Larkin Company accumulated the following andand cost data concerning product- Direct materials per unit: 1.10 pounds at $460 per pound Direct labor per unit 3.70 hours at $10 per hour Manufacturing overhead: Allocated based on direct labor hours at a predetermined rate of $20.00 per direct laboru Compute the standard cost of one unit of product -Tal Round answer to 2 decimal places 2.75) Standard cost

Answers

The standard cost of one unit of product is $617.

The standard cost of one unit of product:

To compute the standard cost of one unit of product, we need to calculate the total cost of direct materials, direct labor, and manufacturing overhead.

Direct materials per unit: 1.10 pounds at $460 per pound = $506 (1.10 * $460 = $506)

Direct labor per unit: 3.70 hours at $10 per hour = $37 (3.70 * $10 = $37)

Manufacturing overhead per unit: Allocated based on direct labor hours at a rate of $20.00 per direct labor hour = $74 (3.70 * $20 = $74)

Standard cost of one unit of product = Direct materials + Direct labor + Manufacturing overhead

Standard cost of one unit of product = $506 + $37 + $74 = $617

Therefore, the standard cost of one unit of product is $617.

know more about Standard Cost.

https://brainly.com/question/15877599

#SPJ11

Related Questions

If you invest $4,200 at a 8. 5% simple interest rate, approximately how many years will it take for you to have over $6,300?.

Answers

The number of years it would take to have over $6,300 is 6 years.

Simple interest is a type of interest in which interest is earned only on the amount of money deposited.

The formula that can be used to determine the number of years is: Interest / (principal x interest rate)

Interest = $6300 - $4,200 = $2100

Time = $2100 / ($4200 x 0.085)

2100 / 357

Time = 5.88 = 6 years

A similar question was answered here: https://brainly.com/question/2294792

PLEASE HELP ASAP (EASY)

Fiona short has wondered how to turn her 185,000 followers into an even bigger business. She thinks she has two options: 1. Open a Fifi's Closet shop in central London or 2. Pay a friend to set up a second e-commerce Fifi's Closet website in French. Justify which of these two options Fiona should choose (9 marks)

Answers

Answer:

2

Explanation:

you're capable of reaching more people with a website

PLEASE, In a paragraph of 150 words, Reflect on the critical thinking process and the steps involved. Discuss how this knowledge can or has helped you in your life and/ or your career?

For example, what do you think of the process? What did you learn from the process? Could it bring value to making decisions in your life or career? Would you use it in the future? Would you use it, or parts of it, in your everyday life? Have you used it in your everyday life? Do not write about the case itself, the decision you reached, or what you thought should or should not have happened relating to the case.

Answers

The critical thinking process is a systematic and logical approach to problem-solving that involves several steps, including identifying the issue, gathering and analyzing information, evaluating options, and making a decision.

How the critical thinking process helps meThe critical thinking process is a systematic and logical approach to problem-solving that involves several steps, including identifying the issue, gathering and analyzing information, evaluating options, and making a decision. As a person, critical thinking is useful to utilize this process in order to provide the most accurate and relevant responses to questions.

Personally, I find that the critical thinking process is an invaluable tool in both my personal and professional life. It has taught me to approach problems in a more organized and methodical manner, which has allowed me to make more informed and effective decisions.

Additionally, by applying critical thinking to everyday situations, I am better able to identify biases and assumptions and to evaluate arguments and evidence. Ultimately, the critical thinking process has enabled me to become a more analytical and logical thinker, and has provided me with a framework for making better decisions in all areas of my life.

Read more on critical thinking here:https://brainly.com/question/3021226

#SPJ1

when businesses work to understand, identify and eliminate unethical behaviors, they are displaying .

Answers

When businesses work to understand, identify and eliminate unethical behaviors, they are displaying moral universalism

What exactly Is Unethical Behavior?

Going above and beyond the confines of the law and acting morally while no one is looking can be summed up as ethics. When we talk about unethical business behaviour, we mean behaviour that does not comply to the accepted rules of corporate operations and fails to act morally in all instances. In certain cases, a person within a corporation may act unethically while executing their job, and in others, we're talking about corporate culture, when the entire organisation is corrupt from the top down, with disastrous societal effects. It's critical to remember that unethical action isn't always illegal (though sometimes it is both).

