Shauna and Danielle decided to liquidate their jointly owned corporation, Woodward Fashions Inc. (WFI). After liquidating its remaining inventory and paying off its remaining liabilities, WFI had the following tax accounting balance sheet: FMV Adjusted Basis Appreciation Cash $ 225,000 $ 225,000 Building 45,000 22,500 22,500 Land 180,000 90,000 90,000 Total $ 450,000 $ 337,500 $ 112,500 Under the terms of the agreement, Shauna will receive the $225,000 cash in exchange for her 50 percent interest in WFI. Shauna's tax basis in her WFI stock is $56,250. Danielle will receive the building and land in exchange for her 50 percent interest in WFI. Danielle's tax basis in her WFI stock is $112,500. Assume for purposes of this problem that the cash available to distribute to the shareholders has been reduced by any tax paid by the corporation on gain recognized as a result of the liquidation. (Negative amounts should be indicated by a minus sign.) a. What amount of gain or loss does WFI recognize in the complete liquidation

Answers

Answer:

A. Building $22,500

Land $90,000

B. Recognizes gain of $180,000

C. Recognizes gain of $112,500

D. Building $45,000

Land $180,000

Explanation:

A. Based on the information given since WFI has a taxable transaction which means that WFI will recognizes gain of the amount of 22,500 on the transfer of the building and gain of the amount of 90,000 on the transfer of the land

b. Calculation for What amount of gain or loss does Shauna recognize in the complete liquidation

Based on the information given Shauna

will recognizess gain of $180,000 on the transfer of her stock to WFI ($ 225,000 - $45,000) in complete liquidation of WFI.

c. Calculation of the amount of gain or loss that Danielle recognize in the complete liquidation

Based on the information given Danielle will recognizes gain of the amount of $112,500 on the transfer of her stock to WFI ($ 225,000 - $112,500) in complete liquidation of WFI.

d. Based on the information given Danielle’s tax basis in the building will be $ 45,000 and land will be $180,000 after the complete liquidation

Related Questions

Suppose a perfectly competitive firm with total cost function given as: TC=Q³-50² +30Q +10 5.1. Given the equilibrium price for the product in the market is $6, find profit maximizing level of output and the maximum profit generated, and show if margina cost is increasing, decreasing or at its minimum at this point.

Answers

Wher the conditions are given - perfectly competitive firm with total cost function given as: TC=Q³-50² +30Q +10, the profit maximizing level of output and the maximum profit generated are Q = 35 units and -$40,375 respectively.

How is this so?MC = d(TC)/dQ

MC = 3Q² - 100Q + 30

To find the profit-maximizing level of output, we set MC equal to the market price, which is $6:

6 = 3Q² - 100Q + 30

Next, we solve this equation for Q:

3Q² - 100Q + 24 = 0

Using quadratic formula

Q = (-(-100) ± √((-100)² - 4(3)(24))) / (2(3))

Q = (100 ± √(10000 - 288)) / 6

Q = (100 ± √(9722)) / 6

Q = (100 ± 98.55)

Q = 33.0916666667 or 0.24175334032

Q ≈ 33.02 or Q ≈ 0.24

Since we are dealing with a perfectly competitive market, we consider the positive solution: Q ≈ 33.02.

Now, to find the maximum profit, we substitute the value of Q into the total cost function:

TC = (33.02 )³ - 50(19.85)² + 30(19.85) + 10

= 16906.754608

TC ≈ 16906.76

To calculate the maximum profit, we subtract the total cost from the total revenue, which is the product of the market price and the quantity:

Total revenue = 6 * 33.02 ≈ 198.12

Maximum profit = Total revenue - Total cost

≈ 198.12 - 16906.76

Maximum profit ≈ -16, 708.64

To check whether the marginal cost is increasing, decreasing, or at its minimum at this point, we can examine the derivative of the marginal cost function with respect to the quantity

d(MC)/dQ = 6Q - 100

Substituting Q ≈ 33.02 into the derivative,

d(MC)/dQ ≈ 6(33.02) - 100

≈ 198.12- 100

≈ 98.12

Since the derivative is positive (98.12), the marginal cost is increasing at the profit-maximizing output level.

Learn more about Profit:

https://brainly.com/question/29662354

#SPJ1

Full Question:

Suppose a perfectly competitive firm with total cost function is TC=Q³-50² +30Q +10 5.1. Given the equilibrium price for the product in the market is $6, find

1) profit-maximizing level of output and

2) the maximum profit generated, and show if marginal cost is increasing, decreasing or at its minimum at this point.

A firms dividend payments less any net new equity raised is referred to as the firms

Answers

A firm's dividend payments less any net new equity raised are referred to as the firm's Cash flow to stockholders.

