Parker & Stone, Inc., is looking at setting up a new manufacturing plant in South Park to produce garden tools. The company bought some land 11 years ago for $9,881,044 in anticipation of using it as a warehouse and distribution site, but the company has since decided to rent these facilities from a competitor instead. If the land were sold today, the company would net $3,037,064. An engineer was hired to study the land at a cost of $550,240, and her conclusion was that the land can support the new manufacturing facility. The company wants to build its new manufacturing plant on this land; the plant will cost $5,681,405 million to build, and the site requires $920,992 worth of grading before it is suitable for construction. What is the proper cash flow amount to use as the initial investment in fixed assets when evaluating this project?

Answers

The proper cash flow amount to use as the initial investment in fixed assets when evaluating this project is $15,091,801. Given that the cost of land bought 11 years ago for $9,881,044 in anticipation of using it as a warehouse and distribution site can be sold now for a net amount of $3,037,064.

Therefore, the loss to the company because of this sale will be= $9,881,044 - $3,037,064= $6,843,980.The cost of grading before the site is suitable for construction = $920,992.The cost of the new manufacturing plant to be built = $5,681,405.Total amount that the company needs to invest = $6,843,980 + $920,992 + $5,681,405= $13,446,377.

However, we also know that an engineer was hired to study the land at a cost of $550,240, and the conclusion was that the land can support the new manufacturing facility.Therefore, the proper cash flow amount to use as the initial investment in fixed assets when evaluating this project = $13,446,377 + $550,240= $15,091,801.

To know more about investment visit:

https://brainly.com/question/15105766

#SPJ11

Related Questions

a cost-cutting project will decrease costs by $65,700 a year. the annual depreciation will be $15,450 and the tax rate is 40 percent. what is the operating cash flow for this project? multiple choice $33,240 $45,600 $39,420 $20,100 $32,460

Answers

The answer is not one of the multiple choice options provided. The annual depreciation will be $15,450 and the tax rate is 40 percent. $48,690 is the operating cash flow for this project.

The operating cash flow for this project can be calculated using the formula:

Operating cash flow = (Cost savings + Depreciation) x (1 - Tax rate)

Plugging in the given values, we get:

Operating cash flow = ($65,700 + $15,450) x (1 - 0.4)

Operating cash flow = $81,150 x 0.6

Operating cash flow = $48,690

Operating cash flow (OCF) is a measure of the amount of cash generated by a company's operations. It represents the cash inflows and outflows that are directly related to a company's core business activities.

To calculate OCF, you start with a company's earnings before interest and taxes (EBIT) and then make adjustments for non-cash expenses, such as depreciation and amortization, as well as changes in working capital. The resulting number represents the cash flow generated or used by a company's operations during a given period.

To know more about depreciation:

https://brainly.com/question/23855808

#SPJ11

When making decisions, managers often must decide between doing what is beneficial for the firm in the short term, and what is beneficial for both the firm and society in the long term. To address this conflict, a firm must

Answers

When making decisions, managers are often faced with a conflict between what is beneficial for the firm in the short-term and what is beneficial for both the firm and society in the long-term.

This conflict arises because the actions that benefit the firm in the short-term may not necessarily align with the interests of society as a whole, which can lead to negative consequences for both the company and society in the long-term.

To address this conflict, a firm must adopt a long-term orientation and consider the broader social and environmental impacts of its decisions. This means looking beyond immediate financial gains and recognizing that actions taken today can have far-reaching implications for the company's reputation, customer loyalty, employee morale, and overall sustainability.

Firms that prioritize social responsibility and sustainable business practices are more likely to build strong relationships with stakeholders, including customers, employees, investors, and regulators. They are also better equipped to weather economic downturns and other disruptions, as they have diversified their risk and invested in building resilient supply chains and communities.

Ultimately, the key to addressing the conflict between short-term gains and long-term benefits is a commitment to corporate social responsibility (CSR) and sustainable business practices. By prioritizing the needs of society and the environment alongside those of shareholders, firms can create value for all stakeholders over the long-term, ensuring their continued success and impact.

learn more about managers here

https://brainly.com/question/32150882

#SPJ11

which of the following explanations best describes why an adjusting entry is needed in connection with prepaid expenses.

Answers

An adjusting entry is needed for prepaid expenses to accurately reflect the consumption or usage of the prepaid item within the appropriate accounting period.

