Welcome to week 1, discussion 1. When it comes to compensation, organizations have to find a way to differentiate between seniority, experience, knowledge, skills, and abilities, for any given job. If they did not, theoretically, everyone could be paid exactly the same as his/her colleague for a given position. As we know, not all jobs are created equal, but all jobs are vitally important in the functioning of the organizational structure. Hence, the reason for salary ranges and pay bands.

For this discussion, Introduce yourself to your classmates with your name, location, current employment, and future goals. Then answer the following questions:

1. When looking at job options, what are the top three compensation factors that influence your decision?

2. How are those factors different from what they may have been five years ago?

3. As you change, your compensation interests change as well. What do you think some of the changes are that have impacted your top three compensation factors?

Answers

The top three compensation factors that can influence someone's decision are: salary, benefits, and potential for growth and development.

Five years ago, some of the top compensation factors could have been job security, work-life balance, and location.

As the job market evolves, new trends and priorities can influence what people value in compensation. For example, the current pandemic has increased the importance of remote work and flexible schedules. Additionally, there is a growing awareness of the importance of mental health, which can impact the value of benefits such as employee assistance programs or mental health days. Lastly, as the workforce becomes more diverse, companies are placing more emphasis on creating inclusive and equitable environments, which can impact the potential for growth and development as a compensation factor.

To know more about salary visit:

brainly.com/question/29105365

#SPJ11

Related Questions

If an economy is in recession, discuss the differing effects created by a tax cut vs. A GDP-G increase to close the gap. Use the concept of multipliers in your answer.

Answers

Answer:

Explanation:

increase government spending will result in increased aggregate demand, which then increases the real GDP, resulting in an rise in prices. ... Conversely, to close an expansionary gap, the government would increase income taxes, which decreases aggregate demand, the real GDP, and then prices.

Economic recession takes place because of fluctuation within the variation. When the contraction point of the trade cycle prolongs or stays for quite six months then recession takes place in an economy. it's a situation when the entire economy shrinks down.

GDPwhen increased government spending will end in increased aggregate demand, which then increases the 000 GDP, as a lead to an increase in prices. Also Conversely, to shut an expansionary gap, the govt. would increase income taxes, which decreases aggregate demand, the important GDP, and also then prices.

Find out more information about GDP here:

https://brainly.com/question/26261960

Fill in the missing data for each of the following independent cases. (Ignore income taxes. ) (Do not round intermediate calculations. ) Sales Revenue Variable Expenses Total Contribution Margin Fixed Expenses Net Income Break-Even Sales Revenue $ 92,000 195,000 $ 92,000 73,600 195,000 42,000 260,000 130,000 12,000 190,000 20,200 60,000

Answers

The missing data for each case is as follows:

Case 1:

Net Income: $18,400

Case 2:

Total Contribution Margin: $153,000

Case 3:

Net Income: -$39,800 (Loss)

How did we get the data?To fill in the missing data for each case, calculate the remaining values based on the given information. Let's go through each case:

Case 1:

Sales Revenue: $92,000

Variable Expenses: $195,000

Total Contribution Margin: $92,000

Fixed Expenses: $73,600

Net Income: $?

To find the net income, we need to subtract the fixed expenses from the total contribution margin:

Net Income = Total Contribution Margin - Fixed Expenses

Net Income = $92,000 - $73,600

Net Income = $18,400

Case 2:

Sales Revenue: $195,000

Variable Expenses: $42,000

Total Contribution Margin: $?

Fixed Expenses: $260,000

Net Income: $130,000

To find the total contribution margin, subtract the variable expenses from the sales revenue:

Total Contribution Margin = Sales Revenue - Variable Expenses

Total Contribution Margin = $195,000 - $42,000

Total Contribution Margin = $153,000

Case 3:

Sales Revenue: $12,000

Variable Expenses: $190,000

Total Contribution Margin: $20,200

Fixed Expenses: $60,000

Net Income: $?