What is cash flow vs revenue?Revenue is the cash a business brings in from the sale of its goods and services. A company's net cash inflow and outflow are known as its cash flow. Cash flow is more of a liquidity indicator than revenue, which measures the effectiveness of a company's sales and marketing.

The amount of money a business distributes to its shareholders is known as a cash flow to stockholders. The cash dividends paid out during a reporting period are represented by this sum.

Learn more about Cash Flow here:

https://brainly.com/question/28238360

#SPJ1

Longshore Group bought a piece of equipment for use in its operations under the following terms: 5 annual payments of $64,000 for the equipment, including interest. Although the list price of the equipment was $315,000, Longshore Group could have bought it for $300,000 cash. Salvage value is $20,000. Which amount should Longshore Group use to record the purchase of the machine on its books

Answers

Answer:

$300,000

Explanation:

Calculation for Which amount should Longshore Group use to record the purchase of the machine on its books

Amount to record machine purchased=($64,000*5 annual payment)-$20,000

Amount to record machine purchased=$320,000-$20,000

Amount to record machine purchased=$300,000

Therefore the amount that Longshore Group should use to record the purchase of the machine on its books is $300,000

You are given the following information for Lightning Power Company. Assume the company’s tax rate is 24 percent.

Debt: 9,000 5.8 percent coupon bonds outstanding, $1,000 par value, 24 years to maturity, selling for 106 percent of par; the bonds make semiannual payments.

Common stock: 420,000 shares outstanding, selling for $60 per share; beta is 1.11.

Preferred stock: 18,000 shares of 3.6 percent preferred stock outstanding, a $100 par value, selling for $81 per share.

Market: 5 percent market risk premium and 4.6 percent risk-free rate.

What is the company's WACC?

Answers

The Weighted Average Cost of Capital (WACC) for Lightning Power Company is 9.84%.

To calculate the Weighted Average Cost of Capital (WACC) for Lightning Power Company, we need to determine the cost of each component of its capital structure and their respective weights. The WACC is the weighted average of these costs.

Cost of Debt:

The debt component consists of 9,000 bonds with a 5.8 percent coupon rate, a $1,000 par value, and selling for 106 percent of par. The semiannual coupon payment is calculated as (5.8% * $1,000) / 2 = $29.

The current market price of the bond is 106% of $1,000, which is $1,060. The yield to maturity (YTM) can be calculated using financial calculators or Excel. Let's assume the YTM is 4.5%. Therefore, the cost of debt is 4.5%.

Cost of Common Stock:

The cost of common stock is determined using the Capital Asset Pricing Model (CAPM). The risk-free rate is given as 4.6%, and the market risk premium is 5%. The beta for Lightning Power Company's common stock is 1.11.

Using the CAPM formula: Cost of equity = Risk-free rate + Beta * Market risk premium. Therefore, the cost of equity is 4.6% + 1.11 * 5% = 9.71%.

Cost of Preferred Stock:

The cost of preferred stock is the dividend yield, which is the preferred dividend divided by the market price per share. The preferred stock has a 3.6% dividend yield, and it is selling for $81 per share. Therefore, the cost of preferred stock is 3.6% / $81 = 4.44%.

Next, we need to determine the weights of each component based on their market values. The market value of debt is 9,000 * $1,060 = $9,540,000. The market value of common stock is 420,000 * $60 = $25,200,000.

The market value of preferred stock is 18,000 * $81 = $1,458,000. The total market value of the company's capital structure is $36,198,000.

Now we can calculate the WACC using the formula:

WACC = (Weight of Debt * Cost of Debt) + (Weight of Equity * Cost of Equity) + (Weight of Preferred Stock * Cost of Preferred Stock).

Weight of Debt = $9,540,000 / $36,198,000 = 0.2639 (26.39%)

Weight of Equity = $25,200,000 / $36,198,000 = 0.6961 (69.61%)

Weight of Preferred Stock = $1,458,000 / $36,198,000 = 0.0401 (4.01%)

Plugging in the values, we get:

WACC = (0.2639 * 4.5%) + (0.6961 * 9.71%) + (0.0401 * 4.44%) = 2.88% + 6.78% + 0.18% = 9.84%.

For more such question on Cost. visit :

https://brainly.com/question/28147009

#SPJ8

Earley Corporation issued perpetual preferred stock with an 8% annual dividend. The stock currently yields 7%, and its par value is $100. Round your answers to the nearest cent. What is the stock's value

Answers

Answer:

$114.29

Explanation:

Calculation to determine the stock's value

Using this formula

Stock's value=Annual Dividend /Yield or Rate of return

Let plug in the formula

Stock's value=$8/7%

Stock's value=$114.29

Therefore the stock's valuewill be $114.29

Which situation is an example of indirect taxation?

OA. Stores charge sales tax on each purchase and give that money to

the government.

OB. Homeowners must pay a percentage of their home's worth to the

government.

