create a formula in cell h5 to calculate the taxable pay. multiply the number of dependents (column b) by the deduction per dependent (b24) and subtract that from the gross pay. with two dependents, abram’s taxable pay is $417.40.

Answers

Create a method in cell H5 to calculate Abram's taxable pay. Multiply the range of dependents (column B) with the aid of the deduction in line with based (B24) and subtract that

multiply the range of dependents (column b) by using the deduction per dependent (b24) and subtract that from the gross pay. with dependents, Abram's taxable pay.

Abrams and Don Leatherman cover taxation of the 3 important categories of business entities: corporations, S corporations, and Partnerships. New to the sixth.

Abram is a masculine given call of Biblical Hebrew beginning, which means exalted father in lots of later languages. inside the Bible, it turned into the beginning of the call of the first of the 3 Biblical patriarchs, who later became referred to as Abraham.

Abraham had mentored Lot for years, however, their own family cooperative had reached its limits. The local grazing land couldn't support both in their herds. Their herdsmen argued and got on every different's nerves. They wished greater area.

Learn more about Abram here:-https://brainly.com/question/28219456

#SPJ4

Related Questions

A group of four friends spends a day at a local theme park, which has just opened a new attraction with very popular rides featuring new technology. They board one of the rides after waiting for over an hour in line, but about five minutes into the ride the electricity fails, and they are stuck on the ride for a half hour. When the ride finally resumes and concludes, they go to the theme park’s guest services department to complain.

What are the facts?

How does the guest feel?

How would you acknowledge the guest’s feelings?

What would be your solution?

How would you follow up with the guest?

Answers

firstly it was totally the system's fault because they can't take risks with electricity in a local theme park as it is a must factor. even if the incident occurred they must have a good backup.

we have already discussed the facts, it was very unpleasant for the guests as they came for enjoying the moment but wasted their time due to system failure and it was very disheartening for all the people gathered there.

acknowledging guests' feelings seems to be very disheartening as they suffered because of the department's negligence and everything that happened was unexpected.

the department should be aware of every basic facility present at that moment and must have options for immediate action if something happens.

Required information Exercise 3-20 (Algo) Record transactions and prepare adjusting entries, adjusted trial balance, financial statements, and closing entries (LO3-3, 3-4,3-5,3-6,3-7) [The following information applies to the questions displayed below.] On January 1, 2024, Red Flash Photography had the following balances: Cash, $26,000; Supplies, $9,400; Land, $74,000; Deferred Revenue, $6,400; Common Stock $64,000; and Retained Earnings, $39,000. During 2024, the company had the following transactions: 1. February 15 Issue additional shares of common stock, $34,600. 2. May 20 Provide services to customers for cash, $49,000, and on account, $44,000. 3. August 31 Pay salaries to employees for work in 2024,$37,000. 4. October 1 Purchase rental space for one year, $26,000. 5. November 17 Purchase supplies on account, $36,000. 6. December 30 Pay dividends, $3,400. The following information is available on December 31,2024 : 1. Employees are owed an additional $5.400 in salaries. 2. Three months of the rental space have expired. 3. Supplies of $6.400 remain on hand. All other supplies have been used. 4. All of the services associated with the beginning deferred revenue have been performed. 3. Prepare an adjusted trial balance.

Answers

We need to debit Deferred Revenue and credit Service Revenue by $6,400.

To prepare an adjusted trial balance, we need to make adjustments for the following information:

1. Employees are owed an additional $5,400 in salaries. This is an accrued expense, so we need to debit Salaries Expense and credit Salaries Payable by $5,400.

2. Three months of the rental space have expired. This is an expense that needs to be recognized. We need to debit Rent Expense and credit Prepaid Rent by $6,500 ($26,000/12 months * 3 months).

3. Supplies of $6,400 remain on hand. This means that $3,000 ($9,400 - $6,400) of supplies were used during the year. We need to debit Supplies Expense and credit Supplies by $3,000.

4. All of the services associated with the beginning deferred revenue have been performed. This means that $6,400 of deferred revenue can now be recognized as revenue. We need to debit Deferred Revenue and credit Service Revenue by $6,400.