To find the net income, subtract the fixed expenses from the total contribution margin:

Net Income = Total Contribution Margin - Fixed Expenses

Net Income = $20,200 - $60,000

Net Income = -$39,800 (Loss)

Therefore, the missing data for each case is as follows:

Case 1:

Net Income: $18,400

Case 2:

Total Contribution Margin: $153,000

Case 3:

Net Income: -$39,800 (Loss)

learn more about Net Income: https://brainly.com/question/28390284

#SPJ1

Explain law of demand and supply along with graphical representation and how can we determine the price of any commodity?

Answers

Answer:

The Law of Demand and Supply help us understand how prices are reached in a market.

The Law of Demand states that the higher the price of a good, the lesser the quantity demanded of that good by consumers. Looking at the graph attached, you will see that the demand curve is downward sloping. This is because of the law of demand.

Notice that when the price of the good is $20, there are 4,000 units demanded but when the price goes up to $30, there are now 3,000 units demanded. Consumers demand less of a good as it gets more expensive because it increases their opportunity cost. This means that the money they are spending on a good could be spent elsewhere and if that amount keeps rising, it reduces the quantity of other goods they can get.

The Law of Supply applies to suppliers and states that as prices increases, Suppliers will supply more goods and services because they will have the incentive of more profit guiding them. For that reason the Supply curve will be upward sloping. Notice how at a price of $20, the supply is only 2,000 but when the price rises to 30, the supply increases to 3,000.

The price of a commodity is determined at the Equilibrium point where the Demand and Supply Curves intersect. At this point, the amount that people are willing to pay for a certain quantity of goods matches the price that suppliers are willing to supply the same quantity of goods for. In the graph you will notice that price is $30 and the quantity is 3,000.

Please help!! This is for economics

Which type of market is the one in which a fast-food company buys the eggs to make a person's favorite breakfast sandwich?

Product market

Factor market

Financial market

Closed market

Answers

The market in which the business buys eggs to make the final product that is a sandwich is called as factor market. Thus, Option B is the correct choice.

What is a Factor market?A factor market is a marketplace wherein elements of manufacturing are bought and sold. Factor markets allocate elements of manufacturing, along with land, labor, and capital, and distribute profits to the proprietors of efficient resources, inclusive of wages, and many more.

Therefore, The market in which the business buys eggs to make the final product that is a sandwich is called factor market. Thus, Option B is the correct choice.

Learn more about Factor market:

https://brainly.com/question/16479482

#SPJ1

help pls

Why should a research check that their information is reliable?

How do you determine the validity and reliability of data?

How do you, as a student, organize information?

Why should a researcher

organize their data?

What are different methods for organizing information?

What does it mean to analyze information?

What is the benefit of analyzing information?

Why is it important to analyze information before making a decision

Answers

Answer:

Why should a research check that their information is reliable?

It is important to critically evaluate sources because using credible/reliable sources makes you a more informed writer. Think about unreliable sources as pollutants to your credibility, if you include unreliable sources in your work, your work could lose credibility as a result.

How do you determine the validity and reliability of data?

Reliability can be estimated by comparing different versions of the same measurement. Validity is harder to assess, but it can be estimated by comparing the results to other relevant data or theory.

How do you, as a student, organize information?

Students arrange information hierarchically, cate- gorically, sequentially, or in other ways. They discover and depict the overall structure of the material as well as how discrete pieces of information fit together. They organize and reorganize generalizations, principles, concepts, and facts.

Why should a researcher organize their data?

Choosing a logical and consistent way to name and organise your files allows you and others to easily locate and use them. ... Organising your files carefully will save you time and frustration by helping you and your colleagues find what you need when you need it.

What are different methods for organizing information?

Chronological Patterns. Sequential Patterns. Spatial Patterns. Compare-Contrast Patterns. Advantages- Disadvantages Patterns. Cause-Effect Patterns. Problem-Solution Patterns. Topical Patterns.

What does it mean to analyze information?

Information analysis is the systematic process of discovering and interpreting information.

What is the benefit of analyzing information?