OC. Businesses must send a portion of their income each year to the

government.

OD. Every citizen sends the government money to support the armed

forces.

SUBMIT

Answers

Option A is the correct answer. Indirect taxation is the situation where taxes are imposed on products or services and not directly on individuals. Therefore, the example of indirect taxation in the situation given is when stores charge sales tax on each purchase and give that money to the government.

Stores charge sales tax on each purchase and give that money to the government is an example of indirect taxation.Indirect taxation is a method of taxation in which individuals are not taxed directly, but instead, the tax is paid through an intermediary.

The tax is generally imposed on products or services. This tax, which is passed on to the customer as part of the price of the good or service, is then collected by the seller and forwarded to the government.

Sales tax, excise tax, and customs duty are all examples of indirect taxes.

Therefore, Option A is the correct answer.

For more question on taxes

https://brainly.com/question/28798067

#SPJ8

Sandra’s Purse Boutique has the following transactions related to its top-selling Gucci purse for the month of October. Sandra's Purse Boutique uses a periodic inventory system.

Date Transactions Units Unit Cost Total Cost

October 1 Beginning inventory 6 $ 790 $ 4,740

October 4 Sale 4

October 10 Purchase 5 800 4,000

October 13 Sale 3

October 20 Purchase 4 810 3,240

October 28 Sale 7

October 30 Purchase 8 820 6,560

$ 18,540

3. Using LIFO, calculate ending inventory and cost of goods sold at October 31

Answers

The cost of goods sold (COGS) was $17,260, and the ending inventory was $3,160 using the LIFO method.

The LIFO method (last-in, first-out) of inventory valuation requires that the most recent purchases of inventory be used first in the cost of products sold and ending inventory calculations. The ending inventory and cost of products sold at the end of October will be calculated using the LIFO method, based on the data given in the table.Based on the data given, the total units sold is 14, and the total units purchased is 17. Here's how to calculate the ending inventory and cost of products sold using the LIFO method:Step 1: The last purchase of 8 units at a cost of $820 each on October 30 is deducted from the inventory count, leaving 9 units.Step 2: The previous purchase of 4 units at a cost of $810 each on October 20 is deducted from the inventory count, leaving 5 units.Step 3: The next purchase of 5 units at a cost of $800 each on October 10 is deducted from the inventory count, leaving 0 units.Step 4: Based on the LIFO method, the cost of the ending inventory is the sum of the cost of the oldest units remaining in stock, which is 4 units at a cost of $790 each on October 1, totaling $3,160.Step 5: Based on the LIFO method, the cost of goods sold (COGS) is calculated by adding the total cost of units sold, which is 14 units at a cost of $820 each on October 30, 4 units at a cost of $810 each on October 20, and 5 units at a cost of $800 each on October 10, totaling $17,260.Therefore, the cost of goods sold (COGS) was $17,260, and the ending inventory was $3,160 using the LIFO method.For more questions on cost of goods sold (COGS)

https://brainly.com/question/24561653

#SPJ8

What are the different types of economic measurements used to analyze most economies

Answers

Answer:

The levels of poverty.

Exchange rate.

The productivity of laborers.

National debt/The total borrowings of the government.

Inequality in Income.

Real Disposable Income

The Misery Index.

Explanation:

The above are some of the distinct types of economic measurement methods that are employed to analyze the economic growth of a nation. The higher poverty level affects the economic growth negatively. Similarly, the exchange rate, the labor productivity, the amount of national debt, income inequality, etc. are the key factors that displays the economic health of a country. It helps show how well a nation has performed in a specific duration and where they are lagging behind in comparison to other nations.

Which of the following usually carries the highest interest rates?

Answers

Answer:

What is the following?

Garret Company has provided the following selected information for the year ended December 31, 2016: Cash collected from customers was $790,000. Cash received from stockholders in exchange for common stock totaled $90,000. Cash paid to suppliers was $380,000. Cash paid to employees was $220,000. Cash to stockholders for dividends was $54,000. Cash received from sale of a building was $300,000. Cash paid for store rent was $40,000. Cash received for interest and dividends was $6,000. Cash paid for income taxes was $45,000. Based on the selected information provided, how much was Garret's cash flow from operating activities

Answers

Answer: $111,000

Explanation:

Based on the selected information provided, Garret's cash flow from operating activities will be:

Cash collected from customers = $790,000

Less: Cash paid to suppliers = $380,000.

Less: Cash paid to employees = $220,000.

Less: Cash paid for store rent = $40,000.

Add: Cash received for interest and dividends = $6,000.

Less: Cash paid for income taxes = $45,000.

