how do you invite an employee to track their hours in quickbooks time? by selecting the quickbooks time send invite link from the benefits tab in the payroll center by selecting the quickbooks time send invite link from the approvals menu in quickbooks time by selecting the quickbooks time send invite link from the company settings menu in quickbooks time by selecting the quickbooks time send invite link from the employee details screen

Answers

To invite an employee to track their hours in QuickBooks Time, you need to select the "QuickBooks Time send invite link" from the employee details screen.

QuickBooks Time, formerly known as TSheets by QuickBooks, is an employee time tracking app. QuickBooks Time makes it easier to track employee hours, manage employee schedules, and accurately record employee time for payroll purposes.

To invite an employee to track their hours in QuickBooks Time, follow these steps:

1. Sign in to QuickBooks Time.

2. Navigate to the "Employees" tab.

3. Choose the employee you want to invite to QuickBooks Time.

4. In the employee's profile, click the "Invite to QuickBooks Time" button.

5. A dialog box will appear, asking you to confirm that you want to send the invitation.

6. Click "Send Invite."

7. The employee will receive an email from QuickBooks Time with instructions on how to set up their account and start tracking their hours in QuickBooks Time.

Therefore, by selecting the QuickBooks Time send invite link from the employee details screen, you can invite an employee to track their hours in QuickBooks Time.

Learn more about QuickBooks Time from the given link.

https://brainly.com/question/30247213

#SPJ11

Related Questions

As in proprietorships, information in a corporation's accounting system is kept separate from the personal records of the owners, and this accounting concept application is called a Business Entity. true or false

Answers

True. Information in a corporation's accounting system is kept separate from the personal records of the owners, and this accounting concept application is called a Business Entity

In accounting, the concept of a business entity means that a business is considered a separate entity from its owners or shareholders. This means that the financial information and records of the business are kept separate from the personal finances of its owners or shareholders.

This concept is particularly important in corporations because they are legally recognized as separate legal entities from their owners or shareholders. As a result, corporations can own property, sue and be sued, and enter into contracts in their own name, rather than the names of their individual owners or shareholders.

The business entity concept also helps to ensure that financial information is accurate and reliable by keeping personal expenses separate from business expenses. This is important for financial reporting and tax purposes.

Learn more about corporation's here:

https://brainly.com/question/31313496

#SPJ11

costs of getting the surplus cars from locations 1 and 2 to the other locations are summarized in the following table. How many cars are to be shipped from Location 2 to Location 4 ?

Answers

Wheel Rent faces problem distributing surplus cars to meet demand at four locations, ensuring at least 5 cars are received at each location.

To formulate the Linear Programming (LP) model for this problem, let's define the decision variables: Let Xij represent the number of surplus cars transported from location i to location j, where i and j can be 1 or 2 (the surplus locations) and 3, 4, 5, or 6 (the demand locations).

The objective function is to minimize the total cost of transportation, which is the sum of the costs of transporting cars from locations 1 and 2 to locations 3, 4, 5, and 6, respectively, multiplied by their corresponding decision variables Xij.

Subject to the constraints:

Each demand location (3, 4, 5, 6) should receive at least 5 cars: X3j + X4j + X5j + X6j >= 5 for j = 3, 4, 5, 6.

Each supply location (1, 2) should send all its surplus cars: X1j + X2j = 16 for j = 3, 4, 5, 6.

The total number of cars sent from supply locations should not exceed the total number of surplus cars available: X13 + X14 + X15 + X16 + X23 + X24 + X25 + X26 <= 34.

The total number of cars received at demand locations should meet the demand: X31 + X32 + X41 + X42 + X51 + X52 + X61 + X62 >= 40.

By setting up and solving this LP model, Wheel Rent can efficiently distribute its surplus cars to meet the demand at various locations while minimizing transportation costs and ensuring each location receives at least 5 cars.