Analysis is the process of breaking a complex topic or substance into smaller parts in order to gain a better understanding of it. The technique has been applied in the study of mathematics and logic since before Aristotle (384–322 B.C.), though analysis as a formal concept is a relatively recent development.

Why is it important to analyze information before making a decision?

Before analyzing data, it is important to first clearly understand for whom and for what purpose you are conducting the analysis. ... Therefore, conducting the analysis to produce the best results for the decisions to be made is an important part of the process, as is appropriately presenting the results.

now i hope this helps you

what actions could be taken to stabilize output in response to a large decrease in u.s. net exports? group of answer choices increase taxes or increase the money supply increase taxes or decrease the money supply decrease taxes or increase the money supply decrease taxes or decrease the money supply

Answers

In order to stabilizing the current balance of trade i.e. large decrease in US Net exports, US Authorities shall decrease the tax rates and increase the money supply. Option C is correct

What are tax rates?A tax rate is the percentage imposed by the government of a country on a individual or on business with the purpose of generating revenue for the development of a nation.

If we talk about the federal government and several state governments in the United States on trading executed between two countries will lead to tariff barriers by imposing tax.

If the govt. decrease the tax rate on production & sale than the partner countries will encourage to purchase goods & procure service from domestic country (US). This will lead to rise in exports and decrease in imports.

Thus decline in tax rates and increase in money supply in the economy will positively affect on US net exports.

To know more about tax rates refer:

https://brainly.com/question/12395856

#SPJ1

Not all voices of protest during this period came from the unions. identify the political agendas of the following individuals.a. Upton Sinclair: He called for the state to utilize disused factories, farms, and homes to create cooperative ventures to provide jobs for the unemployed.b. Huey Long: He called for a restructuring of the American economy in which wealth would be confiscated and redistributed to provide $5,000 grants and guaranteed jobs with annual salaries.c. Dr. Francis Townsend: He won wide support for a plan that would issue $200 to older Americans with the requirement they immediately spend it to boost the economy.

Answers

He demanded that the government develop cooperative ventures that would provide the unemployed economy with employment using abandoned factories, farms, and homes.

Upton Sinclair is the correct name.His suggestion to give seniors $200 and have them spend it immediately away in order to boost the economy was highly supported.It ought to say Francis Townsend, Dr.In order to provide $5,000 grants and ensured employment with annual salaries, he demanded that the American economy be reorganised.proper spelling.Short Huey He called for a restructuring of the American economy in which wealth would be confiscated and redistributed to provide $5,000 grants and guaranteed jobs with annual salaries.Correct label:Huey Long.The processes of an economy are greatly influenced by factors such as a person's culture, values, education, technical development, history, social organisation, political structure, legal system, and availability of natural resources. In addition to providing context and content, these factors establish the rules and conditions under which an economy runs

Learn more about economy:

https://brainly.com/question/951950

#SPJ4

A wholly owned subsidiary whose primary purpose is to finance sales of the parent company's products and services, provide wholesale financing to distributors of the parent company's products, and purchase receivables of the parent company is a

Answers

It should be noted that a wholly owned subsidiary whose primary purpose is to finance sales of the parent company's products and services is regarded as captive finance subsidiary.

Captive finance subsidiary serves as one that finance the sales of the the manufacturer, it helps with resources.

It also provide wholesale financing to distributors that are associated with parent company.

Therefore, Captive finance subsidiary serves as subsidiary whose primary purpose is to finance sales of the parent company's products

Learn more about captive finance subsidiary at:

https://brainly.com/question/10295065

Which situation best illustrates the economic concept of opportunity cost

Answers

Answer: a business spends money on new computers, so it can’t afford de office furniture

Explanation:

A company can't afford office furniture because it's spending money on new computers. As computers are more important than the furniture for working.

What is opportunity cost ?opportunity cost is the choosing the best alternative use of that resources, as per the economist. It is also the profit suffered when one alternative is chosen over another.

Example of opportunity cost is the if a person has spent the time and money in purchasing the gadgets, then he is not able to purchase the books.

Thus, A company can't afford office furniture because it's spending money on new computers.