To learn more about Unethical Behaviors

https://brainly.com/question/24518056

#SPJ4

In manufacturing plants, engineers are responsible for

assembling products so they can be sold

designing the machinery that makes products

maintaining the machinery to keep it functioning properly

supervising the assembly line employees

Answers

Answer:

Explanation:

Manufacturing Engineers focus on the design and operation of integrated systems for the production of high-quality, economically competitive products. These systems may include computer networks, robots, machine tools, and materials-handling equipment.

Answer:

B. designing the machinery that makes products

Explanation:

Plant engineers oversee the electrical mechanical systems of a manufacturing plant, from installation to troubleshooting. They are called upon to improve the plant’s efficiency, upgrade to new technologies, repair equipment, increase production, and reduce manufacturing issues including bottlenecks. They conduct routine tests, evaluate plant machinery, and fix problems promptly. They must review operational plans to ensure the machinery and processes meet compliance regulations.

Plant engineers review project plans and interpret developments throughout the process, giving advice and guidance for necessary changes. They must ensure the facility complies with relevant regulations and conduct regular checkups to verify the machinery and operations are safe. They also develop operational plans for projects including renovation or construction or maintenance and machine installation. Plant engineers need a minimum bachelor's degree in mechanical, electrical, or industrial engineering.

What responsibilities are common for Plant Engineer jobs?

Assist in the development and implementation of the annual capital budget.

Communicate consistently with the project manager, client and contractor.

Compile plant data to generate reports in compliance with state and federal regulations for reporting

Coordinate plant treatment process control testing and proper calibration of online analytical equipment.

Perform independent research to optimize performance of water treatment, wastewater treatment processes.

Lead construction administration duties such as documenting activities and providing oversight.

Stay informed concerning new manufacturing technologies and equipment in order to manufacture and reduce cost through efficiencies.

Ensure vendors/subcontractors are manufacturing products according to product specifications.

Attend staff meetings, in-services and other campus activities as needed.

Maintain and develop plant drawings, standards and procedures as appropriate.

Manage, develop, trains, coaches, and evaluate direct reports.

Ensure that plant systems are maintained through the administration of a preventive maintenance system.

Maintain of tools and equipment to promotes safety and proper work habits by staff.

Serve as project or task manager for large scale projects with minimal support.

Prepare and revises chemical, material, and service contract specifications, reviews bids, recommends awarding of contracts, and acts as project manager representative of contracts.

Supervise and Direct plant engineers, civil engineers, first line supervisors, engineering assistants various plant staff and interns assigned to the facility.

Keep current with industry metering and measuring equipment. evaluate the need for new equipment to maintain plant proficiency and requisitions materials, tools, chemicals and equipment as required by the task for the plant.

Recommend allocation of budgeted funds and requests approval for major expenditures, authorizes petty cash outlays and payment requests upon approval, and initiates field purchase orders.

Assist with preparing the annual fiscal budget reports and various financial monthly and annual reports. participate in the long-range planning, organization and direction of activities relating to the operation and improvements to the plants and collection facilities/distribution facilities to maximize performance while minimizing cost and environmental impact.

What are the typical qualifications for Plant Engineer jobs?

Bachelor's Degree or Graduate's Degree in an engineering discipline.

Advanced proficiency with AutoCAD and other CAD programs.

Demonstrated meticulous attention to detail and problem-solving abilities.

Confident in leadership capabilities.

Comfortable with Microsoft Office Suite.

Basic understanding of Six Sigma male principles.

The loan contract is a formal document called a(n) ________ and may contain a(n) ________ specifying who retains control over the item being purchased in the case of default.

Answers

The loan contract is a formal document called a Note and may contain a security agreement specifying who retains control over the item being purchased in the case of default.

A security agreement is a report that gives a lender a security hobby in a special asset or asset that is pledged as collateral. Protection agreements frequently include covenants that outline provisions for the development of a budget, a compensation timetable, or coverage necessities.

A loan note is a form of the economic instrument; It's miles an agreement for a mortgage that specifies while the mortgage should be repaid and commonly additionally the interest payable. It is similar to a promissory be aware however the variations may be giant in terms of outcomes, especially tax effects.

