que el lenguaje corporal y las expresiones faciales en las reuniones ayudarían a transmitir confianza y apoyo entre los miembros del equipo. En cuanto a la comunicación formal, se utilizarían informes de estado y presentaciones formales para mantener a la alta dirección informada sobre el progreso del proyecto. Por último, la comunicación informal se daría en momentos de descanso, donde los empleados podrían discutir ideas, plantear desafíos y fomentar la creatividad en un ambiente más relajado

Answer:

There are several different forms of communication that are important in an organization. These include:

1. Verbal communication: This is the use of spoken words to convey a message. Verbal communication is important in an organization because it allows employees to communicate with each other and with customers. For example, a salesperson might use verbal communication to explain the features of a product to a customer. Another example is a team meeting where employees discuss project updates and share ideas.

2. Nonverbal communication: This is the use of body language, gestures, and facial expressions to convey a message. Nonverbal communication is important in an organization because it can convey emotions, attitudes, and intentions. For example, a manager might use nonverbal communication to show approval or disapproval of an employee's performance. Another example is a job interview where the interviewer might use nonverbal communication to assess the candidate's confidence and professionalism.

3. Written communication: This is the use of written words to convey a message. Written communication is important in an organization because it provides a permanent record of communication. For example, an email can be used to communicate project updates, deadlines, and other important information. Another example is a report that summarizes the results of a project.

4. Visual communication: This is the use of images, graphs, and other visual aids to convey a message. Visual communication is important in an organization because it can help to simplify complex information and make it easier to understand. For example, a chart can be used to show sales trends over time. Another example is a video that demonstrates how to use a product.

All of these forms of communication are important in an organization because they allow employees to share information, ideas, and feedback. Effective communication can also help to build trust and relationships between employees, customers, and partners. For example, if a customer has a positive experience with a salesperson, they are more likely to return to the organization in the future.

A practical example of the importance of communication in an organization is a team project. Effective communication is essential for the success of the project. Team members need to be able to communicate their ideas, concerns, and progress to each other in order to stay on track and meet deadlines. This might involve verbal communication in team meetings, written communication in project reports, and visual communication in presentations. Without effective communication, the project is likely to fail.

Identify the accounting concept relevant to each situation below:

1.] Mr. Queen is expected to operate for an indefinite period.

2.] A business uses the same depreciation method it has used for the past five years.

3.] The business recorded the purchase of its building at cost price even though the market value has increased.

4.] The owner withdrew goods, in the business records it was recorded in the drawing account.

5.] Record expenses incurred although payment was not yet made.

6.] When a business uses the same method of stock taking every year.

Answers

Answer:

caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca popo caca

Which of the following leaves no room for compromise or gray areas?

O Propaganda

O Bandwagon techniques

O Glittering generalities

O Either/or fallacy

Answers

Either/or fallacy leaves no room for compromise or gray areas

What is Either/or fallacy?Either or fallacy also known as black and white thinking or false dilemma is a type of logical fallacy where only two choices are presented often with one being portrayed as the only correct or acceptable option while the other is portrayed as being completely wrong or unacceptable.

This type of argument leaves no room for compromise or gray areas and can be misleading as it oversimplifies complex issues and limits the range of options that are available

Learn more about fallacy at

https://brainly.com/question/20939336

#SPJ1

An electronics manufacturer in Japan creates a strategic partnership with a

large retailer in the United States. They both invest funds into the partnership

and share in the control of the distribution and resources. The Japanese

company gets a tax advantage because of this partnership, and the U.S.

company gets an advantage because of the exclusivity agreement to carry

these electronic products. Which type of global entry strategy does this

example highlight?

Answers

Answer:

Creating a joint venture.

Explanation:

A foreign direct investment (FDI) can be defined as an investment made by an individual or business entity (investor) into an investment market (industry) located in another country. The investor here, shares a different country of origin from the country where his investment is located. In a foreign direct investment (FDI), an investor must establish his business, factory and operations in a foreign country or acquire assets in a business that is being operated in a foreign country.

Additionally, foreign direct investment (FDI) are categorized into three (3) main types and these are;

1. Vertical FDI: it involves establishing a different business that is however similar to the main business owned by the investor.