Learn more about supply here:

https://brainly.com/question/28285610

#SPJ11

The complete question is:

Wheel Rent! car rental company allows customers to pick up a rental vehicle at one location and return it to any of the other locations. Currently, two locations (1 and 2) have 16 and 18 surplus cars, respectively, and four locations (3, 4, 5, and 6) each need 10 cars. The costs of getting the surplus cars from location 1 and 2 to the other locations are summarized in the following table:

Costs of Transporting Cars Between Locations

Location 3 Location 4 Location 5 Location 6

Location 1 $54 $17 $23 $30

Location 2 $24 $18 $19 $31

Because 34 surplus cars are available at locations 1 and 2, and 40 cars are needed at locations 3, 4, 5, and 6, some locations will not receive as many cars as they need. However, management wants to make sure that all the surplus cars are sent where they are needed, and that each location needing cars receives at least 5. Answer the following questions please! a. Formulate an LP model for this problem.

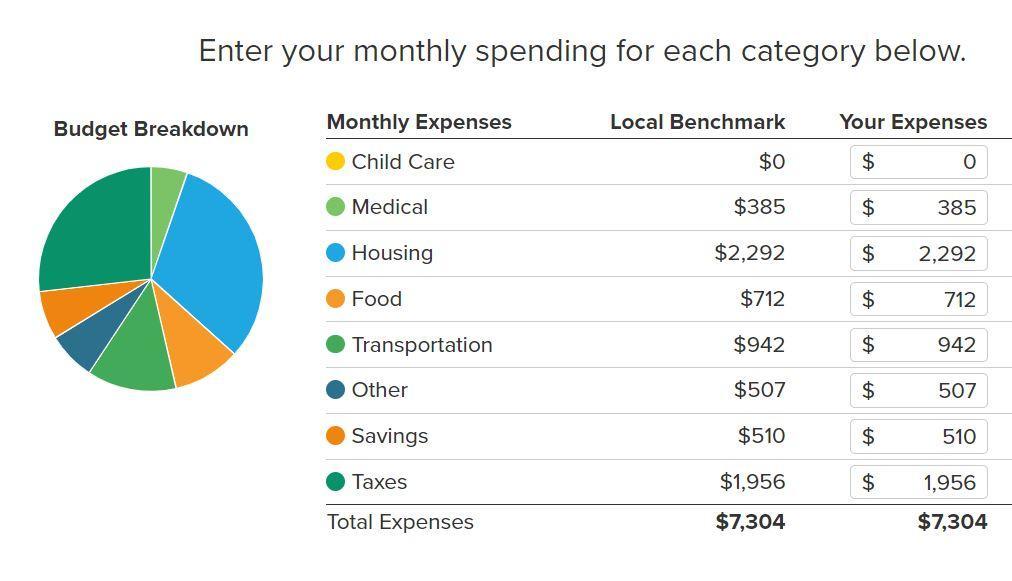

Step 3: Creating a Balanced Family Budget

a) Search for a "family budget estimator" and calculate the monthly expenses for a family living

in your city.

Insert a screenshot of the calculator you used, as well as all of the information you entered

into it. If you are unable to insert a screenshot, then list the information below. (10 points)

b) State the minimum monthly income and hourly wage per worker needed to cover monthly

expenses for the family you used in part a. Then, explain how to calculate the hourly wage

Show we’re u found your information

Answers

The family budget calculator use is attached accordingly. See relevant definition below.

What is the minimum monthly income and hourly wage per worker required to cover the monthly expenses indicated in the budget?The total budget indicated is $7,304. Hence to cover for the above expenses, one would need to work for at least 8 hours per day, and 5 days a week at the minimum income wage of $50 dollars/Hour.

This translates to:

50 x 8 x 20

= $8,000

What exactly is a family budget?A family budget is a plan for your household's incoming and outgoing funds for a specific time period, such as a month or year.

What is the definition of a Family Budget Calculator?The Family Budget Calculator calculates the amount of money required for a family to maintain a modest but decent level of life.

The budgets project community-specific expenses for ten different family types (one or two adults with zero to four children) across all counties and metro regions in the United States.

Learn more about Family Budget Calculator:

https://brainly.com/question/9621657

#SPJ1

List five organizations where you could volunteer your services. Describe the type of work you might perform for each organization.

Answers

Answer: Five organizations I can volunteer my services are;

Total plc

Shell

Cheveron

Halliburton

Schlumberger

Explanation:

Five organizations I can volunteer my services are;

Total plc

Shell

Cheveron

Halliburton

Schlumberger

Total; I would work as a procurement officer. I would be helping the organization procure their items easily,fast and affordable from the right source

Shell; I would work as an a geologist, to identify locations where natural resources like crude oil can be found

Cheveron; I'll work as an I.C.T personnel

Halliburton; I'll work as a mechanical engineer

Schlumberger; I'll work as a mechanical instructor on air compressors

Which change should she make in her outline?