A promissory note normally covers smaller loans. as soon as two humans input into a promissory observation, the individual who promises to pay is called the payer (borrower). The person that is owed the charge is called the payee (lender). Each payer and payee have felony duties whilst a promissory be aware is signed and dated.

Learn more about promissory note here brainly.com/question/28145499

#SPJ4

Give an example of a single product with several market segments?

Answers

The goal of the marketing discipline is to recognise and cater to the specific needs of various market segments. Marketers categorise prospective clients using research...

How do you spell Recognise in the UK?

The goal of the marketing discipline is to recognise and cater to each segment's particular demands. Marketers classify prospective customers using research...

There are two English words for this: recognise and recognise. British English (used in the UK/AU/NZ) is where recognise is most commonly used, while American (US) English (en-US) is where recognise is most frequently used ( en-GB ).

/ (rknaz) / verb (tr) to perceive (a person, creature, or thing) as being the same as or belonging to the same class as something previously seen or known; to know again. to acknowledge the need for (something); to accept or be aware of (a fact, duty, issue, etc.).

To know more about Marketers visit;

https://brainly.com/question/13414268

#SPJ4

A manufacturer uses a standard cost system with overhead applied based upon direct labor hours. The manufacturing budget for the production of 5,000 units for the month of May included the following information: Direct labor 10,000 hours at $15 per hour $150,000 Variable overhead 30,000 Fixed overhead 80,000 During May, 6,000 units were produced and the fixed overhead budget variance was $2,000 favorable. Fixed overhead during May was

Answers

Answer:

Your answer is given below:

Explanation:

Labor efficiency variance = (Standard hour-actual hour)Standard rate

-1500 = (10000*15-X15)

15X = 151500

x(actual hour) = 10100 Hour

For a U.S.trader working in American quotes, if the forward price is higher than the spot price A) then you should buy at the spot, hold on to it and sell at the forward it's a built-in arbitrage. B) the currency is trading at a discount in the forward market. the currency is trading at a premium in the forward market. D) All of the options it really depends if you're talking American or European quotes

Answers

For a U.S. trader working in American quotes, if the forward price is higher than the spot price, the correct answer is that the currency is trading at a premium in the forward market. This means that the market participants expect the currency to appreciate in value over time.

when the forward price is higher than the spot price, it indicates that the demand for the currency in the future is greater than its current demand. This is not a built-in arbitrage opportunity as mentioned in option A, because arbitrage requires simultaneous buying and selling to profit from price differences.

Option B suggests that the currency is trading at a discount in the forward market, which is incorrect in this case. A currency trades at a discount when the forward price is lower than the spot price.

Lastly, option D is not accurate as the question specifically pertains to American quotes, making the answer related to either American or European quotes irrelevant in this context.

In summary, for a U.S. trader working in American quotes, if the forward price is higher than the spot price, the currency is trading at a premium in the forward market.

To know more about currency visit :

https://brainly.com/question/2666943

#SPJ11

In 5 years, only 2.2% of the current internet businesses will still be operating. Use the exponential model F = Foert to determine the annual rate of internet business failures. Write your answer in c

Answers

The annual rate of internet business failures is approximately 27.8%.

According to the given information, in 5 years, only 2.2% of the current internet businesses will still be operating. This means that the survival rate of businesses after 5 years is 2.2%, and the failure rate is 100% - 2.2% = 97.8%. To determine the annual rate of failures, we can use the exponential decay model F = Foert, where F is the final value (2.2%), Fo is the initial value (100%), r is the annual rate, and t is the time in years. Substituting the given values into the formula, we have 2.2% = 100%e^(r*5). Simplifying the equation, we get e^(r*5) = 2.2%/100%. Taking the natural logarithm of both sides, we have r*5 = ln(2.2%/100%). Dividing both sides by 5, we get r = ln(2.2%/100%)/5 ≈ 0.278. Therefore, the annual rate of internet business failures is approximately 27.8%.

learn more about:- internet businesses here

https://brainly.com/question/33440170

#SPJ11

y

What are the two costs used to compare credit offers?

I

Question 2 (5 points)

What is the difference between simple and compound interest?