Prepaid expenses refer to payments made in advance for goods or services that will be consumed or used over a specific period of time. When a prepaid expense is initially recorded, it is treated as an asset because the expense has not yet been incurred. However, as time passes and the prepaid item is consumed or used, it becomes an expense that should be recognized in the appropriate accounting period. To accurately reflect the consumption or usage of the prepaid item, an adjusting entry is needed. This adjusting entry decreases the prepaid expense asset account and recognizes the corresponding expense in the income statement.

Learn more about Prepaid expenses here:

https://brainly.com/question/28424313

#SPJ11

Question 2 of 10

What is product positioning?

O

A. The set of plans for product, price, place, and promotion that the

marketer will use

O

B. The use of names and symbols to identify the company's products

O C. The process of dividing up a total market into groups (segments)

with similar needs and buying behaviors

OD. A definition of how the company intends for customers to view its

product relative to the competition

Answers

Answer:

I think it should be D keep checking just in case

Employer payroll taxes are used to fund

O A. educational systems

B. disability programs

O C. national defense

O D. public works

Answers

Answer:

B Disability programs

Explanation:

government uses this tax to pay for programs like social security and health programs like disability programs.

the marginal tax rate on labor income for many workers in the united states is almost a. 65 percent. b. 50 percent. c. 40 percent. d. 30 percent.

Answers

The marginal tax rate.Below is a calculation of the annual percentage rate: Annual percentage rate is calculated as follows: percentage of the specified rate x the number of quarters in a year = 2.75% x 4 = 11%. The correct option is C. 40 percentage.

Therefore, we used the aforementioned formula to calculate the annual percentage rate by multiplying the percentage of the stated rate by the number of quarters in a year.In a tax system, the tax rate is the ratio (usually expressed as a percentage) at which a business or person is taxed. There are several methods used to present a tax rate: statutory, average, marginal, and effective.

These rates can also be presented using different definitions applied to a tax base: inclusive and exclusive.If you add up these amounts, the entire tax liability for this individual would be $3\29,835.50, or an effective tax rate of 19.9% = ($29,835.50 / $150,000).The seven marginal tax rates of the brackets remain constant regardless of a person's filing status.

To know more about Marginal tax rate visit:

https://brainly.com/question/17031608

#SPJ4

what is the formula for activity ratio

Answers

Answer:

The ratio is calculated by dividing the net sales by the working capital. The ratio helps you figure out the net annual sales generated by the average amount of working capital during a year.

Explanation:

Please mark me brainliest

Answer:

The ratio is calculated by dividing the net sales by the working capital. The ratio helps you figure out the net annual sales generated by the average amount of working capital during a year.

The inflation rate measures the A. percentage change in the price level from one year to the next year. B. percentage change in the quantity of goods and services consumed by urban consumers. C. cost of the CPI market basket at base period prices divided by the cost of the CPI market basket at current period prices. D. cost of the CPI market basket at current period prices divided by the cost of the CPI market basket at base period prices. E. average price of the goods and services consumed by urban consumers.

Answers

Answer:

Its D

Explanation:

A restaurant customer complains to the waiter person that their meal has arrived at the table cold. After apologizing to the customer, the waiter person should:

a) remove the meal and reorder immediately

b) reheat the meal immediately

c) tell the customer that other staff are to blame

d) leave the meal on the table and reorder as soon as possible

Answers

Answer:a

Explanation:

Which of the following is true of small business owners?

A. the work business owners do requires little physical stamina.

B. the business owner starts with a business plan.

C. the business owner need to know little about management and finance. D. it's easy for most business owners to find a marketable idea.

Answers

Answer:

B

Explanation:

I mean, hopefully, they made a business plan lol. If you don't plan out your business right, you'll have a hard time making it become successful without a good plan.

The following selected accounts and normal balances existed at year-end. Make the four journal entries required to close the books: Accounts receivable $45,000, Prepaid insurance 4,500, Land 50,000, Accounts payable 39,000, Notes payable 55,000, Retained earnings 12,000, Dividends 2,000, Fees earned revenue 65,000, Selling expenses 34,500, Administrative expenses 12,750, Miscellaneous expense 1,250.

Answers

The required Journal Entries that are required to close the book for the selected four accounts at year-end include the following:

Journal Entries:

December 31,

Debit Fees earned revenue $65,000

Credit Income Summary $65,000

To close the Fees revenue to income summary.

Debit Income Summary $34,500

Credit Selling expenses $34,500

To close the selling expenses to income summary.

Debit Income Summary $12,750

Credit Administrative expenses $12,750

To close the administrative expenses to income summary.

Debit Income Summary $1,250

Credit Miscellaneous expense $1,250

To close the miscellaneous expenses to income summary.