O change step 2 to “click the format tab”

O change step 3 to “open chart title dialog box “

O change step 4 to “type in the chart title”

O change step 5 to “add the chart title”

Answers

Answer:

A

Explanation:

Answer:

B

Explanation:

what additional information would be desirable before the final direct rate (r) is selected?

Answers

Market conditions, profitability impact, customer behavior, and feedback are important before finalizing the direct rate (r).

Prior to finishing the immediate rate (r), a few extra snippets of data would be attractive to guarantee that the picked rate is fitting and powerful for the planned reason. First and foremost, it would be fundamental to have an unmistakable comprehension of the economic situations and the cutthroat scene.

This data would assist with guaranteeing that the chose rate is cutthroat and appealing to clients. Furthermore, taking into account the effect of the rate on the general productivity of the organization would be important. The rate ought to be set so that it is economical in the long haul and doesn't prompt misfortunes or monetary precariousness.

Thirdly, it would be vital to investigate client conduct and inclinations to decide the degree of interest for the item or administration at various rates. This would assist with distinguishing the ideal rate that adjusts the necessities of clients and the monetary objectives of the association.

Finally, it would be useful to accumulate criticism from clients and partners on the proposed rate to guarantee that it is seen as fair and sensible. This would assist with building trust and trust in the association and its evaluating techniques.

To learn more about final direct rate, refer:

https://brainly.com/question/13579409

#SPJ4

operations and sales are the two ________ functions in businesses.

Answers

According to the list, the two functions in a firm are operations and sales. As a result, choice (E): Line is the right one.

The foundation of a company's structure and operations is referred to as its functions in business.Here, we must distinguish between the two roles that operations and sales play in enterprises.As is common knowledge, the three main management functions in every firm are finance, marketing, and operations management.These functions are performed one after the other in a sequential order.The lined ways can be used in another format.

Operations and sales are the two functions in businesses.

A. strategic

B. tactical

C. support

D. value-adding

E. line

To know more about Sales, here:

https://brainly.com/question/30157418

#SPJ4

For Cindy’s position as the school nurse, she is required to keep her CPR and first aid certifications up to date. She organized a CPR and first aid course at the elementary school where she works. During the course, students are encouraged to practice CPR on dummies. As Cindy was doing her practice chest compressions, she sprained her wrist. Cindy visited the doctor, and he prescribed her physical therapy for her wrist. Which party is responsible for paying Cindy’s medical bills?

Answers

Answer:

the school where Cindy works

Explanation:

According to the rules created by Occupational Safety and Health administration, incidents that occurred toward the employees within the workplace environment or employer's premises are presumed to be work related.

Since Cindy sprained her wrists during her job, this can be related as a work-related injury or illness. Because of this, the employer will be the one that is responsible in paying Cindy's medical Bill. In this case, the employer is the school.

How to convince people to buy your wine.

Answers

Answer and Explanation:

Talk them into it..

Answer:

either make an ad, or make the wine actually delicous and do not click-bait. click-baiting will have your chances on people buying your wine to a lower chance.

Lerato has been searching for a job and recently read an ad for a position at a company that he wants to work for. His résumé has already been written, reviewed, and revised, but he needs to craft an effective cover letter. What should Lerato do when writing his cover letter?A. Address it to "To whom it may concern"B. Rely on his computer's spell check to catch any errors in spelling and grammarC. Explain how his education and experience would benefit the companyD. Focus on how the job would fit into his long-term career plan

Answers

Option C. Explain how his education and experience would benefit the company. So option c is the correct option.

What is in a resume?Your experiences, skills, and work history are detailed in your resume for the employer to see. Make sure your CV stands out by emphasizing the qualities that show you are a reliable employee, suited for the job, and have the necessary abilities.

What qualities distinguish a strong resume?It's not a good idea to apply with the same CV for each position. The position you are seeking for should be the focus of your CV. Prioritize your education, training, and work history according to how well they relate to the position you're applying for.