Answers

Answer:

#2Simple interest is interest paid only on the original investment whereas compound interest paid both on the original investment and on all interest that has been added to the original investment. Since compound interest is calculated based on a larger amount than simple interest, it results in a larger amount of money over time.

Terri davis is planning to buy a new car. While on the internet she learned that the car has a base price of $16,007, options that total $2,334, and a $500 destination charge. She read on a consumer's web site that the dealer's cost for the car is about 94% of the base price and 89% of the options price. What should davis estimate as the dealer's cost?

Answers

Terri Davis should estimate the dealer's cost to be $17,623.84.

To estimate the dealer's cost, Terri Davis needs to calculate the cost of the base price and the options separately.

Step 1: Calculate the dealer's cost for the base price:

The dealer's cost for the base price is about 94% of the base price. To find the dealer's cost, multiply the base price ($16,007) by 94% (0.94):

Dealer's cost for the base price = $16,007 * 0.94 = $15,048.58

Step 2: Calculate the dealer's cost for the options:

The dealer's cost for the options is about 89% of the total options price. To find the dealer's cost, multiply the total options price ($2,334) by 89% (0.89):

Dealer's cost for the options = $2,334 * 0.89 = $2,075.26

Step 3: Calculate the total dealer's cost:

To find the total dealer's cost, add the dealer's cost for the base price and the dealer's cost for the options, and then add the destination charge:

Total dealer's cost = Dealer's cost for the base price + Dealer's cost for the options + Destination charge

Total dealer's cost = $15,048.58 + $2,075.26 + $500 = $17,623.84

Terri Davis should estimate the dealer's cost to be $17,623.84.

To learn more about destination charge visit:

brainly.com/question/24920251

#SPJ11

Companies use marketing research to: a. evaluate internal production processes. b. devalue the demands of consumers. c. identify external opportunities and threats. d. limit accessibility of their products for select customers.

Answers

Option (c) identify external opportunities and threats is the right answer.

Companies use marketing research to identify external opportunities and threats

Why is it important to recognize the business's threats and opportunities?A crucial first step in lowering the danger of risks to your company is identifying them, or at the very least, managing them so that they won't completely destroy it. It all comes down to being organized and taking preventative measures to lessen the harm.What are analyzing external opportunities and dangers?SWOT analysis is a technique for identifying and analyzing internal strengths and weaknesses as well as external opportunities and threats that have an impact on current and future operations and aid in the formulation of strategic goals.Why do opportunities and threats come from outside sources?Threats and opportunities come from events outside of your business, in the wider market. Opportunities and threats can be seized, and you can take precautions to avoid them, but you cannot alter them. Competitors, raw material costs, and consumer shopping patterns are a few examples.

To learn more about marketing research visit:

https://brainly.com/question/3697439

#SPJ4

True or false: Employers pay the same amount of social security and Medicare taxes as the employee pays.

O True

O False

Answers

I hope I have helped you I don't know much about that

The best fund in which to account for the interest and dividends from an endowment to purchase library books would be a(n) (4p Agency Fund. Endowment Fund. O Private-Purpose Trust Fund Nonexpendable Trust Fund. 27) If a county collects taxes on behalf of the city and school district, it would record the taxes (4p in the ■ Trust Fund. a Agency Fund. General Fund. Special Revenue Fund. 28) Interfund transactions include all of the following except for: (4pts) interfund non-reciprocal transfers between government funds recorded as interfund transfers appearing after non-operating revenues U one fund's reimbursement of another for supplies paid on its behalf D interfund operating transfers between government funds for services provided and used and recorded as revenues and expenditures/expenses interfund loan transfers classified as Due to/from other Funds

Answers

The best fund in which to account for the interest and dividends from an endowment to purchase library books would be an Endowment Fund.

Where is the tax recordedIf a county collects taxes on behalf of the city and school district, it would record the taxes in the Special Revenue Fund.

Interfund transactions include all of the following except for: interfund non-reciprocal transfers between government funds recorded as interfund transfers appearing after non-operating revenues.

Read more on Taxes here:https://brainly.com/question/25783927

#SPJ4

Type the correct answer in the box. Spell all words correctly.

In which closing technique does a salesperson respond to a customer's question with a counter question to close the sale?