Data Analysis:

1. Accounts to be closed to Income Summary are:

Fees earned revenue $65,000 Income Summary $65,000

Income Summary $34,500 Selling expenses $34,500

Income Summary $12,750 Administrative expenses $12,750

Income Summary $1,250 Miscellaneous expense $1,250

2. Assets and Liabilities accounts:

Accounts receivable $45,000

Prepaid insurance 4,500

Land 50,000

Accounts payable 39,000

Notes payable 55,000

Retained earnings 12,000

Closed to Retained earnings: Dividends 2,000

See related links for closing accounts at year-end at https://brainly.com/question/18882009

what information would a business gather if they have meetings and how would they make this better?

Answers

A meeting's main goal is to bring important people together to discuss issues of shared interest. If a meeting is required, it is essential to create an agenda listing the subjects for discussion.

In all businesses, meetings are a necessary component of the modern office. Think of meetings as the lifeblood of a company. A successful flow of ideas and choices creates a robust and healthy organization by invigorating every element of the company, inspiring fresh concepts, and advancing strategy.

In a meeting reviewing ongoing initiatives and the status of the quarterly targets also helps. This has to be communicated so that everyone is aware of how the team is doing in relation to its goals and where a team member might be struggling and in need of assistance. Roadblocks and obstacles are also evaluated, along with information on industry insights and updates.

Along with this, crucial information regarding product updates is also found in meetings. The weekly key metrics and individual priorities can also be ascertained. Information regarding Past or incomplete action items and team shoutouts are also a part of the information in this context.

Read more about business meetings on:

brainly.com/question/15545567

#SPJ9

Which is the definition of competitiveness?

Responses

1. the ability to create an environment built on support and encouragement

2. steadfastness and commitment in achieving a goal

3. doing something that might result in loss to achieve business goals

4. the property of having a strong desire for success and achievement

Answers

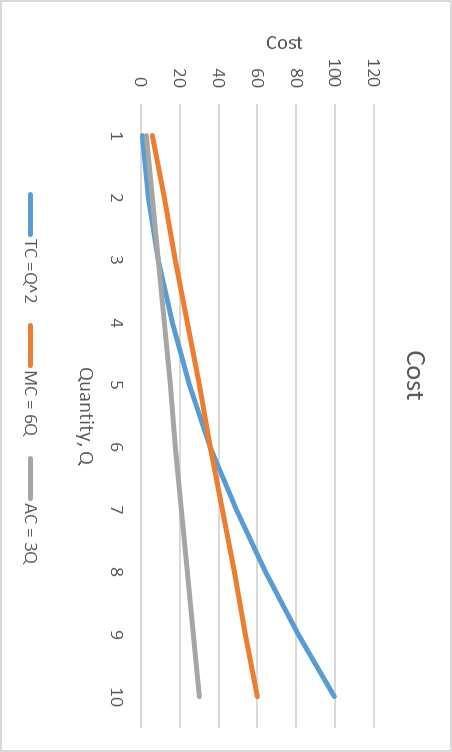

Suppose that the production function is F(L) = √L in the short run, where L is the quantity of labor employed. If the wage rate is w = 3, what are the total, marginal, and average cost curves in the short run? (a) The total cost curve is given by TC(Q)=w F-¹(Q) = 3Q². Hence, the marginal cost curve is MC(Q) = TC'(Q) = 6Q, and the average cost curve AC(Q) = TC(Q)/Q=3Q.

Answers

The total, marginal, and average cost curves in the short run for the production function is F(L) = √L in the short run, where L is the quantity of labor employed will be upward sloping. The marginal cost curve is MC(Q) = 6Q.

The technological relationship between the quantities of physical inputs and the quantities of output of commodities is provided by a production function.

The quantity of labor employed is calculated as:

F(L) = VL,

w = 3

Total Cost = TC = L = \(3Q^{2}\)

or

3 TC = \(3Q^{2}\)VI L

or F(L)-¹ = L-1/2 = \(Q^{2}\)

or L = Q4

Q TC =Q^2 MC = 6Q AC = 3Q L = Q^4

1 1 6 3 1

2 4 12 6 16

3 9 18 9 81

4 16 24 12 256

5 25 30 15 625

6 36 36 18 1296

7 49 42 21 2401

8 64 48 24 4096

9 81 54 27 6561

10 100 60 30 10000

The graph for the total, marginal, and average cost curves for all the is attached below.