After making these adjustments, we can prepare the adjusted trial balance by listing all the account balances, including the adjusted balances for the accounts affected by the adjustments.

Know more about the credit

https://brainly.com/question/28390335

#SPJ11

Terophone charge is debit or credit

Answers

Answer:

credit

Explanation:

Faleye Consulting is deciding which of two computer systems to purchase. It can purchase state-of-the-art equipment (System A) for an after-tax cost of $25,000, which will generate after-tax cash flows of $9,000 at the end of each of the next 6 years. Aiternatively, the company can purchase equipment with an after-tax cost of $12,000 that can be used for 3 years and will generate after-tax cash flows of $9,000 at the end of each year (System B). If the company's WaCC is 5% and both "projects" can be repeated indefinitely, which system should be chosen, and what is its EAA? Do not round intermediate calculations. Round your answer to the nearest cent. Choose Project , whose EAA=$

Answers

System b should be chosen.the eaa for system b is approximately $2,877.the company should choose system b, which has an equivalent annual annuity (eaa) of approximately $2,877.85.

to determine which system to choose, we need to compare their equivalent annual annuities (eaas). the eaa represents the equal annual cash flow that would result in the same present value as the cash flows from the system.

for system a:

after-tax cost = $25,000

after-tax cash flows per year = $9,000 for 6 years

using the formula for the present value of an annuity (pva), we can calculate the present value of the cash flows from system a:

pva = after-tax cash flows per year * (1 - (1 + wacc)⁽⁻ⁿ⁾) / wacc

pva = $9,000 * (1 - (1 + 0.05)⁽⁻⁶⁾) / 0.05

pva ≈ $40,711.88

for system b:

after-tax cost = $12,000

after-tax cash flows per year = $9,000 for 3 years

calculating the present value of the cash flows from system b:

pvb = after-tax cash flows per year * (1 - (1 + wacc)⁽⁻ⁿ⁾) / wacc

pvb = $9,000 * (1 - (1 + 0.05)⁽⁻³⁾) / 0.05

pvb ≈ $22,588.12

comparing the eaas of both systems, we can see that system b has a lower present value and thus a higher eaa. 85, rounded to the nearest cent.

Learn more about Company here:

https://brainly.com/question/30532251

#SPJ11

fill the blank! plans with time frames beyond five years are ________-term plans; plans with time frames of one year or less are ________-term plans.

Answers

Plans with time frames beyond five years are long-term plans, while plans with time frames of one year or less are short-term plans.

Long-term plans are generally used by businesses to help them achieve their long-term goals.A long-term plan provides a company with a framework for achieving its long-term goals. It's a strategy that includes goals, a timeline, and a plan for achieving those goals. Short-term plans, on the other hand, are typically more tactical. They focus on the immediate needs of the company and are designed to address short-term issues that may arise.The length of a plan's time frame is critical in determining its level of detail. Long-term plans must be comprehensive and detailed, whereas short-term plans can be more concise and focused. Short-term plans are frequently revised or modified to reflect changes in the company's environment, whereas long-term plans are reviewed less frequently and only adjusted if the company's circumstances change.Long-term plans require a long-term outlook and the ability to forecast trends and patterns. In contrast, short-term plans are usually based on current trends and patterns, and they are frequently revised as circumstances change. Long-term plans necessitate a higher level of investment and are therefore riskier than short-term plans.