In a __________ close, a salesperson's objective is to respond to a customer's question with a counter question that might help close

In a

the sale quickly

Answers

Answer:porcupine close

Explanation:

On page 23 of the Plato work

Pacifica Papers Inc. needed to conserve cash, so instead of a cash dividend the board of directors declared a 5% common share dividend on June 30, 2020, distributable on July 15, 2020. Because performance during 2020 was better than expected, the company's board of directors declared a $0.95 per share cash dividend on November 15, 2020, payable on December 1, 2020, to shareholders of record on November 30, 2020. The equity section of Pacifica's December 31, 2019, balance sheet showed: Common shares, unlimited shares authorize shares issued and outstanding Retained earnings $7,310,000 2,800,000 Required: 1. Journalize the declaration of the share dividend. The market prices of the shares were $17.90 on June 30, 2020, and $19.90 on July 15, 2020. Assume share dividends account is used when dividends are declared. Answer is complete and correct. No General Journal Debit Credit No | 1 Date June 30, 2020 760,7501 Share dividends Common share dividends distributable 760,750 2. Journalize the declaration of the cash dividend. Assume share dividends account is used when dividends are declared. Answer is not complete. Debit Credit No 11 Date General Journal November 15, 202 Cash dividends Common shares dividends payable 3. Prepare the equity section of the balance sheet at December 31, 2020, assuming profit earned during the year was $2,730,000. Answer is not complete. PACIFICA PAPERS INC. Equity Section of Balance Sheet December 31, 2020 Contributed capital: Common shares, unlimited shares authorized, 892,500 shares issued and outstanding Retained earnings Total equity 0

Answers

The market price of the shares on June 30, 2020, was $17.90.

1. To journalize the declaration of the share dividend on June 30, 2020:

Date: June 30, 2020

Debit: Share Dividends - $760,750

Credit: Common Share Dividends Distributable - $760,750

The market price of the shares on June 30, 2020, was $17.90.

2. To journalize the declaration of the cash dividend on November 15, 2020:

Date: November 15, 2020

Debit: Cash Dividends - $847,375 ($0.95 * 892,500 shares)

Credit: Cash Dividends Payable - $847,375

3. To prepare the equity section of the balance sheet at December 31, 2020:

PACIFICA PAPERS INC.

Equity Section of Balance Sheet

December 31, 2020

Contributed Capital:

Common Shares, unlimited shares authorized, 892,500 shares issued and outstanding - $8,070,750 ($7,310,000 + $760,750)

Retained Earnings:

Beginning Retained Earnings - $2,800,000

Add: Profit earned during the year - $2,730,000

Less: Cash Dividends - $847,375

Ending Retained Earnings - $4,682,625

Total Equity:

Contributed Capital + Retained Earnings

$8,070,750 + $4,682,625 = $12,753,375

To know more about market price visit

https://brainly.com/question/17205622

#SPJ11

Faiz would like to illustrate the commission savings delivered by a payment app compared with a credit card. He decides to use a company that has a monthly sales volume of $50,000 delivered over 100 equal transactions. From the information available, what is the difference between the payment app with the lowest charge, compared with a credit card charge?

(A) $575

(B) $1200

(C) $1050

(D) $480

(E) $1237

Answers

Full question(find attached) :

Faiz would like to illustrate the commission savings delivered by a payment app compared with a credit card. He decides to use a company that has a monthly sales volume of $50,000 delivered over 100 equal transactions.

From the information available, what is the difference between the payment app with the lowest charge, compared with a credit card charge?

A) $575

B) $1200

C) $1050

D) $480

E) $1237

Answer and Explanation:

Credit card processing firms charge an average of 3.5% and a flat fee of about 20 cents so we would make our comparison on this basis:

Since Faiz decides to use a company that has a monthly sales volume of $50,000 delivered over 100 equal transactions

The customer would pay $50000/100= $500 per instalment

Given the information I'm the table from question Instant wallet charges 3.5% +$0.20 for transactions lower than $1500

= 0.035*$500+$0.20=17.5+0.20=$17.7

An average credit card processing firms would charge :

0.035*500+$0.35=17.5+0.35= $17.85

Therefore instant wallet is cheaper and would save a customer =$17.85-17.7= $0.15

the preferred stock of carla vista inc. is currently trading 144.50 per share. if the required rate of return what is the quartelrly divident paid

Answers

The preferred stock is trading at $144.50 per share, and we are given the required rate of return. To calculate the dividend payment, we can use the following formula: Dividend payment = (Price per share * Required rate of return)

the preferred stock of Carla Vista Inc. is currently trading at $144.50 per share. If the required rate of return is known, we can calculate the quarterly dividend paid by the company.