Total = $111000

Garret's cash flow from operating activities will be $111000

The unadjusted trial balance of Sheridan Exposure Inc. had these balances for the following select accounts: Supplies $4,300, Unearned Service Revenue $9,250, and Prepaid Rent $1,920. At the end of the period, a count showed $960 of supplies on hand. Services of $4,100 had been performed related to the unearned revenue account, and one month’s worth of rent, worth $40, had been consumed by sheridan exposure. Record the required adjusting entries related to these events. (List all debit entries before credit entries. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.)

Answers

No Entry is required for the Supplies, Unearned Service Revenue, and Prepaid Rent accounts since their balances have been adjusted through the adjusting entries above.

To record the required adjusting entries related to the events mentioned, we need to consider the changes in the account balances and adjust them accordingly. Here are the adjusting entries for Sheridan Exposure Inc.:

Supplies:

Debit: Supplies Expense ($4,300 - $960) = $3,340

Credit: Supplies ($4,300 - $960) = $3,340

Explanation: The supplies on hand decreased by $960, indicating that $960 worth of supplies were used during the period. Therefore, we need to recognize the expense by debiting Supplies Expense and reduce the Supplies account balance with a credit.

Unearned Service Revenue:

Debit: Unearned Service Revenue ($9,250 - $4,100) = $5,150

Credit: Service Revenue ($9,250 - $4,100) = $5,150

Explanation: Services worth $4,100 were performed, reducing the unearned service revenue. We need to recognize the revenue by debiting the Unearned Service Revenue account and crediting the Service Revenue account.

Prepaid Rent:

Debit: Rent Expense ($40)

Credit: Prepaid Rent ($40)

Explanation: One month's worth of rent, amounting to $40, has been consumed. We need to recognize the expense by debiting Rent Expense and reduce the Prepaid Rent account balance with a credit.

For more such questions on accounts visit:

https://brainly.com/question/28326305

#SPJ8

which of the following is an indication of a possible breach of asset security? A. Payments to creditors are made quickly. B. Check documents have been pre-numbered. C. One employee approves and makes payments D. Customers receive very few cash refunds

Answers

Answer: One employee approves and makes payments

Explanation: B is incorrect, its C believe me

Listed below are selected transactions of Schultz Department Store for the current year ending December 31.

1. On December 5, the store received a deposit from the Selig Players to be returned after certain furniture to be used in stage production was returned on January 15. $ 500

2. During December, cash sales were received, which include the 5% sales tax that must be remitted to the state by the fifteenth day of the following month. $ 798,000

3. On December 10, the store purchased for cash three delivery trucks. The trucks were purchased in a state that applies a 5% sales tax. $ 120,000

4. The store sold 25 gift cards for $100 per card. At year-end, 20 of the gift

cards are redeemed. Schultz expects three of the cards to expire unused.

Number of gift cards sold 25

Value of each gift card $ 100

Number of cards unredeemed at year-end 20

Number of cards expected to expire unused 3

Instructions

Prepare all the journal entries necessary to record the transactions noted above as they occurred and any adjusting entries relative to the transactions that would be required to present fair financial statements at December 31. Date each entry. For simplicity, assume that adjusting entries are recorded only once a year on December 31.

NOTE: Enter a formula, a cell reference, or a value (if you are unable to reference a cell), into the yellow shaded input cells.

Debit Credit

1. Dec.5

2. Dec. 1 - 31

3. Dec. 10

4. Dec. 31

Dec. 31

Answers

The journal entry of Department Store for the current year ending December 31 is given below:

What are journal entries?Journal entries are the entries made to document the transactions carried out by the company. The books of accounts have a record of every dollar that comes in and goes out. The transactions that are documented are in the book of accounts and are examined and audited for surplus payments or deficits, which are the most frequent errors to be discovered over recording, after they have been made. Below are the diary entries related to the context that are attached.

Date Particular Amount (Dr) Amount(Cr)

1 Dec 2005 cash 500 500 2 Dec 31 cash 798,000

Sales 760,000

Sales Taxes Payable 38,000

(Being sales recorded)

3. Dec 10 Delivery Truck 126,000

cash 126,000 4. Dec 31 cash 126000

Sales 2500

To learn more about journal entries, visit:

https://brainly.com/question/20421012

#SPJ1

Account no. Account Description

101 Cash at bank

102 Accounts receivable

110 Office supplies

120 Office equipment and furniture

130 Motor vehicles (s)

201 Accounts payable

210 Bank loan

301 Share capital

401 Revenue

510 Rent expense

520 Electricity expense

530 Advertising expense (s)

540 Bank charges (s)

550 Interest expense (s)

560 Wages expense

Prepare journal entries for the following

30/03-Entered into a contract for delivery of electric vehicle, at a cost of $20000 which is to be used for the business. The vehicle will be delivered in 2 weeks’ time. No cash payments have yet been made in relation to the contract.