To learn more on production function, here:

https://brainly.com/question/13755609

#SPJ4

Invest in what you know than what you don’t know:

I need 3-4 sentences on this PLEASE HELP ME

Answers

I pulled this out my ašš hope it helps :)

The law of increasing opportunity cost is reflected in the shape of the…

a) production possibilities curve concave to the origin

b) production possibilities curve convex to the origin

c) horizontal production possibilities curve

d) straight-line production possibilities curve

e) upward-slopping production possibilities curve

Answers

The law of increasing opportunity cost is reflected in the shape of the production possibilities curve concave to the origin (option A).

What is the production possibilities curve?The production possibilities curve depicts the various combination of two goods a company can produce when all its resources are fully utilised.

The production possibilities curve is concave to the origin. This means that as more quantities of a product is produced, the fewer resources it has available to produce another good. As a result, less of the other product would be produced. So, the opportunity cost of producing a good increase as more and more of that good is produced.

For more information about the production possibility curve, please check: https://brainly.com/question/25774783

#SPJ1

What’s at least 5 daily responsibilities of polygraph analyst

Answers

Answer: Why is it advantageous to take market trends into consideration when planning a career path?

Read More >>

Explanation:

One cost of starting your own business is

A. Loan payments on a small business loan

B. Escrow

C. Revenue

D. PMI

Answers

Answer:

A. Loan payments on a small business loan

Explanation:

One cost of starting your own business is loan payments on a small business loan.

If analysis using the bcg matrix suggests that a business should be sold immediately, what factors in the ge business screen would suggest that the business is actually worth keeping?

Answers

The GE Business Screen, analysis using the BCG matrix suggests that a business should be sold immediately factors in GE Business Screen is given by

option A. The market is large and there are few competitors.

This factor indicates that the business operates in an attractive industry with significant market potential.

Despite its low market share,

the presence of a large market and a limited number of competitors implies an opportunity for growth and increased market penetration.

It suggests that the business has the potential to capture a larger share of the market

and achieve sustainable success if the right strategies are implemented.

The combination of a sizable market and fewer competitors can provide favorable conditions for the business to thrive

and make it worth keeping, even if it currently faces challenges.

Learn more about business here

brainly.com/question/30453403

#SPJ4

The above question is incomplete, the complete question is:

If analysis using the BCG matrix suggests that a business should be sold immediately, what factors in the GE Business Screen would suggest that the business is actually worth keeping A. The market is large and there are few competitors. B. The capital requirements for expanding the business are high. C. The company's operating costs are higher than those of competitors. D. The company's service network is less extensive than that of competitors.

Which formula is NOT correct?

A) COGS=COGAS-EI

B) BI=COGS+EI-P-FI

C) EI=BI+P+FI-COGS

D) COGAS=BI+P+FI

Answers

Answer:

Explanation:

The answer is d the correct formula is COGS=BI+P+FI

What do Alabama's Black Belt counties have in common?

Answers

charging interest in excess of the legal limit is known as _____.

Answers

Charging interest in excess of the legal limit is known as usury.

Usury refers to the practice of charging an excessively high interest rate on a loan or credit, exceeding the legal limit set by regulatory authorities. Usury laws vary across jurisdictions and are designed to protect borrowers from unfair lending practices and exorbitant interest rates that could lead to financial exploitation.

The legal limits on interest rates are typically established by government regulations or legislation to ensure fairness and prevent predatory lending. These limits aim to balance the interests of borrowers and lenders, promoting responsible lending practices and preventing borrowers from falling into cycles of debt.

When a lender charges interest rates above the legal limit, they are considered to be engaging in usury. Usury laws provide legal protection to borrowers by imposing penalties or restrictions on lenders who violate the prescribed interest rate caps.

By prohibiting excessive interest charges, usury laws aim to maintain a fair and equitable lending environment, protect vulnerable borrowers, and prevent exploitative lending practices.

to learn more about usury click here:

brainly.com/question/28536084

#SPJ11

the agencies that regulate food safety at your establishment isA. CDC B. State and local departments of health C. Federal department of health D. HACCP

Answers

The agencies that regulate food safety at your establishment may vary depending on the location and type of establishment, but typically include:

B. State and local departments of health - These agencies are responsible for enforcing food safety regulations at the local level, including inspections of food establishments, investigating foodborne illness outbreaks, and enforcing food safety laws and regulations.

C. Federal department of health - The U.S. Department of Health and Human Services (HHS) and its agencies, such as the Food and Drug Administration (FDA) and the Centers for Disease Control and Prevention (CDC), are responsible for ensuring the safety and security of the nation's food supply.