To know more about resume visit:

https://brainly.com/question/18888301

#SPJ4

To identify the financial benefits and costs associated with the development project is the purpose of:________.

Answers

The purpose of identifying the financial benefits and costs associated with a development project is to perform a cost-benefit analysis.

Cost-benefit analysis is a systematic process used to assess the financial implications of a project or decision. Its purpose is to compare the anticipated benefits against the costs incurred in order to determine the feasibility and profitability of the project. By identifying and quantifying both the financial benefits and Cost Management, organizations can make informed decisions and allocate resources efficiently.

In a cost-benefit analysis, the financial benefits of a development project refer to the positive outcomes and gains that can be attributed to the project. These benefits can include increased revenues, cost savings, improved efficiency, enhanced market position, or other measurable financial advantages. On the other hand, the financial costs represent the expenses and investments required to initiate and maintain the project, such as upfront costs, operational expenses, maintenance fees, and any other financial outlays.

By analyzing and comparing the projected benefits and costs, decision-makers can assess the financial viability and potential return on investment of the development project. This analysis provides crucial insights into the financial impact and helps guide decision-making processes, ensuring that resources are allocated to projects that offer the greatest financial benefits relative to their costs.

Learn more about Cost Management here

https://brainly.com/question/29612844

#SPJ11

free hhahahahahhaha ok just for yalll

Answers

Answer:

why?

Explanation:

Answer:

nice thanks mark me brainiest

Explanation:

Name three types of financial payment methods for labour services.

Answers

1. Checks

2. Electronic bank transfers (direct deposit)

3. Pre-paid debit cards

Alan is young, but he decides to plan for his retirement early. He decides to formulate some estimates of his lifetime income. Which answer best describes Alan’s lifetime income?

Alan’s lifetime income is his employee benefits, like health insurance.

Alan’s lifetime income includes his salary and retirement benefits.

Alan’s lifetime income includes both his career outlook and his career environment.

Alan’s lifetime income is both his college classes and his vocational training.

Answers

Based on personal economics and the context of the question the statement that best describes Alan’s lifetime income is that "Alan's lifetime income includes his salary and retirement benefits."

What is Lifetime IncomeLifetime Income is a term that is used to describe the kind of retirement plan that enables individuals with a constant stream of income for the rest of their life.

Usually, annuities are the only retirement plan that can give this type of income, which is why they're often called “annuities for life.”

Given that Alan is young, and decided to plan for his retirement early. This implies that Alan has decided to formulate some estimates of his lifetime income.

Therefore, the answer that best describes Alan's lifetime income is - Alan's lifetime income includes his salary and retirement benefits.

Hence, in this case, it is concluded that the salary, he earned throughout his life created his assets and savings. And the money that he will get as retirement benefits is also his income.

Learn more about Lifetime Income here: https://brainly.com/question/20715113

#SPJ1

Answer:

b.

Explanation:

create a SWOT/SWOC analysis of one of the following companies.

ALDI

LIDL

Penneys/Primark

Coca Cola

Audi

Tesco

Dunnes Stores

IKEA

Topshop

JD Sports

Answers

Answer:

coca cola

Explanation:

s- coca cola is enjoyed all over the world therefore it will always make money

w- coca cola is a sugary drink which some people won't enjoy

o- coca cola can expand and make it more accessible to people local shops

t-coca cola is in competition with many other soda brands

Monitoring the competition is important for all the following reasons EXCEPT

a

to keep prices competitive.

b

a similar décor will attract customers.

c

to match competitors’ promotions.

d

to detect weaknesses in competitors’ promotional strategies.

Answers

Answer: The answer is B

Explanation: Took the test

Answer:

B. a similar décor will attract customers.

Explanation:

_______ is a term referencing the concept that a sufficient interest must exist on the part of an insured in order to take out a policy of insurance. Multiple Choice Insurable interest Pecuniary interest Financial concern Financial effect Profit impact

Answers

Answer:

Insurable interest

Explanation:

The insurance interest is the interest of the insurer while taking the policy so that the risk of the loss is reduced also it is an important requirement that makes the firm or the event to be legal, valid, enforceable, and protected against any harmful acts done intentionally

Therefore according to the given situation, the concept in which enough interest must exist on the part of the insurer while taking the policy is known as the insurer interest

Hence, the first option is correct

.Comfort living produces three types of three luggage sets (Carryon, Upright, and Duffel)

Carryon Upright Duffel Quantity 8,000 set 12,000 set 6,000 set

Selling price $750 per set $800 per set $600 per set

Direct material and direct labour cost $340 per set $600 per set $360 per set

Answers

Comfort living produces three types of three luggage sets. The total direct material and direct labor cost of all three sets is $12,080,000.