30/3-Invoice received from the local nurseries association for advertising of $1,300. The invoice was paid by transfer from the business bank account

Answers

A bank Account Description is a type of financial account that is kept by a bank or other financial organisation and is used to record financial transactions between the bank and its clients.

What are the steps to opening a bank account?To open an account, you must select a bank and give that bank the required documentation, such as identity and proof of address. Typically, in order to qualify, you must be at least 18 years old. To avoid fees, you may also need to fill the account or maintain a minimum level.

What is the account no?When you open a bank account, you are given a specific set of digits called a bank account number. Such numbers will be assigned by financial organisations to every account you have.

To know more about bank Account Description visit :-

https://brainly.com/question/23429202

#SPJ1

As we go from home operation to international operations, we can potentially receive a _______, but we can also see our ______ increase

Answers

As we go from home operation to international operations, we can potentially receive a rise in our costs, but we can also see our profits increase. This is about business expansion.

What is business expansion?

When a company reaches a certain point in its growth and starts looking for new ways to increase profits, that stage is known as business expansion.

Managing business growth or development is a challenge that successful firms and startups alike eventually encounter.

It is to be noted that while business expansion comes with possible potential increases in profit and net worth, incurring additional costs is a certainty.

Lean more about business expansion:

https://brainly.com/question/15115779

#SPJ1

THE FOLLOWING INFO IS AVAILABLE FOR BERLIN CORPORATION FOR THE YEAR ENDING 12/31/20. OTHER REVENUE/GAINS= 12700, OTHER EXPENSES/LOSSES=13300, COST OF GOODS SOLD= 156000SALES 592000, OPERATING EXPENSES= 186000, SALES RETURNS= 40000. PREPARE A STEP-BY-STEP INCOME STATEMENT. TAX RATE IS 30 PERCENT

Answers

Based on the information available for Berlin Corporation, the step - by - step income statement would be:

Berlin Corporation.

Income Statement

Sales Revenue $592,000

Less: Sales Return $40, 000

Net Sales $552, 000

Less : Cost of Goods sold ($156, 000)

Gross Profit $396, 000

Less Operating expenses: (186, 000)

Income from operations $210, 000

Other Revenue /Gains 12, 700

Other Expenses /Losses (13, 300) ( 600 )

Income before income taxes $209 ,400

Less: Income tax expense ($62, 820)

Net Income / (Loss) $146,580

What goes into an income statement?An income statement is the financial document that is used to find the amount of net income or loss that a company made in a certain period of time which is often a year or a quarter.

The main components of a net income statement are the revenue, the cost of goods sold, the gross profit, the operating expenses, and the net income.

To find the net income, subtract cost of goods sold and the operating expenses from the sales revenue.

In this case, you need to find the taxes to Berlin Corporation as well:

= Income before taxes x Income tax rate

= 209, 400 x 30%

= $62, 820

Find out more on income statements at https://brainly.com/question/21851842

#SPJ1

The type of leadership most appropriate when major changes are needed in an organization would be: Group of answer choices transactional transformational path-goal managerial grid task-centered

Answers

The name which is given to the type of leadership which is most appropriate when major changes are needed in an organization would be transformational leadership.

According to the given question, we are asked to state the type of leadership which would be best suited when there is a need to effect major changes in an organization.

As a result of this, we can see that the name of this type of leadership is the transformational leadership as the leader pushes the workers to go beyond their self interests to see a change.

The other options are not appropriate for major changes as they are more concerned with the satisfaction of the workers rather than getting major changes.

Therefore, the correct answer is option A

Read more about transformational leadership here:

https://brainly.com/question/14531259

what type of occupation do you prefer to do any why

Answers

Answer:

a hands on occupation

Explanation:

I dont like sitting around

When two clerks share the same cash register it is a violation of which internal control principle? a. Establish responsibilities. b. Maintain adequate records. c. Insure assets. d. Bond key employees. e. Apply technological controls.

Answers

The principle of "establishing responsibilities" is violated when two clerks share the same cash register. This is because the clerks' duties and roles are not well-defined, and there is a risk of errors, fraud, and abuse.Option (A)

An internal control system is established by an organization to protect its assets, prevent fraud and errors, and ensure that accounting information is reliable and accurate. The following are the five components of an internal control system:Control environmentRisk assessmentControl activitiesInformation and communicationMonitoring of activities

When two or more people are given the same responsibility, it becomes difficult to hold any one person accountable. Because of this, the principle of "establishing responsibilities" is violated when two clerks share the same cash register. It is difficult to determine who is responsible for any discrepancies or errors that arise as a result of sharing the cash register.

To avoid this, it is advisable for each cashier to have their own cash register.The principle of "insuring assets" is also relevant in this context. However, in this case, it is not violated by sharing a cash register. Instead, it is violated when the cash register is not locked and kept in a secure location.