For more such questions on term plans

https://brainly.com/question/15321481

#SPJ11

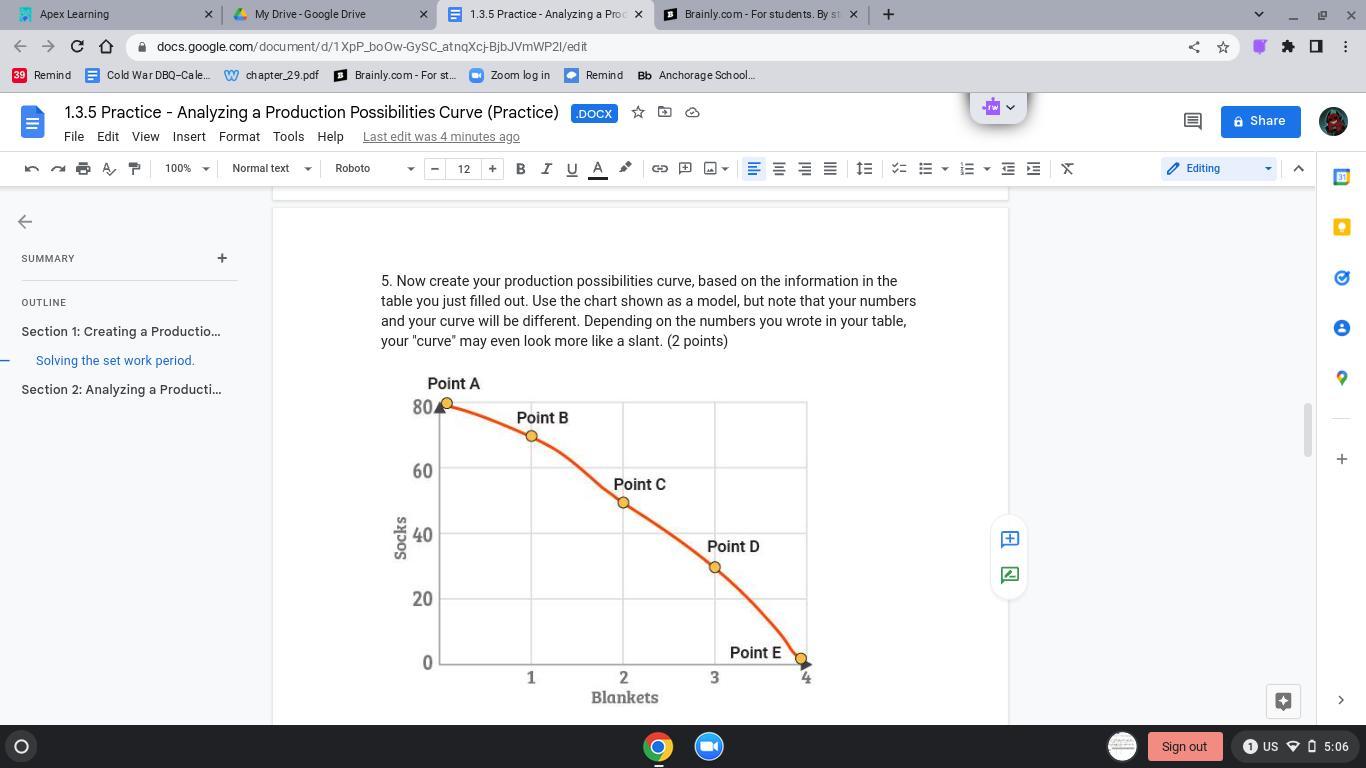

5. Now create your production possibilities curve, based on the information in the table you just filled out. Use the chart shown as a model, but note that your numbers and your curve will be different. Depending on the numbers you wrote in your table, your "curve" may even look more like a slant. (2 points)

Answers

Two units—blankets and socks—are depicted in the production possibilities curve model. However, in relation to another illustration, coffee and sugar.

What is production possibilities curve?

A production possibility curve essentially depicts two items graphically. The "production possibility frontier" is another name for PPC.

Underutilization of resources and technology is demonstrated by the production possibilities curve model. One unit is added while another is sacrificed on the production possibilities curve. Levels are displayed at various places.

The PPC is a useful tool for demonstrating the ideas of scarcity, opportunity cost, efficiency, and economic development and contraction. The downward slope of the concave shaped.

As a result, production possibility curve model is two different commodities such as sugar and coffee.

Learn more about on production possibility curve, here:

https://brainly.com/question/15179228

#SPJ1

When an orginization's size increases, its complexity ______. a) increases. b) decreases

Answers

When an organization's size increases, its complexity generally a) increases. This is because there are more layers of hierarchy, communication channels, and processes involved as the organization expands.

When an organization's size increases, its complexity generally increases. As an organization grows in size, it typically becomes more intricate due to a variety of factors. Firstly, there are more people involved, leading to increased coordination and communication challenges. More departments and divisions are established, adding layers of hierarchy and decision-making processes.