2. Horizontal FDI: it involves establishing the same type of business in a foreign country as owned in the investor's country.

3. Conglomerate FDI: it involves establishing a business that is completely different in another (foreign) country.

A joint venture can be defined as a type of business partnership which typically involves making direct investment in a foreign country with a domestic partner. It is typically established or initiated by two or more people on mutual grounds to make profits and sharing costs.

In this scenario, an electronics manufacturer in Japan creates a strategic partnership with a

large retailer in the United States.

Thus, the type of global entry strategy which this example highlight is creating a joint venture.

Write the quadratic equation in standard form that corresponds to the graph shown below.

Answers

The quadratic equation of the graph in standard form is y = x² + 2x - 8

What is a quadratic equation in standard form?A quadratic equation in standard form is given by y = ax² + bx + c

Given the graph below, to write the quadratic equation for the graph in s tandard form, we notice that the graph has two x - intercepts at

(-4, 0) and(2, 0)The x - intercepts are the roots of the quadratic equation.

So, we have that

x = -4 andx = 2So,

x + 4 = 0 andx - 2 = 0So, the factors of the quadratic equation are

x + 4 andx - 2So, multiplying the factors, we have that the equation is

y = (x + 4)(x - 2)

= x² - 2x + 4x + 4 × (-2)

= x² - 2x + 4x - 8

= x² + 2x - 8

So, the quadratic equation is y = x² + 2x - 8

Learn more about quadratic equation in standard form here:

https://brainly.com/question/30537252

#SPJ1

Q1. A manufacturing firm has discontinued production of a certain unprofitable product

line. This created considerable excess production capacity. Management is considering to

devote this excess capacity to one or more of three product 1,2 and 3. The available capacity

on the machines which might limit output are given below:

Machine type Available time

(in machine hours per week)

Milling

machine

250

Lathe 150

Grinder 50

The number of machine hours required for each units of the respective product is given

below;

Machine type Productivity (in machine hours/unit)

Product 1 Product 2 Product 3

Milling 8 2 3

Lathe 4 3 0

Grinder 2 0 1

The unit profit would be 20 birr, 6 birr and 8 birr for products 1,2 and 3. Find how much of

each product the firm should produce in order to maximise profit ? Solve the problem by

simplex method.

Answers

The simplex method is a linear programming technique used to find the maximum value of a linear objective function subject to constraints represented by linear equations or inequalities.

How do we use this method?Here's how you can solve this problem using the simplex method:

Formulate the problem as a linear program:

The objective is to maximize the total profit, which is given by 20x1 + 6x2 + 8x3, where x1, x2, and x3 are the number of units of products 1, 2, and 3, respectively. The constraints are the available machine time, which are:

8x1 + 4x2 + 2x3 <= 250 (milling machine)

3x1 + 3x2 <= 150 (lathe)

x3 <= 50 (grinder)

Create a simplex tableau:

The simplex tableau is a matrix used to keep track of the variables and the coefficients of the objective function and the constraints. The first row of the tableau is the objective function, the rest of the rows are the constraints. The last column is called the "result" column and contains the values of the variables and the objective function.

Choose a basic variable:

In the first iteration, we will choose x1 as the basic variable, since it is the only non-negative variable in the objective function. We will write x1 in terms of x2 and x3 using the first constraint:

x1 = (250 - 4x2 - 2x3)/8

Update the simplex tableau:

Substitute x1 in the objective function and in the rest of the constraints:

20 * (250 - 4x2 - 2x3)/8 + 6x2 + 8x3

3x2 <= 150

x3 <= 50

Check for optimality:

Check if all the coefficients in the objective function are non-negative. If so, the current solution is optimal and the problem is solved. If not, choose the next basic variable and repeat steps 3 and 4.

Repeat steps 3 to 5 until optimality is reached:

In the second iteration, we will choose x2 as the basic variable. Substitute x2 in the objective function and in the rest of the constraints, and check for optimality. Repeat this process until the coefficients in the objective function are non-negative, indicating that the solution is optimal.