For more such questions on establishing responsibilities

https://brainly.com/question/15097240

#SPJ11

answer the following questions, please

Answers

The cost reconciliation indicates a discrepancy, as the total costs assigned exceed the beginning work in process costs. This could be due to additional costs.

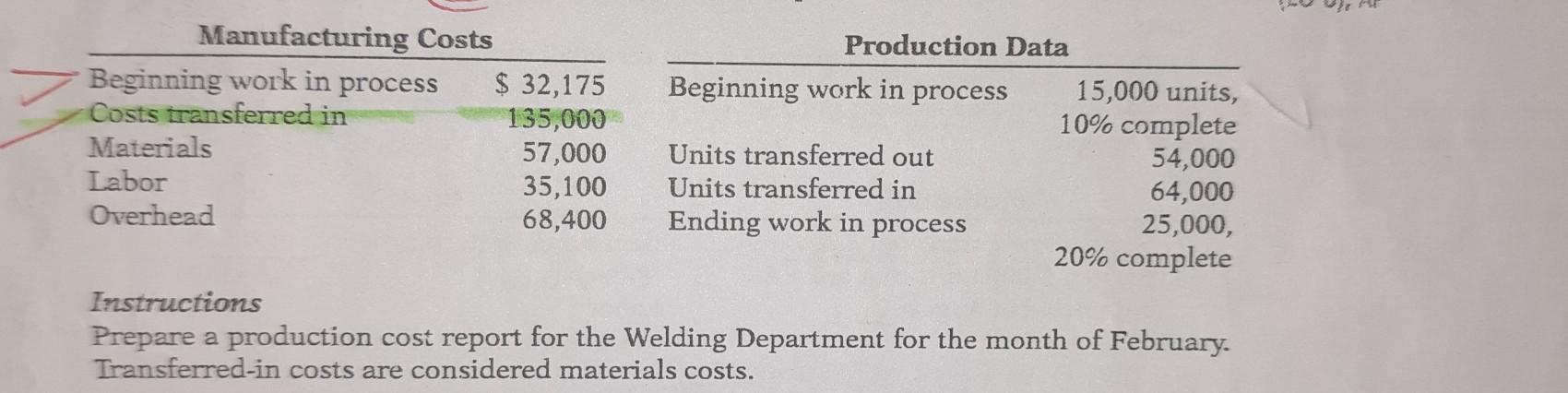

How did we arrive at this assertion?To prepare a production cost report for the Welding Department for the month of February, we need to calculate the following:

1. Equivalent units of production for materials, labor, and overhead.

2. Cost per equivalent unit for materials, labor, and overhead.

3. Total costs assigned to units transferred out and ending work in process.

4. Cost reconciliation.

Let's calculate each of these steps:

Step 1: Equivalent Units of Production

Equivalent units of production are calculated based on the percentage of completion for units in process.

For materials:

Beginning work in process: 15,000 units x 10% complete = 1,500 equivalent units

Units transferred in: 64,000 units

Ending work in process: 25,000 units x 20% complete = 5,000 equivalent units

Total equivalent units for materials: 1,500 + 64,000 + 5,000 = 70,500 equivalent units

For labor and overhead:

Since the given data does not provide the percentage of completion for labor and overhead, we assume it is the same as for materials. Therefore, the equivalent units for labor and overhead will also be 70,500 units.

Step 2: Cost per Equivalent Unit

To calculate the cost per equivalent unit, we divide the total costs by the total equivalent units.

Cost per equivalent unit for materials: $135,000 / 70,500 units = $1.91 per unit

Cost per equivalent unit for labor: $57,000 / 70,500 units = $0.81 per unit

Cost per equivalent unit for overhead: $35,100 / 70,500 units = $0.50 per unit

Step 3: Total Costs Assigned

To calculate the total costs assigned to units transferred out and ending work in process, we multiply the cost per equivalent unit by the equivalent units for each category.

For units transferred out:

Materials: 64,000 units x $1.91 per unit = $122,240

Labor: 64,000 units x $0.81 per unit = $51,840

Overhead: 64,000 units x $0.50 per unit = $32,000

For ending work in process:

Materials: 25,000 units x $1.91 per unit = $47,750

Labor: 25,000 units x $0.81 per unit = $20,250

Overhead: 25,000 units x $0.50 per unit = $12,500

Step 4: Cost Reconciliation

To reconcile the costs, we compare the total costs assigned to units transferred out and ending work in process with the beginning work in process costs.

Beginning work in process costs: $32,175

Total costs assigned to units transferred out: $122,240 + $51,840 + $32,000 = $206,080

Total costs assigned to ending work in process: $47,750 + $20,250 + $12,500 = $80,500

Total costs: $206,080 + $80,500 = $286,580

Since the total costs assigned exceed the beginning work in process costs, there may be some additional costs that need to be investigated or accounted for.