For more details about opportunity cost, click here:

https://brainly.com/question/13036997

#SPJ2

According to this image :

1- What is the age range of the generation with the highest amount of household debt?

2-Which is the only generation to decrease its average debt from 2019 to 2020?

3-Compare the rate at which Gen Z’s debt increased from 2019 to 2020 compared to other generations.

With an increase of 67.2%, Gen Z’s debt increased at a much higher rate than other generations.

4-Calculate how long it would take for Gen Z’s average debt ($16,000) to reach Gen X’s level of average debt ($140,000) if it continued to increase at its current rate (67.2% per year).

5-Develop a logical argument why Gen Z’s debt is rising at such a high rate when the Silent Generation’s debt is decreasing.

I have to turn this worksheet today, So please ANYONE help me out please ASAP..

Answers

Answer:

1. Gen X 41-56years

2. Silent Gen reduced debt by 4.6%

3.Baby boomers increased by 0.3% from 2019 to 2020, they had the least increase in debt

Gen X followed with 3.5% increase from 2019 to 2020 while Millenials had 11.5% increase in debt between 2019 and 2022. Even though Gen Z debt increased by 67.2%, they still have the lowest debt overall into two years.

4.Gen Z average debt $16,000

Gen X average debt $ 140,000

In 5years, it will meet up with Gen Xs level of debt

5. The silent Gen are the elderly, mostly retired and no longer taking new loans while Gen Z is the younger generating, newly exploring the world, teenagers and students, young school leavers and new work force taking loans at the slightest offer. The silent age are no longer active, they are most been taken care of and won't be taking loan facilities for any purpose. Student loan, technology etc is available and most suitable for the age range of Gen Z, hence the difference in the loan dimension.

unemployment remained above 7our years after the 2007–2009 recession ended. this is an example of a:

Answers

The statement describes an example of prolonged unemployment following a recession.

The statement suggests that unemployment remained high for several years after the 2007-2009 recession concluded. This situation is an example of what is commonly called "jobless recovery." Jobless recovery occurs when an economy shows signs of economic growth and recovery, but the unemployment rate remains elevated for an extended period. It indicates a delayed improvement in the labor market despite overall economic progress.

The 2007-2009 recession, also known as the Great Recession, was a severe economic downturn that had a profound impact on the global economy. Following the recession, the labor market faced challenges in terms of job creation and reduced unemployment rates. Factors such as slow economic growth, industry changes, and structural shifts in the labor market can contribute to prolonged unemployment even after the recession ends. In this case, the extended period of unemployment above 7 years after the recession's end highlights the persistent nature of the challenges faced by the labor market and the time required for the recovery to fully translate into improved employment opportunities.

Learn more about unemployment here:

https://brainly.com/question/17272604

#SPJ11

Why very few subsistence economies exist today

Answers

Answer:

As previously mentioned,

subsistence markets are

extremely vulnerable to

external influences.

Because of this

vulnerability, these economies are

becoming more scarce around the

world. In the past, for example, large

populations of indigenous peoples lived

throughout North America.

Explain why a rise in the pound sterling exchange is likely to affect the rate of inflation in the uk

Answers

Answer:

A higher inflation rate in the UK compared to other countries will tend to reduce the value of the Pound Sterling because: High inflation in the UK means that UK goods increase in price quicker than European goods. ... This increase in the supply of pounds decreases the value of Pound Sterling.

In which market would a producer sell bicycles to consumers?

Answers

In the markets for goods and services, a producer would sell his bike for purchase by customers.

What is the market for goods and services?Consumers buy consumables on the products and services market, and firms sell their commodities there. The market encompasses physical stores, the Internet, and any other location where consumers can exchange products and services.

The trading of finished goods takes place here. Businesses receive payment from customers in exchange for goods. The consumer gives money to the business in a flow. In contrast to this, enterprises can buy the materials they need on the factor market to make an item.

The rule of supply and demand governs how much is produced and at what price in the market for products and services.