The number of interdependencies and interactions among different parts of the organization also increase, making it more complex to manage. Additionally, larger organizations often operate in multiple locations or serve diverse markets, introducing additional complexities in terms of logistics, operations, and market dynamics. Therefore, the expansion of an organization's size tends to bring about a corresponding increase in complexity, requiring effective management strategies and systems to maintain organizational effectiveness.

Learn more about organization's here:

https://brainly.com/question/28097781

#SPJ11

Financial literacy includes information about income, banking, loans, and credit cards.

True

False

Answers

you are analyzing a process with an average activity time of 1 minute and an interarrival time of 10 seconds. there are 7 servers and cva is 1.3 and cvp is .80. what is the average total flow time?

Answers

The answer is the average total flow time is 35.39.

How to find?We need to calculate the average total flow time. The formula to calculate the average total flow time is as follows:$$\text{Average Total Flow Time} =\text{Average Waiting Time} + \text{Average Service Time}$$Where,$$\text{Average Service Time} = \text{Average Activity Time}\div\text{Number of Servers}$$The given average activity time of the process is 1 minute, i.e., 60 seconds.

Number of servers = 7Average service time = 60 / 7 = 8.57 seconds.

The average interarrival time is 10 seconds. Therefore, the arrival rate (λ) is,$$\lambda = 1 / \text

{Interarrival Time}=1 / 10=0.1$$.

The Coefficient of variation for processing time is given as cvp = 0.8.

The Coefficient of variation for arrival time is given as cva = 1.3.

Using the following formula, we can calculate the average waiting time:

So, let's calculate utilization.$$\text{Utilization} = \lambda \times\text{Average Service Time}\times\text{Number of Servers}$$$$= 0.1 \times 8.57 \times 7$$$$= 6$$Now, let's calculate the average waiting time.

$$\text{Average Waiting Time} =\frac{\text{Co-efficient of Variation of Service Time}^2+\text{Co-efficient of Variation of Interarrival Time}^2}{2(1-\text{Utilization})}\times\text{Average Service Time}

$$$$=\frac{0.8^2+1.3^2}{2(1-6/7)}\times 8.57$$$$= 26.82$$.

Finally, average total flow time is given as, $$\text{Average Total Flow Time} =\text{Average Waiting Time} + \text{Average Service Time}$$$$= 26.82 + 8.57$$$$= 35.39$$.

Hence, the average total flow time is 35.39.

To know more on average total cost visit:

https://brainly.com/question/15071280

#SPJ11

g if the tax multiplier is -1.5 and a $200 billion tax increase is implemented, what is the change in gdp, holding everything else constant? (assume the price level stays constant.)

Answers

If the tax multiplier is -1.5 and a $200 billion tax increase is implemented, then we can calculate the change in GDP by multiplying the tax multiplier by the tax increase. In this case, -1.5 x $200 billion = -$300 billion.

This means that the change in GDP would be a decrease of $300 billion, holding everything else constant. The reason for this is that when taxes increase, people and businesses have less money to spend and invest, which leads to a decrease in aggregate demand and a decrease in GDP.

It's important to note that this calculation assumes that the price level stays constant, meaning that there is no inflation or deflation. If the price level were to change, then the calculation would need to be adjusted accordingly.

To know more about tax multiplier, visit:

https://brainly.com/question/31090551

#SPJ11

a trade ______ occurs when imports exceed exports.

Answers

Answer:

goes good and you could get stuff out of it

in the world of business, competition and cooperation seldom coexist.

Answers

In the world of business, competition, and cooperation often coexist rather than being mutually exclusive.

Contrary to the notion that competition and cooperation cannot coexist in the business world, it is common to find examples where both concepts are intertwined.

While competition refers to the rivalry among businesses to gain market share and outperform each other, cooperation involves collaborative efforts between businesses to achieve common goals and mutual benefits.

In many industries, businesses recognize the benefits of collaboration and engage in cooperative activities such as strategic partnerships, joint ventures, and industry-wide initiatives.

These collaborations can lead to various advantages, including shared resources, cost reduction, knowledge sharing, innovation, and expanded market opportunities. By working together, businesses can leverage their strengths and complement each other's weaknesses, leading to overall industry growth and development.