The production cost report for the Welding Department for the month of February is as follows:

------------------------------------------------------------------------

| | Equivalent Units | Cost per Equivalent Unit | Total Costs |

------------------------------------------------------------------------

| Materials | 70,500 | $1.91 | $135,000 |

| Labor | 70,500 | $0.81 | $57,000 |

| Overhead | 70,500 | $0.50 | $35, 100 |

------------------------------------------------------------------------

| Total (Transferred-out) | 64,000 | | $227,240 |

| Ending work in process | 25,000 | | $80,500 |

------------------------------------------------------------------------

| Total Costs $307,740 |

------------------------------------------------------------------------

Note that the cost reconciliation indicates a discrepancy, as the total costs assigned exceed the beginning work in process costs. This could be due to additional costs.

learn more about cost reconciliation: https://brainly.com/question/16342430

#SPJ1

1. A department is looking for an entry-level cashier. One of the job applicants is a cashier with 30 years of experience as a cashier. The department manager feels that this candidate is overqualified for the job and is likely to be bored and leave the job in a short time. Instead, they want to pursue a candidate with 6 months of work experience who seems like a better fit for the position.

Answers

The candidate with 6 months of experience shall be hired by the department for the position as an entry-level cashier.

Who is cashier?A cashier is a professional who has expertise in managing the cash inflows and outflows of an organization and deal with the cash transactions of an organization on a daily basis.

A cashier who has 6 months of experience be more suitable for such role in the department, and will also take lesser pay than the one with 30 years of experience.

Hence, it may be concluded that the cashier with less experience will be a suitable one to be hired at the position as such.

Learn more about cashier here:

https://brainly.com/question/27622487

#SPJ1

FILL IN THE BLANK managers provide for _________, a combination of formal education, job experiences, relationships, and assessment of personality and abilities to help employees prepare for the future of their careers.

Answers

Managers provide for employee development, a combination of formal education, job experiences, relationships, and assessment of personality and abilities to help employees prepare for the future of their careers.

Managers are crucial in encouraging staff members to learn new things and develop their abilities over time. When employees perform the same type of task every day, their work becomes tedious. Supervisors or employees managers need to make sure their team members try something new every day. Mentoring. Senior members of your staff can mentor less-experienced workers to help them get ready to take on new challenges in their careers. Additionally, training aids in boosting retention and lowering turnover.

To learn more about Managers, click here.

https://brainly.com/question/29023210

#SPJ4

Yes! Assuming Economia's aggregate supply curve is upward sloping, when the aggregate demand curve shifts rightward, this will:

Answers

When the aggregate demand curve shifts rightward, this will increase Economia's real output and the price level.

What happens when the aggregate demand shifts rightward?

The aggregate demand curve is a curve that shows the total quantity of all goods and services demanded by the economy at different price levels. The aggregate demand curve slopes downward.

When aggregate demand curve shifts to the right, there would be an increase in the real output and the price levels.

To learn more about the demand curve, please check: https://brainly.com/question/25140811

COMO CREES QUE SE PODRIA SOLUCIONAR LA POBREZA ?? POR FAVOR DOY CORONA , Y CORAZON ( E QUE NO SEPA NO ESCRIBA ) :(

Answers

Answer:

tenga pa que se entretenga

00 For Market failures means that the market has not achieved its optimum production outcome. This means that it has not produced the correct quantity of goods and services. QUESTION 1 Conduct a research to any small business that is manufacturing goods in your community. Make an appointment to interview the owner for the purpose of collecting the information using the questionnaire below. 1.1 General information: ● Name of the firm / business Specify the type of goods or service ● ● Position of the person interviewed ● Date of the interview 1,2 Explain briefly the negative impact the following factors have in your business. (10) Lack of information: ● Price discrimination Immobility of factors of production with special reference to: Physical capital Structural changes ● ● (1) ● (1) (1) (1) [14] QUESTION 2: Interview 3-4 community members that reside near the business you have visited. 2.1 Ask them to name any TWO negative externalities and TWO positive externalities caused by the local business, (2 x 2) (4) 2.2 Request them to list any TWO characteristics of public goods. (2 x 1) (2) 2.3 Use the negative externality and positive externality graphs to explain the impact this business have to the society (10) [16]

Answers

The first step in researching a small business in your neighborhood is to find a suitable nearby manufacturing company.

Once you do, contact the manager or owner to arrange an interview. Gather general information during the interview, such as the name of the company or business, what types of products or services they provide, the interviewer's position, and the time and date of the interview.

Then, focus on the detrimental effects different situations can have on the company. Briefly describe the impact on business of informational gaps, price discrimination, immobility of production variables (with a focus on physical capital), and structural changes.

Interview three to four locals who live close to the establishment you just visited. Ask them to list two unfavorable and two beneficial externalities brought about by the neighborhood business. Ask them to add two properties of public goods to the list as well.