Learn more about the goods and services market, from:

brainly.com/question/17078982

#SPJ1

A firm that produces potato chips occupies four hectares of land. The firm produces 10 tons of output per day and sells its output at a price of $240 per ton on the export market. The firm does not engage in factor substitution as the price of land changes. Intra-urban transportation is on trucks, with a unit cost of $12 per ton per mile. The firm’s non-land

cost is $560 per day. The firm exports its output via circumferential highway (i. E. , beltway around the city). That is, it wants to be near the beltway.

(a) Sketch the firm’s bid-rent curve for land for different distances from the beltway, from a distance zero to five miles.

(b) What is the bid-rent at the beltway? What is the slope of the bid-rent function? Show your work

Answers

(a) The bid-rent curve represents the maximum amount the firm is willing to pay for land at different distances from the beltway. (b) $800, slope is -$40.

(a) To sketch the firm's bid-rent curve for different distances from the beltway, we need to consider the cost components involved in the firm's operations. The bid-rent curve represents the maximum amount the firm is willing to pay for land at different distances from the beltway.

The firm's total cost per day consists of two components: the non-land cost and the transportation cost. The non-land cost is given as $560 per day, which remains constant regardless of the location. The transportation cost is incurred for each ton of output transported via trucks, and it is given as $12 per ton per mile.

Let's consider different distances from the beltway, ranging from zero to five miles. The transportation cost will vary depending on the distance from the beltway.

At distance zero (on the beltway), the transportation cost is zero since the trucks do not have to travel any distance. Therefore, the total cost per day at distance zero is $560.

At distance one mile, the transportation cost per day would be $12 per ton multiplied by the 10 tons of output produced, which equals $120. So, the total cost per day at distance one mile would be $560 + $120 = $680.

Similarly, we can calculate the total cost per day for distances two, three, four, and five miles from the beltway. Considering the transportation cost and adding it to the non-land cost, we get the following results:

Distance Total Cost per Day

------------------------------------

0 miles $560

1 mile $680

2 miles $800

3 miles $920

4 miles $1,040

5 miles $1,160

These values represent the maximum amount the firm is willing to pay for land at different distances from the beltway, given its production and transportation costs.

(b) The bid-rent at the beltway, i.e., distance zero, is $560 per hectare per day, which is equal to the firm's non-land cost. The slope of the bid-rent function can be determined by calculating the change in bid-rent per unit change in distance.

Considering the bid-rent values at distance zero and one mile, we can calculate the slope as follows:

Slope = (Bid-rent at distance zero - Bid-rent at distance one mile) / (Distance zero - Distance one mile)

= ($560 - $680) / (0 - 1)

= -$120 / -1

= $120

Therefore, the slope of the bid-rent function is -$120 per hectare per mile.

To learn more about firm click here: brainly.com/question/32241343

#SPJ11

Lifelong Learning( Veronica takes advantage of all training opportunities offered at her job. She registered and attended workshops on diversity, cultural awareness, computer programs, etc...)This is an example of a ... *

Answers

Answer:

Lifelong Learning

Explanation:

This is an example of Lifelong Learning. This term refers to when an individual pursues knowledge in any and all shapes and forms from their own free will. This means that they are voluntarily going after knowledge and taking every opportunity to learn more without being forced to do so. Usually, because they believe that knowledge is power and want to learn because they like to do so. This is exactly, what Veronica is doing by taking full advantage of any opportunity that becomes available for her to learn any new skill.

1. Which of the following is not true of a debenture?

a. Debenture holders get a fixed rate of return b. All businesses can have debenture holders

c. They must be repaid on an agreed date

d. Debenture holders are creditors of the company

Answers

Answer:

B.

Explanation:

A debenture can only be taken on a limited company or limited liability partnership; it can't to be taken over a sole trader or standard partnership. A director who has advanced or lent money into their own company could take a debenture to secure the loan. A private lender can also take a debenture.