At the same time, competition remains a driving force in the business world. It incentivizes businesses to improve their products, services, and operations and drives innovation and efficiency.

Competition fosters a dynamic environment where businesses strive to differentiate themselves and offer better value to customers.

Overall, while competition and cooperation may sometimes appear as conflicting concepts, they are often interwoven in the complex landscape of the business world. Successful businesses understand the importance of both competition and cooperation and find ways to navigate and leverage these dynamics to achieve sustainable growth and success.

learn more about market share here

https://brainly.com/question/31233079

#SPJ11

What is an example of a common part of a company's brand that would be represented in television

commercials?

Answers

Answer:

logos, product, company's name, :DDD and endorsers

the return of earnest money in the event that the transaction is not going to take place requires that

Answers

When a buyer provides a deposit to the seller to demonstrate their intent to purchase a property, the money is referred to as earnest money.

If the transaction fails to close, the earnest money may be returned to the buyer or forfeited to the seller. Earnest money is typically returned to the buyer if a contingency, such as financing or inspection, is not met. In such cases, the contingency release form, which outlines the terms and conditions of the contingency, must be completed by the parties involved.

If the buyer fails to comply with the terms of the contingency release, the earnest money may be forfeited. In other circumstances, if the transaction fails to close, the buyer may lose their earnest money. If the seller terminates the contract due to a breach on the part of the buyer, such as failure to pay or breach of the purchase agreement, the seller may retain the earnest money deposit as damages.

When the buyer breaches the purchase agreement, the seller may also have the option of suing for additional damages. A buyer's earnest money deposit may be protected in certain circumstances.

In some jurisdictions, the deposit must be placed in an escrow account, which ensures that the funds are not disbursed until the conditions specified in the contract are met. The terms of the escrow account may be detailed in the contract or in state law.

for more such questions on money.

https://brainly.com/question/24179665

#SPJ11

Smart Twalifishiba, a Second year Engineering student on industrial break, walks into the office of the serious looking and intimidating Production Engineer, Clever Hanonosense, who barks" I want you to quench a thick sectioned piece of steel to the extent that it forms martensite uniformly". To Smart's surprise however much he tries he can not form martensite.

(a) Assuming he is doing the right thing explain his dilemma. [5marks]

(b) If he is now given a choice to pick another piece of steel from various, well labelled thick sectioned pieces of steels that Hanononsense keeps neatly stacked in his office, which steels, in your opinion, should he go for and why would this make a difference if any?

(c) Describe in detail the test that Smart would carry out to prove the effectiveness of his quench.

Answers

Smart should select a steel with alloying elements such as chromium, molybdenum, and nickel, as they enhance hardenability.

(a) smart's dilemma arises from the fact that despite his efforts, he is unable to form martensite uniformly in the thick sectioned piece of steel. this can be attributed to the limitations of the steel's composition and the quenching process itself. martensite formation requires rapid cooling of the steel from the austenitic phase to below the martensite start temperature. however, thick sections of steel pose challenges in achieving uniform cooling rates throughout the entire section.

when cooling a thick section of steel, the outer layers cool faster than the inner layers due to heat dissipation. this creates temperature gradients within the steel, resulting in non-uniform cooling rates. as a result, some areas may cool too slowly, leading to the formation of undesired microstructures like bainite or pearlite instead of martensite. non-uniform cooling can also cause internal stresses and distortion, further complicating the formation of martensite.

(b) to improve the chances of forming martensite uniformly, smart should choose a steel with enhanced hardenability. hardenability refers to the ability of a steel to be hardened throughout its entire cross-section. steels with higher hardenability exhibit a slower transformation from austenite to martensite, allowing for more uniform cooling rates in thick sections. these alloying elements promote the formation of a finer and more uniformly distributed microstructure, leading to improved martensite formation.