The Carryon Upright Duffel Quantity of each type of set is as follows:-

Carryon - 8,000 sets Upright - 12,000 sets Duffel - 6,000 sets.

The selling price for each set is as follows:-

Carryon - $750 per set Upright - $800 per set Duffel - $600 per set.

The direct material and direct labor costs for each set are as follows:-

Carryon - $340 per set Upright - $600 per set Duffel - $360 per set

Now, we need to calculate the total amount of direct material and direct labor costs for each type of luggage set. So, we need to multiply the cost per set with the quantity of sets produced. Then we add all three to get the total direct material and direct labor cost.

Hence,Total direct material and direct labor cost for the Carryon set = $340 × 8,000 = $2,720,000

Total direct material and direct labor cost for the Upright set = $600 × 12,000 = $7,200,000

Total direct material and direct labor cost for the Duffel set = $360 × 6,000 = $2,160,000

Total direct material and direct labor cost for all three sets = $2,720,000 + $7,200,000 + $2,160,000 = $12,080,000

Consequently, $12,080,000 is the total direct material and direct labour cost for the three sets.

To learn more about "Direct Material" visit: https://brainly.com/question/26245657

#SPJ11

owen's adjusted gross income for the year will be $150,000 and he is planning to make only one of following charitable donations. if he contributes $100,000 cash to a public charity, he can deduct $ . if he contributes property that is worth $80,000 to a public charity, he can deduct $ . or, if he contributes publicly traded stock with a fmv of $60,000

Answers

AGI (adjusted gross income) is total gross earnings less above-the-line deductions such as the educator rate deduction or the scholar loan activity deduction.

These are located on Schedule 1 of Form 1040. Your taxable income is your AGI minus either the preferred or itemized deductions and the qualified enterprise profits deduction.

What is the method for AGI?The AGI calculation is enormously straightforward. It is equal to the total earnings you report it is subject to profits tax—such as revenue from your job, self-employment, dividends and hobby from a bank account—minus unique deductions, or “adjustments” that you're eligible to take.

Learn more about adjusted gross income here:

https://brainly.com/question/1931633#SPJ4Can a taxpayer start the three-year statute of limitations on additional assessments by the IRS by filing his income tax return early (i.e., before the due date)? Can the period be shortened by filing late (i.e., after the due date)?

Previous question

Answers

Yes, filing an income tax return early starts the three-year statute of limitations on additional assessments by the IRS. Filing late does not shorten the statute of limitations.

The statute of limitations is the time period within which the IRS can assess additional taxes or make adjustments to a taxpayer's return. By filing the tax return early, the taxpayer initiates the clock on the statute of limitations, giving the IRS a three-year window to conduct any further assessments. However, filing late does not shorten this time period; the statute of limitations still applies from the date of the late filing. It's important to comply with tax filing deadlines to ensure timely initiation of the statute of limitations.

learn more about income tax here:

https://brainly.com/question/21595302

#SPJ11

Filing an income tax return early does not start the three-year statute of limitations for additional IRS assessments. Filing late can extend the period for assessments.

The three-year statute of limitations for additional assessments by the IRS begins from the original due date of the tax return, regardless of whether the taxpayer files early or on time. Filing an income tax return early does not have any impact on the statute of limitations. However, if a taxpayer files their return late, the statute of limitations is extended and the IRS has a longer period to assess additional taxes. In such cases, the statute of limitations begins from the actual date of filing. It's important for taxpayers to be aware of the applicable statute of limitations when filing their tax returns and to comply with the filing deadlines to avoid potential extensions of the assessment period by the IRS.

Learn more about income tax return here:

https://brainly.com/question/13285206

#SPJ11

What is the current price of a $1,000 par value bond maturing in 12 years with a coupon rate of 14 percent, paid semiannually, that has a ytm of 13 percent?.