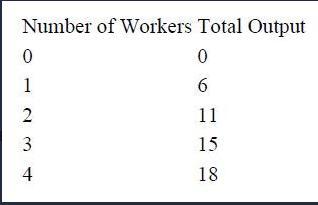

praxis if the firm's labor cost is $20 per worker per hour and the firm sells its output for $5 per unit, how many workers should the firm hire to maximize profit? 1

Answers

Assuming the association's work cost is $20 per laborer each hour and the firm sells its result for $5 per unit the firm shopuld enlist 3 workers.

To boost benefit, a firm ought to employ laborers up to the place where the negligible expense of work is equivalent to the peripheral income produced from selling an extra unit of result. All in all, the firm ought to recruit laborers until the expense of creating an additional unit of result approaches the income acquired from selling that unit.

The ideal number of laborers not entirely set in stone by finding where the peripheral expense of work approaches the negligible income from selling an extra unit. This point addresses the greatest benefit.

Learn more about work, from:

brainly.com/question/33629397

#SPJ4

Your question is incomplete, probably the question should contain the below list-

In the early days of the new monetary system, stockholders were more willing to invest in corporations because of ____________, which limits their financial liability to whatever they invested in the company. Group of answer choices

Answers

In the early days of the new monetary system, stockholders were more willing to invest in corporations because of limited liability, which limits their financial liability to whatever they invested in the company. This concept provided protection to investors, encouraging them to invest without the fear of losing more than their initial investment.

What do you mean by limited liability?

Limited liability refers to the legal concept that limits the financial liability of an individual or entity to the amount of their investment in a business. In other words, it protects the personal assets of business owners or investors from being used to pay off the debts or obligations of the business.

Limited liability is typically associated with certain types of business structures, such as limited liability companies (LLCs) and corporations. In these structures, the owners or shareholders of the business are not personally liable for the debts or obligations of the business, beyond their investment in the company. This means that if the business incurs significant debts or legal liabilities, the personal assets of the owners or shareholders, such as their homes or personal bank accounts, are generally protected.

To know more about Limited liability:

https://brainly.com/question/14609616

#SPJ11

how much would need to be deposited into savings account today earning 3.5ompounded annually in order to offer a $100 yearly scholarship forever?

Answers

In order to offer a $100 yearly scholarship forever, approximately $2,857.14 would need to be deposited into the savings account today, assuming an interest rate of 3.5% compounded annually.

To determine how much would need to be deposited into a savings account today, we can use the concept of perpetuity. A perpetuity is a series of equal payments that continues indefinitely. In this case, the scholarship payment of $100 per year is a perpetuity.

The formula to calculate the present value of a perpetuity is:

Present Value = Payment / Interest Rate

In this case, the payment is $100 per year and the interest rate is 3.5% compounded annually.

Converting the interest rate to decimal form, we get 0.035. Plugging the values into the formula, we have:

Present Value = $100 / 0.035

Calculating this, we find:

Present Value = $2,857.14

Know more about present value here:

https://brainly.com/question/28304447

#SPJ11

In its 1st month of business, brewed awakenings, inc. Purchased $1,000 of supplies of which it had paid $700 and owes the rest. At the end of the month, it had $400 of supplies available for use. What is the amount of supplies expense on the income statement?.

Answers

Brewed Awakenings, Inc. completed its first month of operation. bought $1,000 worth of materials, of which it paid $700 and is still liable for the balance. It has $400 worth of supplies available at the conclusion of the month. There will be a $600 charge for materials on the income statement.

It spent $600 on items it had spent $1,000 on but only had $400 left. Supplies Expense is the amount used, and it is recorded as an adjusting entry with a debit of $600 to Supplies Expense and a credit of $600 to Supplies. One of the three crucial financial statements used to describe a company's financial performance throughout a certain accounting period is the income statement. An income statement offers useful information about a company's operations, managerial effectiveness, underperforming industries, and performance in comparison to competitors.

To learn more about Income Statement here

https://brainly.com/question/13463210

#SPJ1

one reason financial institutions become very large is to:

Answers

One reason financial institutions become very large is to achieve economies of scale.