The final solution will give the number of units of each product that the firm should produce in order to maximize profit.

learn more about simplex method: https://brainly.com/question/30387091

#SPJ1

. Define corporate-level strategy. What are the different levels of diversification firms

can pursue by using different corporate-level strategies?

Answers

Answer:

Tipos de diversificación empresarial

Explanation:

°Inversión propia. Constituye la fórmula de diversificación más seguida, puesto que supone echar mano de los recursos propios a la hora de intentar conquistar nuevos espacios productivos y clientes.

°Adquisición total o parcial de una empresa.

°Diversificación relacionada.

°Diversificación no relacionada.

Part A:

Describe two possible financial goals for which you may require $12,000. Classify each as a want or need. Do research to ensure that amount is enough for your goal.

Part B:

Create and describe three possible investments to reach your goal within five (5) years. Investment 1 is a simple interest investment with 3% annual interest. How much would you need to invest at the beginning? Investment 2 is a compound interest investment, with 3% annual interest compounded monthly. How much would you need to invest at the beginning?

Investment 3 is a regular deposit in an account that earns 3% compound interest, compounded once per year. How much do you need to deposit, and how often will you deposit it, to reach it Part C:

Calculate and describe the total interest earned on each of your three investments. Explain your thinking and show your work.

Answers

To pay off debt, which is a need and establish good credit, a want to save money for short- and medium-term goals are two possible financial goals for which you may require $12,000.

Describe the total interest earned on each of the three investments.As it offers a simple interest investment with 3% yearly yield, you should start out with least investment amount. The simple interest of 3.2% per year is a good investment, but not better than compound interest.

The moderate money should be put into investment 2 because it earns 3% compound interest and is compounded once a year, it calculates interest on the principal amount and the accrued interest.

As compound interest is calculated on a monthly basis, investment 3 is where you can put the most amount of money. Due to compounding, this interest increases your wealth compounded monthly. Consequently, it makes a sum of money grow at a faster rate than simple interest and annual compounding because you will earn returns on the money you invest, and also on returns at the end of every compounding period.

The calculations for 3 investments are:

The total amount you will invested = $12,000.00

Number of years = 5

Investment 1

Total at end of investment after 5 years = $13,800

Interest earned = $1800

Investment 2

Total at end of investment after 5 years = $13,911.

Interest earned = $1911

Investment 3

Total interest = $1,939.4.

Total at end of investment after 5 years = $13,939.4.

To learn more about compound interest, visit:

https://brainly.com/question/14295570

#SPJ1

Over the period of 1926 to 2017, small-company stocks had an average return of ________ percent. Group of answer choices

Answers

Answer:

12.1%

Explanation:

Over the period of 1926 to 2017, small-company stocks had an average return of ___12.1%_____ percent. 12.1% was the highest rate of small stock during the period of 1926 to 2017.