Answers

The current price of a $1,000 par value bond maturing in 12 years with a coupon rate of 14%, paid semiannually, and a YTM of 13% is $1,899.31.

How is the price of bonds calculated?The price of bonds can be computed using the present value formula of all future cash flows.

The present value table can also be used. Here, we have used the present value calculator from an online finance calculator, as below.

Data and Calculations:N (# of periods) = 24 (12 x 2)

I/Y (Interest per year) = 13%

PMT (Periodic Payment) = $140

FV (Future Value) = $1,000

Results:

PV = $1,899.31

Sum of all periodic payments = $3,360 ($140 x 24)

Total Interest $2,460.69

Thus, the current price of a $1,000 par value bond maturing in 12 years with a coupon rate of 14%, paid semiannually, and a YTM of 13% is $1,899.31.

Learn more about the price of bonds at https://brainly.com/question/25596583

Question 5 of 10

For accountants, which of the following is the most important consequence

of the unethical use of technology?

A. the threat to the reliability of accounting systems

OB. the direct and indirect loss of revenue

C. the possibility that privacy will be compromised

D. the loss of trust in the accounting profession

SUBMIT

Answers

The most important consequence of the unethical use of technology for accountants is the threat to the reliability of accounting systems (option A).

What are accounting systems?Accounting systems are described as the controls, procedures, and processes in accounting. The main purpose of accounting systems is to make a summary and record the different business transactions in a way that will allow the creation of reports, and enhance operations.

If the accountants are unethically using technology, then it will directly impact the accounting processes, and transaction records of businesses, and the financial report will produce erroneous results and will highly degrade the decision-making process.

It can be concluded that the most important consequence of the unethical use of technology for accountants is the threat to the reliability of accounting systems (option A).

To know more about accounting systems, click this link:

https://brainly.com/question/26380452

#SPJ9

Answer: The loss of trust in the accounting profession

Explanation: believed the other person aaaannnnnddddd got it wrong

True or false?

The law of diminishing returns states that as more variable inputs are added to production, the productivity of these inputs increases.

Answers

Answer:

that would be true

Explanation:

"What a given group of people appreciates" are their ___________. A. Cultural contexts b. Culture shock c. Cultural education d. Cultural values Please select the best answer from the choices provided A B C D

Answers

Answer:

d. Cultural values

Explanation:

Cultural values are the values and norms that are followed by a distinct society or a group of people. In other terms, values and norms developed within the society to form its basis are said to be the cultural values. The people believe, follow, and appreciate the values. They help in defining the ways of living and leading the life. The behavior, nature, and thinking of the society is influenced or structured as per the cultural values.

Answer:

D

Explanation:

I just took the assignment

Ralph buys new furniture for his living room from Good Times Furniture. It is agreed that the goods will be placed with a common carrier for delivery. The contract between Ralph and Good Times is ambiguous regarding whether the seller had the duty to deliver the goods only to the common carrier's hands or whether the seller had the duty to deliver the goods to Ralph's home. Unfortunately, on the way to Ralph's home, through no fault of the delivery driver, the delivery truck was wrecked and the furniture was significantly damaged.

Required:

What is true regarding the risk of loss at the time the goods were damaged?

Answers

True statement regarding the risk of loss is that Ralph bears the risk of loss when the goods are damaged since the seller fulfilled their obligation by transferring them to the common carrier.

In the case where Ralph bought new furniture from Good Times Furniture, and the goods were placed with a common carrier for delivery. The contract between Ralph and Good Times is ambiguous regarding whether the seller had the duty to deliver the goods only to the common carrier's hands or whether the seller had the duty to deliver the goods to Ralph's home.

Unfortunately, on the way to Ralph's home, through no fault of the delivery driver, the delivery truck was wrecked and the furniture was significantly damaged.In this case, the Uniform Commercial Code (UCC) guidelines govern. The UCC's guidelines include provisions regarding the risk of loss in the event of loss, damage, or destruction of goods sold.

The UCC requires that the transfer of goods occur once they have been given to the carrier, and therefore, Ralph has incurred the loss.The goods were transferred to the common carrier for delivery, indicating that the seller fulfilled their obligation when the goods were delivered to the carrier.