(c) to test the effectiveness of his quench, smart can perform a hardness test. he would first need to prepare samples from different regions of the quenched steel, including the surface and various depths within the section. the hardness test involves pressing an indenter into the surface of the sample and measuring the resistance to indentation.

smart can use a rockwell hardness tester or a vickers hardness tester for this purpose. by comparing the hardness values obtained from different regions of the sample, he can assess the uniformity of martensite formation. if the hardness values are consistent across the different depths, it indicates that martensite has formed uniformly.

additionally, smart can also perform a metallographic examination by preparing thin sections of the quenched steel. these thin sections can be observed under a microscope to determine the presence and distribution of martensite and other microstructural constituents.

by conducting these tests, smart can gather empirical evidence to evaluate the effectiveness of his quench and identify any areas that may require improvement to achieve uniform martensite formation.

Learn more about evaluate here:

https://brainly.com/question/20067491

#SPJ11

In general Accounts are split into Personal Accounts and ImpersonalAccounts

True

False

Answers

Answer:

True.

Explanation:

Financial accounting is an accounting technique used for analyzing, summarizing and reporting of financial transactions like sales costs, purchase costs, payables and receivables of an organization using standard financial guidelines such as Generally Accepted Accounting Principles (GAAP) and financial accounting standards board (FASB).

Thus, it is a field of accounting involving specific processes such as recording, summarizing, analysis and reporting of financial transactions with respect to business operations over a specific period of time. Financial experts or accountant uses either the cash basis or accrual basis of accounting.

An account can be defined as a formal and individual record of the financial transactions of a person, business firm, goods, assets, liability, etc.

All the transactions with respect to a particular item such as income, expenses, assets, liability, etc., are recorded in its account.

In general, accounts are split or divided into two main categories and these includes;

I. Personal Accounts

II. Impersonal Accounts.

There are several measures of variability with each measure providing its own unique version of information that helps to describe the diversity of responses. Which of the following is NOT one of those measures of variability?

Mode

Answers

In the following question, among the given options, The "mode" is NOT a measure of variability.

The mode is a measure of central tendency, which represents the most frequently occurring value in a dataset.

Measures of variability, on the other hand, describe the spread or dispersion of data points within a dataset. Examples of measures of variability include range, variance, and standard deviation.

The other measures of variability include range, variance, and standard deviation. Mode is a measure of central tendency that describes the most frequently occurring value in a dataset. It is not a measure of variability as it does not provide information about the spread of the data. Instead, it only describes the value that appears most often.

For more such questions on variability

brainly.com/question/17245220

#SPJ11

Match each law with its correct description.

Answers

Answer:

Not too sure but I think it goes 1.Fair credit billing act 2.Credit CARD act 3.Uniform commercial code 4.Truth in lending act.

Match the law terms and definition:

Truth in Lending Act - requires lenders to establish standardized disclosures regarding terms and how they calculate fees.

Through the meaningful disclosure of loan conditions, which enables customers to evaluate standardized credit terms more easily and intelligently, the Truth in Lending Act (TILA) aims to safeguard consumer protection and promote competition among financial institutions.

Match the law terms and definition:

Truth in Lending Act - requires lenders to establish standardized disclosures regarding terms and how they calculate fees.Fair Credit Billing Act: allows consumers to exercise their rights regarding disputes and billing errors.Uniform Commercial Code: a set of laws that govern US commercial transactions.Credit CARD Act: prohibits unfair and abusive credit practices and ensures the transparency of fees.As a result, the significance of the law terms and definition are the aforementioned.

Learn more about on Truth in Lending Act, here:

https://brainly.com/question/30386250

#SPJ5

HELP ASAP!!!!!! Which of the following is true of bureaucratic

organizational structures? Choose all that apply.

They are hierarchical.

They are common to small businesses.

Roles are undefined.

Responsibilities are defined.

Tasks are usually standardized.

Answers

They are hierarchical.

They are common to large corporations.

Responsibilities are defined.

Tasks are usually standardized.

A pyramidal command structure is characteristic of a bureaucratic organization. The bureaucratic structure is well-organized, and it operates with a high degree of formality.

The Options which are correct are a,b,d and e.