By growing in size, financial institutions can benefit from economies of scale, which refers to the cost advantages that arise from increased production or operation levels. Here are a few ways in which larger size can lead to cost advantages:

Cost Spread:Large financial institutions can spread their fixed costs, such as infrastructure, technology systems, and compliance expenses, over a larger customer base. This can result in lower average costs per customer or transaction.

Negotiating Power:With greater size, financial institutions often have increased negotiating power with suppliers, vendors, and other counterparties. They can negotiate better terms, bulk discounts, or favorable pricing, which can contribute to cost savings.

Enhanced Efficiency:Larger institutions can invest in advanced technology, automation, and streamlined processes to achieve higher levels of efficiency. This can reduce operational costs and improve productivity.

Diversification:Large financial institutions have the ability to diversify their revenue streams across different products, services, and markets. This diversification can help mitigate risks and enhance overall profitability.

It's important to note that while achieving economies of scale can be a motivating factor for financial institutions to grow in size, there can also be potential drawbacks, such as increased complexity, regulatory challenges, and concentration of power.

Learn more about financial institutions from the given link

https://brainly.com/question/29630223

#SPJ11

the british economicst ______________ demonstrated in 1817 that even though one nation held an absolute advantage over another in the production of each of two different goods, international trade could still be a positive-sum game in which both countries benefit.

Answers

Answer:

David Ricardo

Explanation:

Disadvantages of choosing a job that is extremely popular or in demand

Answers

The disadvantage of choosing a job that is very popular or a job that is in high demand is that after a while such a job may become saturated or it would become monotonous.

What is a high demand job?This is the term that is used to refer to a job that the people that wpould employ labor are constantly in need of. Such a job is one that would require the people that have the qualification to opt in and get the places and the roles that they are to fill.

The issues that may arise from such a job that is in high demand is that after a period, such a job may have a lot of persons that would want to fulfil the role.

The number of qualified persons may become more than the job that is available for the people to do in the long run.

Hence this is a disadvantage. Therefore I would conclude by saying that the disadvantage of choosing a highly popular job is that the number of persons that are willing to fulfil the role may exceed the job overtime.

Read more on jobs here: https://brainly.com/question/26355886

#SPJ1

what is meant by business

Answers

Answer:

A business is defined as an organization or enterprising entity engaged in commercial, industrial, or professional activities.

Medicare is a government program funded by tax dollars to:

A-provide health insurance to children in a recount

B-provide health insurance to working adults

C-provide hospital insurance for those over 65

Answers

Answer: C

Explanation: Trust me

Palmona Company establishes a $310 petty cash fund on January 1. On January 8, the fund shows $205 in cash along with receipts for

the following expenditures: postage, $43; transportation-in, $14; delivery expenses, $16; and miscellaneous expenses, $32. Palmona

uses the perpetual system in accounting for merchandise inventory.

1. Prepare the entry to establish the fund on January 1.

2. Prepare the entry to reimburse the fund on January 8 under two separate situations:

a. To reimburse the fund.

b. To reimburse the fund and increase it to $360. Hint. Make two entries.

Answers

The entry to establish the fund on January 1 is: Debit Petty Cash Fund 310, Credit Cash 310

How to prepare journal entry?1. Entry to establish the fund on January 1:

Debit Petty Cash Fund 310

Credit Cash 310

2a. Entry to reimburse the fund on January 8:

Debit Postage Expense 43

Debit Transportation-In Expense 14

Debit Delivery Expense 16

Debit Miscellaneous Expense 32

Credit Cash 105

2b.8-Jan

Debit Petty Cash $255

($360 - $105)

Credit Cash $255

(Being increment of petty cash recorded)

Therefore the entry is Debit Petty Cash Fund 310, Credit Cash 310.

Learn more about journal entry here:https://brainly.com/question/14279491

#SPJ1

Percent of Sales Method At the end of the current year, Accounts Receivable has a balance of $885,000; Allowance for Doubtful Accounts has a debit balance of $8,000; and sales for the year total $3,980,000. Bad debt expense is estimated at 1/4 of 1% of sales. a. Determine the amount of the adjusting entry for uncollectible accounts

Answers

The percent of sales method is one way of estimating the allowance for doubtful accounts. At the end of the current year, Accounts Receivable has a balance of $885,000; Allowance for Doubtful Accounts has a debit balance of $8,000; and sales for the year total $3,980,000.