According to the UCC, after the goods are shipped, the buyer assumes the risk of loss, which means that the buyer has to bear the consequences of the loss. In this case, Ralph has incurred the loss because the goods were shipped, and the carrier assumed responsibility for delivering them to Ralph's house.

Know more about Furniture here:

https://brainly.com/question/31441302

#SPJ11

Calculate the range of potential annual returns if you invested 10% in bonds and 90% in stocks. How does this compare with the range of potential annual returns if you invested 10% in stocks and 90% bonds?

Answers

Answer:

From the graph, if you invest 10% in bonds and 90% in stocks, the range of potential return is given as +49.8% to -39.0% with a average of 9.9% whereas if investment is made by 10% in stocks and 90% in bonds, then the range of annual returns would become +31.2% to -8.2% with a average of 6%. Therefore, as the investment in stocks increases the average annual returns also increase.

Explanation:

Hope this helps!

Production systems with customized outputs typically have relatively: A. high volumes of output B. low unit costs C. high amount of specialized equipment D. fast work movement E. skilled workers

Answers

Production systems with customized outputs typically have relatively high amounts of specialized equipment and skilled workers.

This is because custom outputs require specific tools and machinery, as well as skilled workers who can handle the intricacies of the customization process. While the volume of output may not be as high as in mass production systems, the unit costs can still be relatively low due to efficient use of specialized equipment and skilled labor. However, the work movement may not be as fast as in other production systems due to the need for careful attention to detail in the customization process.

Learn more bout Production systems here:https://brainly.com/question/28478997

#SPJ11

The process of getting information into memory is called priming. chunking ... Unlike implicit memories, explicit memories are processed by

Answers

Option c: Encoding. Encoding is the process of transforming data into the formats required for various information processing needs, such as: Compile and run the program.

Data transmission, storage and compression/decompression, application data processing. File conversion.

Encoding has two meanings:

In computer technology, encoding is the process of applying a specific code, such as letters, symbols, or numbers, to data to convert it into its cipher equivalent.

In electronics, coding refers to analog to digital conversion.

Encoding is also used in to reduce the size of audio and video files. All audio and video file formats have a corresponding coder/decoder (codec) program that is used to encode them into the appropriate format and decode them for playback.

Don't confuse encoding with encryption, which hides the content. Both technologies are widely used in networking, software programming, wireless communications, and storage.

To learn more about encoding, here:

https://brainly.com/question/13963375

#SPJ4

Complete question:

The process of getting information into memory is called

A) priming.

B) chunking.

C) encoding.

D) registering.

E) storing.

a company has granted 2,000,000 options to its employees. the stock price and strike price are both $60. the options last for 8 years and vest after two years. the company decides to value the options using an expected life of six years and a volatility of 22% per annum. the dividend on the stock is $1, payable half way through each year, and the risk-free rate is 5%. what will the company report as an expense for the options on its income statement?

Answers

To calculate the expense for the options that the company granted to its employees, we must first determine the fair value of the options. Using the Black-Scholes model, the fair value of the options can be computed as follows:

C = S*N(d1) - X*e^(-rT)*N(d2)

where,

C = the fair value of the call option

S = the current stock price

X = the strike price of the option

r = the risk-free rate

T = the time to expiration

N(d1) and N(d2) = the cumulative normal distribution functions

d1 = [ln(S/X) + (r + σ²/2)*T]/(σ√T)

d2 = d1 - σ√T

Given the parameters of the problem, the fair value of the options can be computed as follows:

S = $60

X = $60

T = 6 years

r = 5%

σ = 22%

d1 = [ln(60/60) + (0.05 + 0.22²/2)*6]/(0.22√6) = 0.5000

d2 = 0.5000 - 0.22√6 = -0.2444

N(d1) = 0.6915

N(d2) = 0.4049

C = 60*0.6915 - 60*e^(-0.05*6)*0.4049 = $18.68

Therefore, the fair value of each option is $18.68, and the total expense for the options can be computed as follows:

Expense = 2,000,000*$18.68 = $37,360,000

Therefore, the company will report an expense of $37,360,000 for the options on its income statement.

For more such questions on Black-scholes model

https://brainly.com/question/28809449

#SPJ11

does 1 plus 1 = 65 yes or no

Answers

Answer:

No 1 + 1 = 2

Explanation:

Lol