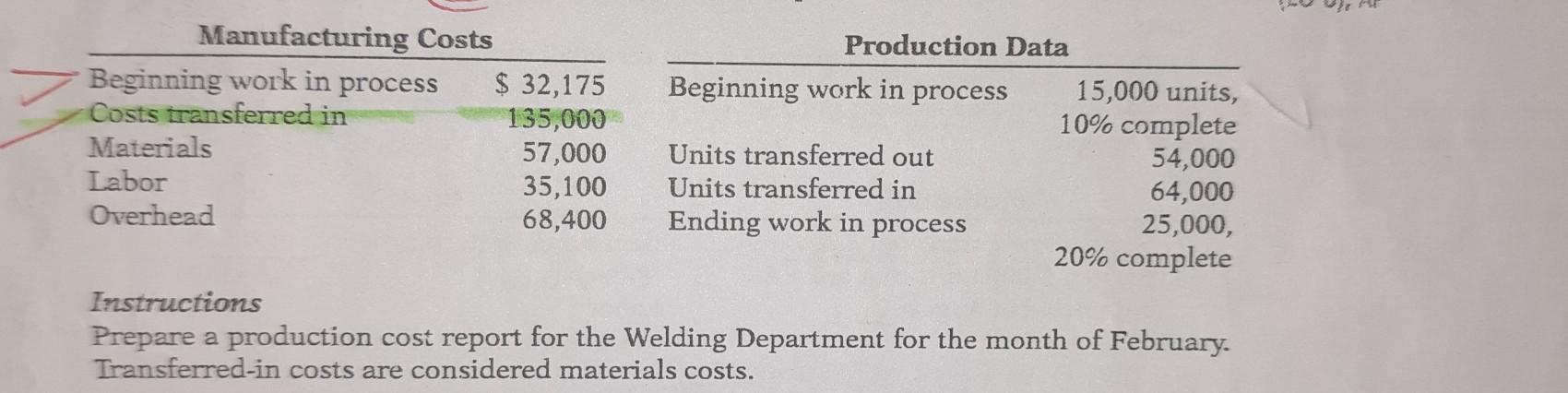

answer the following questions, please

Answers

The cost reconciliation indicates a discrepancy, as the total costs assigned exceed the beginning work in process costs. This could be due to additional costs.

How did we arrive at this assertion?To prepare a production cost report for the Welding Department for the month of February, we need to calculate the following:

1. Equivalent units of production for materials, labor, and overhead.

2. Cost per equivalent unit for materials, labor, and overhead.

3. Total costs assigned to units transferred out and ending work in process.

4. Cost reconciliation.

Let's calculate each of these steps:

Step 1: Equivalent Units of Production

Equivalent units of production are calculated based on the percentage of completion for units in process.

For materials:

Beginning work in process: 15,000 units x 10% complete = 1,500 equivalent units

Units transferred in: 64,000 units

Ending work in process: 25,000 units x 20% complete = 5,000 equivalent units

Total equivalent units for materials: 1,500 + 64,000 + 5,000 = 70,500 equivalent units

For labor and overhead:

Since the given data does not provide the percentage of completion for labor and overhead, we assume it is the same as for materials. Therefore, the equivalent units for labor and overhead will also be 70,500 units.

Step 2: Cost per Equivalent Unit

To calculate the cost per equivalent unit, we divide the total costs by the total equivalent units.

Cost per equivalent unit for materials: $135,000 / 70,500 units = $1.91 per unit

Cost per equivalent unit for labor: $57,000 / 70,500 units = $0.81 per unit

Cost per equivalent unit for overhead: $35,100 / 70,500 units = $0.50 per unit

Step 3: Total Costs Assigned

To calculate the total costs assigned to units transferred out and ending work in process, we multiply the cost per equivalent unit by the equivalent units for each category.

For units transferred out:

Materials: 64,000 units x $1.91 per unit = $122,240

Labor: 64,000 units x $0.81 per unit = $51,840

Overhead: 64,000 units x $0.50 per unit = $32,000

For ending work in process:

Materials: 25,000 units x $1.91 per unit = $47,750

Labor: 25,000 units x $0.81 per unit = $20,250

Overhead: 25,000 units x $0.50 per unit = $12,500

Step 4: Cost Reconciliation

To reconcile the costs, we compare the total costs assigned to units transferred out and ending work in process with the beginning work in process costs.

Beginning work in process costs: $32,175

Total costs assigned to units transferred out: $122,240 + $51,840 + $32,000 = $206,080

Total costs assigned to ending work in process: $47,750 + $20,250 + $12,500 = $80,500

Total costs: $206,080 + $80,500 = $286,580

Since the total costs assigned exceed the beginning work in process costs, there may be some additional costs that need to be investigated or accounted for.

The production cost report for the Welding Department for the month of February is as follows:

------------------------------------------------------------------------

| | Equivalent Units | Cost per Equivalent Unit | Total Costs |

------------------------------------------------------------------------

| Materials | 70,500 | $1.91 | $135,000 |

| Labor | 70,500 | $0.81 | $57,000 |

| Overhead | 70,500 | $0.50 | $35, 100 |

------------------------------------------------------------------------

| Total (Transferred-out) | 64,000 | | $227,240 |

| Ending work in process | 25,000 | | $80,500 |

------------------------------------------------------------------------

| Total Costs $307,740 |

------------------------------------------------------------------------

Note that the cost reconciliation indicates a discrepancy, as the total costs assigned exceed the beginning work in process costs. This could be due to additional costs.

learn more about cost reconciliation: https://brainly.com/question/16342430

#SPJ1