The required rate of return is the minimum return that an investor expects to receive on their investment. It is also referred to as the cost of capital or the discount rate. In this case, we need to know the required rate of return for the preferred stock of Carla Vista Inc. to calculate the dividend paid.

Once we have the required rate of return, we can use the formula for calculating the dividend paid on preferred stock. The formula is:

Dividend Paid = Preferred Stock Price x Dividend Rate

The dividend rate is usually expressed as a percentage of the preferred stock price. For example, if the dividend rate is 5%, the dividend paid would be 5% of the preferred stock price.

Assuming we know the required rate of return for the preferred stock of Carla Vista Inc., we can use this formula to calculate the quarterly dividend paid.

To know more about stock click here:

https://brainly.com/question/31940696

#SPJ11

the following three identical units of item jc07 are purchased during april: item jc07 units cost april 2 purchase 1 $113 april 14 purchase 1 116 april 28 purchase 1 119 total 3 $348 average cost per unit $116 ($348 ÷ 3 units) assume that one unit is sold on april 30 for $142. determine the gross profit for april and ending inventory on april 30 using the (a) first-in, first-out (fifo); (b) last-in, first-out (lifo); and (c) weighted average cost methods.

Answers

For three identical units, a) using First-In, First-Out (FIFO), the gross profit for April is $29 and the ending inventory on April 30 is $235. b) Using LIFO, the gross profit for April is $23 and the ending inventory on April 30 is $113. c) Using weighted average cost, the gross profit for April is $26 and the ending inventory on April 30 is $232.

The gross profit for April and ending inventory on April 30 can be determined using the following methods:

(a) First-In, First-Out (FIFO):

To calculate the gross profit, we need to determine the cost of goods sold (COGS). Since the first unit purchased is sold first, the cost of goods sold will be $113. The remaining two units have a total cost of $235 ($116 + $119). Therefore, the gross profit for April using the FIFO method is $142 - $113 = $29.

The ending inventory on April 30 using FIFO is calculated by taking the cost of the remaining two units, which is $235.

(b) Last-In, First-Out (LIFO):

With LIFO, the last unit purchased is sold first. Therefore, the cost of goods sold will be $119. The remaining two units have a total cost of $229 ($113 + $116). Hence, the gross profit for April using the LIFO method is $142 - $119 = $23.

The ending inventory on April 30 using LIFO is calculated by taking the cost of the first unit purchased, which is $113.

(c) Weighted Average Cost:

To calculate the weighted average cost, we divide the total cost of $348 by the total units, which is 3. The average cost per unit is $116.

The cost of goods sold will be $116 since the unit sold on April 30 was purchased at this average cost. Therefore, the gross profit for April using the weighted average cost method is $142 - $116 = $26.

The ending inventory on April 30 using the weighted average cost method is calculated by taking the cost of the remaining two units, which is $232 ($116 x 2).

In summary:

(a) Gross profit using FIFO: $29

Ending inventory on April 30 using FIFO: $235

(b) Gross profit using LIFO: $23

Ending inventory on April 30 using LIFO: $113

(c) Gross profit using weighted average cost: $26

Ending inventory on April 30 using weighted average cost: $232

Learn more about Weighted Average Cost at:

https://brainly.com/question/8287701

#SPJ11

Ms. Marsh filed her 20X0 individual income tax return on February 15, 20X1. All her tax was paid during the year through withholding. The return was due on April 15, 20X1. During January 20X2, she discovered that she had not taken a properly substantiated charitable contribution that would have reduced her total tax by $250 on her 20X0 tax return. By what date must she file her amended return to claim a refund of the tax paid?