Finally, use the data from the interviews to create graphs showing the positive and negative externalities of business on society. These infographics will graphically describe the costs and benefits that the company's neighborhood has.

Learn more about business, here:

https://brainly.com/question/15826604

#SPJ1

Which of the following organizations might help you learn how to be financially literate?

A. the IRS

B. the Department of the Treasury

C. Goldman Sachs

D. The Finance Bar

Answers

The Department of the Treasury organizations might help you learn how to be financially literate. The correct option is (B).

What do you mean by the Department of the Treasury?The Department of the Treasury manages systems that are essential to the country's financial infrastructure, including those that produce coin and currency, distribute payments to Americans, collect taxes, and borrow money needed to sustain the federal government.

Government cash flow, debt management, and accountancy. drafting and enforcing tax and tariff legislation. Internal revenue evaluation and collection. coin and money production.

In addition to advising the President on economic and financial matters, the Department is also in charge of promoting sustainable economic growth and better financial institution governance.

Therefore, the Department of the Treasury organizations might help you learn how to be financially literate.

To know more about the Department of the Treasury, visit:

https://brainly.com/question/24538705

#SPJ1

3. Find the amount of tax owed: residential property valued at $162,000.00; assessed at 15%; taxed at $12.00 per hundred

dollars worth of property.

Answers

The amount of tax owed for the residential property is $29.16.

How to calculate the amount of tax owed1. Calculating the assessed value of the property by multiplying the property value by the assessment rate (expressed as a decimal):

Assessed value = Property value x Assessment rate

Assessed value = $162,000.00 x 0.15

Assessed value = $24,300.00

2. Calculate the taxable value of the property by dividing the assessed value by 100:

Taxable value = Assessed value / 100

Taxable value = $24,300.00 / 100

Taxable value = $243.00

3. Calculate the amount of tax owed by multiplying the taxable value by the tax rate:

Tax owed = Taxable value x Tax rate

Tax owed = $243.00 x ($12.00 / $100.00)

Tax owed = $29.16

Therefore, the amount of tax owed for the residential property is $29.16.

Learn more about Taxable value at https://brainly.com/question/3316916

#SPJ1

what is the yearly salary or hourly wage of a librarian?

Answers

Answer

$23–43per hour

Librarian

United States

$34k–78kper year

Librarian

Chicago, IL

Explanation:

Farmers company purchased equipment on January 1 year one for $96,000 The equipment is estimated to have a five-year life and a salvage value of 13,000 the company use straight line depreciation method at the beginning of year for farmer revise the expected life to eight years the annual amount of depreciation expense for each of the remaining years would be

Answers

Answer:

$6,240

Explanation:

annual amount of depreciation expense for each of the remaining years would be $6,240.

Please let me know if you found this answer helpful or it can be improved in any way!

Have an awesome day!

Listed here are 20 control plans discussed in the chapter. On the blank line to the left of each control plan, insert a P (preventive), D (detective), or C (corrective) to classify that control most accurately. If you think that more than one code could apply to a particular plan, insert all appropriate codes and briefly explain your answer.Code Control Plan _________1. Library controls _________2. Program change controls _________3. Fire and water alarms_________4. Fire and water insurance _________5. Install batteries to provide backup for temporary loss in power _________6. Backup and recovery procedures _________7. Service level agreements _________8. IT steering committee 9. Security officer _________10. Operations run manuals _________11. Rotation of duties and forced vacations _________12. Fidelity bonding _________13. Personnel management (supervision) _________14. Personnel termination procedures _________15. Segregation of duties _________16. Strategic IT plan _________17. Disaster recovery planning _________18. Restrict entry to the computer facility through the use of employee badges, guest sign- in, and locks on computer room doors _________19. Access control software _________20. Personnel development controls

Answers

Answer:

Code Control Plan

____D_____1. Library controls

____P_____2. Program change controls

____D_____3. Fire and water alarms

____C_____4. Fire and water insurance

____C_____5. Install batteries to provide backup for temporary loss in power

____C_____6. Backup and recovery procedures

____P_____7. Service level agreements

____C_____8. IT steering committee

____P_____9. Security officer

____P_____10. Operations run manuals

____D_____11. Rotation of duties and forced vacations

____C_____12. Fidelity bonding

____P_____13. Personnel management (supervision)

____C_____14. Personnel termination procedures

____P_____15. Segregation of duties

____D_____16. Strategic IT plan

____C_____17. Disaster recovery planning

____P_____18. Restrict entry to the computer facility through the use of employee badges, guest sign- in, and locks on computer room doors

____P_____19. Access control software

____D_____20. Personnel development controls

Explanation:

P (preventive) controls protect against errors occurring.

D (detective) controls discover errors that have already occurred.

C (corrective) controls correct errors that have already occurred.