D. HACCP - Hazard Analysis and Critical Control Points (HACCP) is a systematic approach to food safety that involves identifying potential hazards in food production, developing and implementing controls to prevent those hazards from occurring, and monitoring the effectiveness of those controls.

Learn more about establishments

https://brainly.com/question/14533840

#SPJ4

You have decided that you want to be a millionaire when you retire in 45 years. a. If you can earn an annual return of 11.4 percent, how much do you have to invest today? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What if you can earn 5.7 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

Answers

The amount I should invest today if I earn an annual return of 11.4% is $7,765.45.

The amount I should invest today if I earn an annual return of 5.7% is $82,532.61.

What is the amount I should invest today?The formula that can be used to determine the amount I should invest today is:

PV = FV / (1 +r)^t

Where:

PV = present value FV = future value = $1,000,000 t = 45 years r = interest rate = 11.4%, 5.7%$1,000,000 / (1.114)^45 = $7,765.45

$1,000,000 / (1.057)^45 = $82,532.61

To learn more about present value, please check: https://brainly.com/question/25748668

Shivaram and Kiran are buying a home in a new subdivision. Due to all of the subdivisions in the area, a new elementary school is being built. Additionally, a new area park is planned. Shivaram and Kiran have been informed the taxes on their new home are substantially higher than their previous property. Why

Answers

Answer:

The Mello-Roos Community Facilities Act of 1982

Explanation:

The Community Facilities Act enacted in 1982 with the motive to generate the alternative method of financing required to improve every type of services with respect to schools, areas, etc

Here in the question, it is mentioned that there is plan of new area park and also the new home taxes are more than the last property they have. This is done due to this above act

hence, the same is to be considered

can regional level employment be converted into national level

employment? Why? Why not ?

Answers

Answer:

The work or occupation for which one is used and often paid is known as employment. If employment is generated in a particular region or a locality only, it is termed as regional level employment and if employment is generated at the national level, it is termed as national level employment.

Explanation:

plz mark me as brilliant plz

What is the best definition of profit profit is the possible income from producing an additional item?.

Answers

Correct answer is D)Profit is the financial gain from business activity minus expenses.

What is Profit?The cost of making one more unit of a good is called the cost of profit. Profit is the extra income generated by the sale of an additional good. Profit is the difference between an organization's financial gain and its outgoing costs.The term "profit" is frequently used to denote the monetary benefit that a business experiences when its income exceeds its costs and expenses. A young person at a lemonade stand, for instance, pays a quarter to make one cup of lemonade. She then asks $2.00 for the beverage. The lemonade she sold for $1.75 gave her a profit.Hence the best definition of profit is Profit is the financial gain from business activity minus expenses.

The complete question is:

What is the best definition of profit?

A. Profit is the possible income from producing an additional item.

B. Profit is the price of producing one additional unit of a good.

C. Profit is the additional income gained from selling an additional good.

D. Profit is the financial gain from business activity minus expenses.

To learn more about Profit refer to:

https://brainly.com/question/15777765

#SPJ4

a liability is a probable future payment of assets or services that a company is presently obligated to make as a result of past transactions or events.

Answers

The management of liabilities is an important part of a company's financial health and solvency.

Managing Liabilities: Essential to Maintaining Financial Health and SolvencyLiabilities are typically listed on a company's balance sheet and include items such as:

Accounts payableAccrued expensesBonds payableDeferred revenue, and other debtsLiabilities are a result of past transactions or events and represent a probable future payment of assets or services from the company. It is important for companies to manage their liabilities in order to remain financially healthy and solvent. Failure to do so could lead to financial distress or insolvency.

Learn more about Liability: https://brainly.com/question/9503055

#SPJ4

The Italy can produce 20 Gas turbines and 60 Tyres. France can produce 80 Gas turbines and 30 Tyres.

a). What is the opportunity

cost of producing Gas turbines in Italy? ______ tyres.

b). What is the opportunity cost of producing Tyres in

France ? _______ Gas turbines.

Answers

Answer:

1. 60 Tyres

2. 80 Gas Turbines

Explanation:

Given that the Opportunity cost is an economics term that is used in describing the cost of an alternative that must be forgone to continue or proceed with a certain activity.

Hence, in this case, considering the available information in the question, the correct answer is that the opportunity cost of producing Gas turbines in Italy is 60 Tyres.

At the same time the opportunity cost of producing Tyres in France 80 Gas turbines.

In 3-5 sentences, what aspects of economic growth may not be reflected in the GDP of a country?

Answers

Answer:

iwndwhaidnaifbqibdqibdqibdna