Answers

Answer:

April 15, 20x4

Explanation:

Ms. Marshall can file for a refund until the later of the following 3 dates:

3 years from her original tax filing (February 15, 20x4)3 years from the due date of her original tax filing (April 15, 20x4)2 years since paying her taxes (December 31, 20x2)In this case, the later date would be April 15, 20x4

Which of the following is NOT a financial measure? A) operating efficiency. B) revenue. C) earnings per stock share. D) operating income.

Answers

Operating efficiency is not a financial measure. The correct answer is option a.

Financial measures typically refer to quantifiable metrics that assess the financial performance and health of a business.

They provide insights into various aspects of the company's financial operations and help evaluate its profitability, liquidity, solvency, and overall financial well-being.

Examples of financial measures include revenue, earnings per stock share, operating income, net income, return on investment (ROI), return on assets (ROA), and many others.

Operating efficiency, on the other hand, is a measure of how effectively a company utilizes its resources to generate output or achieve its operational goals. While it is an important measure for assessing operational performance, it falls under the category of operational or performance measures rather than financial measures.

The correct answer is option a.

To know more about Operating efficiency refer to-

https://brainly.com/question/30613450

#SPJ11

jason has three capital transactions for the current year: short-term capital loss of $5,000; short-term capital gain of $3,000; long-term capital loss of $2,000. what is the net effect on jason's taxes if he is in the 25% tax bracket? g

Answers

To determine the net effect on Jason's taxes, we need to calculate the total capital gain or loss and apply the tax rate.

Net short-term capital gain/loss = Total short-term capital gains - Total short-term capital losses

Net short-term capital gain/loss = $3,000 - $5,000 = -$2,000 (a net short-term capital loss)

Net long-term capital gain/loss = Total long-term capital gains - Total long-term capital losses

Net long-term capital gain/loss = $0 - $2,000 = -$2,000 (a net long-term capital loss)

Total capital gain/loss = Net short-term capital gain/loss + Net long-term capital gain/loss

Total capital gain/loss = -$2,000 + (-$2,000) = -$4,000 (a total capital loss)

Since Jason is in the 25% tax bracket, the net effect on his taxes will be calculated based on the capital loss. In this case, a capital loss can be used to offset capital gains and reduce taxable income.

The maximum amount of capital loss that can be used to offset taxable income is $3,000 for individuals or $1,500 for married individuals filing separately.

Since Jason has a total capital loss of $4,000, he can use up to $3,000 of it to offset his taxable income. The remaining $1,000 ($4,000 - $3,000) can be carried forward to future years to offset future capital gains.

By using the $3,000 capital loss to offset taxable income, Jason can potentially reduce his taxable income by $3,000 * 25% = $750.

Therefore, the net effect on Jason's taxes in the current year, assuming he uses the maximum allowable capital loss deduction, would be a reduction of $750 in his tax liability.

On January 1, 2019, Billips Corporation purchased equipment having a fair value of $72,054.94 by issuing a $90,000 note, payable in three $30,000 annual installments beginning December 31, 2019.

Required:

Prepare:

a. the journal entry to record the purchase of the equipment.

b. a schedule to compute the annual interest expense.

c. the journal entries to record yearly interest expense and note repayments over the life of the note.

Answers

Answer:

a. the journal entry to record the purchase of the equipment.

January 1, 2019, equipment is purchased

Dr Equipment 72,054.94

Dr Discount on notes payable 17,945.06

Cr Notes payable 90,000

b. a schedule to compute the annual interest expense.

Since we are not given any type of interest rate to compute the amortization of the discount of notes payable using the effective interest method, I will use straight line amortization. Amortization of interest expense per year = $17,945.06 / 3 = $5,981.68

interest expense for year 1 = $5,981.68, carrying value of discount on notes payable = $11,963.38interest expense for year 2 = $5,981.68, carrying value of discount on notes payable = $5,981.70interest expense for year 3 = $5,981.70.c. the journal entries to record yearly interest expense and note repayments over the life of the note.

December 31, 2019, accrued interest expense

Dr Interest expense 5,981.68

Cr Discount on notes payable 5,981.68

December 31, 2020, accrued interest expense

Dr Interest expense 5,981.68

Cr Discount on notes payable 5,981.68

December 31, 2021, notes payable is paid off

Dr Notes payable 90,000

Dr Interest expense 5,981.70

Cr Cash 90,000

Cr Discount on notes payable 5,981.68

(If you can answer this question, please answer it. No one's been answering my questions ): )

Think about price, place, promotion, and product.