Bad debt expense is estimated at 1/4 of 1% of sales. To calculate the amount of the adjusting entry for uncollectible accounts, follow the steps given below:Step 1: Calculate the bad debt expense:Bad Debt Expense = Sales * Estimated Bad Debt RateBad Debt Expense = $3,980,000 * 0.25%Bad Debt Expense = $9,950Step 2: Calculate the required allowance for doubtful accounts:

Required Allowance for Doubtful Accounts = Accounts Receivable * Estimated Bad Debt RateRequired Allowance for Doubtful Accounts = $885,000 * 0.25%Required Allowance for Doubtful Accounts = $2,213

Step 3: Determine the amount of adjustment:

Adjustment = Required Allowance for Doubtful Accounts - Existing Allowance for Doubtful AccountsAdjustment = $2,213 - ($8,000)Adjustment = $2,213 + $8,000Adjustment = $10,213Thus, the amount of the adjusting entry for uncollectible accounts is $10,213.

To know more about estimating visit :

https://brainly.com/question/30870295

#SPJ11

3. One day you happen to hear a snippet of conversation between two graduate students, who are drinking coffee and contemplating an open box of exquisitely delicious chocolate truffles in the Page Break Café. The first student opines that one can definitely outline a set of objective design principles that should underpin the construction of any professional chart or map. The second student disagrees vehemently and argues that the one and only important thing to worry about is aesthetics. The first student is speechless. What do you think? Use your knowledge of data visualization to inform your answer, and be sure to explain your answer carefully.

Answers

The first student believes in objective design principles for professional charts/maps, while the second student prioritizes aesthetics.

In data visualization, both objective design principles and aesthetics play crucial roles. Objective design principles focus on conveying information accurately and efficiently.

This includes considerations such as choosing appropriate chart types, using clear labels and legends, organizing data effectively, and ensuring accessibility. Following these principles helps ensure that the intended message is effectively communicated and understood by the audience.

On the other hand, aesthetics, while subjective, should not be disregarded. Well-designed visualizations with aesthetically pleasing elements can enhance engagement, captivate attention, and improve comprehension.

Aesthetics involve aspects like color choices, typography, layout, and visual appeal. Striking a balance between objective design principles and aesthetics is essential for creating impactful visualizations that effectively communicate data while captivating the audience's interest. Ignoring either aspect may lead to a compromised visualization that fails to deliver the intended message or fails to engage the viewers effectively.

Learn more about Designs click here :brainly.com/question/21422013

#SPJ11

After the government has increased the quota limit of imported vegetables, the quantity transacted of the vegetables is still lower than the equilibrium quantity without the quota. Suppose the demand for vegetables is elastic. With the aid of a diagram, explain the effect of the above measure on the price, quantity transacted and the total sales revenue of the vegetables.

Answers

The increased quota limit on imported vegetables lowers the price and quantity transacted, reducing total sales revenue due to elastic demand.

When the government increases the quota limit on imported vegetables, it allows more foreign vegetables to enter the domestic market. However, if the demand for vegetables is elastic, consumers are highly responsive to price changes. As a result, the price of vegetables decreases due to the increased supply, but the quantity transacted does not reach the equilibrium level.

In the diagram, the demand curve is relatively elastic, meaning it is flatter. As the quota limit is raised, the supply curve shifts to the right, resulting in a new equilibrium point with a lower price and quantity transacted. However, since the demand is elastic, the decrease in price is not sufficient to stimulate a significant increase in quantity demanded to reach the equilibrium quantity without the quota.

As a result, the total sales revenue of vegetables decreases because the decrease in price is not compensated by the decrease in quantity transacted. This illustrates the impact of the increased quota limit on the price, quantity transacted, and total sales revenue of vegetables.

Learn more about quota here:

https://brainly.com/question/31954986

#SPJ11