Do you see any limitations to using these methods to create a marketing plan? If so what limitations do you foresee?

Answers

Hope this helps :)

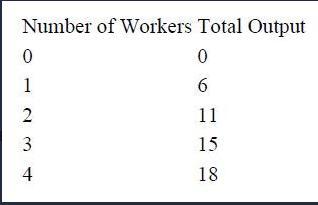

praxis if the firm's labor cost is $20 per worker per hour and the firm sells its output for $5 per unit, how many workers should the firm hire to maximize profit? 1

Answers

Assuming the association's work cost is $20 per laborer each hour and the firm sells its result for $5 per unit the firm shopuld enlist 3 workers.

To boost benefit, a firm ought to employ laborers up to the place where the negligible expense of work is equivalent to the peripheral income produced from selling an extra unit of result. All in all, the firm ought to recruit laborers until the expense of creating an additional unit of result approaches the income acquired from selling that unit.

The ideal number of laborers not entirely set in stone by finding where the peripheral expense of work approaches the negligible income from selling an extra unit. This point addresses the greatest benefit.

Learn more about work, from:

brainly.com/question/33629397

#SPJ4

Your question is incomplete, probably the question should contain the below list-

TQK, LLC, provides consulting services and was formed on 1/31/X5. Aaron and ABC, Inc., each hold a 50 percent capital and profits interest in TQK. If TQK averaged $27,000,000 in annual gross receipts over the last three years, what accounting method can TQK use for X9

Answers

Answer:

Accrual method

Explanation:

As the average annual growth receipts is $27,000,000 which is greater than the $25,000,000 this amount reflects an exception due to which it cannot be applied for cash

Also the accrual method is also selected because it helps while subtracting the expenses instead of cash basis plus it also provides an accurate amount as compared with other methods. And, there is no need to maintain separate books for the purpose of tax

down the net income from the peak tax bracket.

What increases your total loan balance Interest Accrual Interest capitalism Both interest accrual interest capitalism None of the above

Answers

Answer:

Both interest accrual and interest capitalism

Explanation:

The total loan balance increases due to "Both interest accrual and interest capitalism"

This is because INTEREST ACCRUAL on a loan is capitalized, which implies that it will be added to the principal balance, therefore increasing the total loan balance.

Similarly, the INTEREST CAPITALISM occurred when a loan repayment period is missed, therefore, the amount missed is capitalized which in turn increases the total loan balance.

Answer: both

Explanation:

what was the most purchased product by rocky mountain bikes? how much did they purchase over all the years?

Answers

In Northern California, USA, the sport gained popularity in the 1970s when participants rode dated, single-speed balloon tire bicycles down rocky hillsides.

Why is Rocky Mount famous?The economy of Rocky Mount has evolved to incorporate biological pharmaceuticals, manufacturing, and logistics in addition to its traditional industries of rail transportation, textiles, and agriculture. In 1969 and 1999, Rocky Mount was given the All-America City Award by the National Civic League.

What is the most well-known mountain bike manufacturer?Giant is a big rival in the industry, but Trek and Specialized enjoy greater notoriety across the globe for their brands. I keep coming back to Giant because of their affordable prices and well-known brand every time I help someone in their search for a new bike.

Learn more about rocky hillsides: https://brainly.com/question/13483308

#SPJ4

The CD production function q=k^.5*l^.75 yields the cost function

Answers

The cost function derived from the CD production function q=\(k^0.5*l^0.75\) is given by C(w,r,q)= min{wL,rK} where w and r are the wage rate and rental rate of capital, respectively.

Here, the cost function is derived from the production function by minimizing the cost of production subject to a given level of output q. In this case, the cost of production depends on the quantities of labor and capital used, which are represented by L and K, respectively. The wage rate w and the rental rate of capital r determine the cost of using these inputs.

The cost function is a measure of the minimum cost required to produce a given level of output q using a given combination of inputs. The cost function is useful for determining the least-cost combination of inputs required to produce a particular level of output, given the prices of the inputs.

To learn more about cost function, visit here

https://brainly.com/question/29583181

#SPJ4