Reasons for the same are:

Option A is correct as yes they are hierarchical in nature as The organization is hierarchical, which means there are clearly defined levels of management, with lower levels reporting to higher levels and higher levels reporting to lower levels. Option B is correct as the bureaucratic organization is the system which is commonly used in small companies. Option D is correct as defined responsibilities are one of the characteristics of a bureaucratic organization. Option E is correct as Tasks in the bureaucratic organization are standardized.Option C is incorrect as roles in the bureaucratic organization are defined.

A bureaucrat's job is to put government policy into action, to put laws and decisions made by elected authorities into practice. Public administration is the process of administering a government and providing services through policy execution.

Thus Option A, B, D and E are correct options.

For more information about bureaucratic organization refer to the link:

https://brainly.com/question/14346682

Which of the following BEST represents democratic values?

a) the power to rule

b) equality among people

c) freedom to travel

d) the right to free books

can some one plss help me???

Answers

Answer:

B

Equality among all the people

Stephenson Limited produces a variety of products for the computing industry. The company’s CEO plans to produce a new product, WiFi router and asked the controller to prepare some information and be ready to meet with him to discuss about it. In preparing for the meeting, the controller accumulated the following data: Selling price of a router $1,250 Direct materials per router $270 Direct labour per router $130 Variable overhead per router $80 Total fixed costs $120,000

Required: a) Calculate the contribution margin per unit, break-even point in units and in sales dollar.

b) Calculate the number of units that must be sold and the amount of sales revenue to earn $300,000 of profit.

c) Calculate the break-even point in units and in sales dollar if the company were to reduce variable costs by $220 per unit by investing in technology resulting in an overall increase of $20,000 in total fixed costs? d) The CEO believes the company can increase sales by 50 units if advertising expense is increased by $31,000 based on the original data. Justify whether the company should increase advertising expenditure.

Answers

a) Contribution Margin per Unit: $770, Break-Even Point in Units: ≈ 155.84, Break-Even Point in Sales Dollars: ≈ $194,800.

b) Number of Units for $300,000 Profit: ≈ 584.42, Sales Revenue for $300,000 Profit: ≈ $730,525.

c) New Contribution Margin per Unit: $1,410, New Break-Even Point in Units: ≈ 94.33, New Break-Even Point in Sales Dollars: ≈ $117,912.50.

d) Additional Sales Revenue: $62,500, Contribution from Additional Sales: $38,500, Additional Advertising Expense: $31,000. Conclusion: Increase in advertising expenditure is justified as it would result in a positive contribution to profit.

a) To calculate the contribution margin per unit, break-even point in units, and break-even point in sales dollars, we need the following information:

Selling price per router: $1,250

Direct materials per router: $270

Direct labor per router: $130

Variable overhead per router: $80

Total fixed costs: $120,000

Contribution Margin per Unit:

Contribution Margin per Unit = Selling Price per Unit - Variable Costs per Unit

Contribution Margin per Unit = $1,250 - ($270 + $130 + $80)

Contribution Margin per Unit = $1,250 - $480

Contribution Margin per Unit = $770

Break-Even Point in Units:

Break-Even Point in Units = Total Fixed Costs / Contribution Margin per Unit

Break-Even Point in Units = $120,000 / $770

Break-Even Point in Units ≈ 155.84

Break-Even Point in Sales Dollars:

Break-Even Point in Sales Dollars = Break-Even Point in Units × Selling Price per Unit

Break-Even Point in Sales Dollars = 155.84 × $1,250

Break-Even Point in Sales Dollars ≈ $194,800

b) To calculate the number of units and sales revenue needed to earn $300,000 of profit, we need to consider the contribution margin per unit and total fixed costs:

Number of Units for $300,000 Profit:

Number of Units = (Total Fixed Costs + Desired Profit) / Contribution Margin per Unit

Number of Units = ($120,000 + $300,000) / $770

Number of Units ≈ 584.42

Sales Revenue for $300,000 Profit:

Sales Revenue = Number of Units × Selling Price per Unit

Sales Revenue = 584.42 × $1,250

Sales Revenue ≈ $730,525

c) If the company reduces variable costs by $220 per unit and incurs an additional $20,000 in total fixed costs, the new calculations would be:

New Contribution Margin per Unit = $1,250 - ($270 - $220 + $130 + $80) = $1,410

New Break-Even Point in Units = ($120,000 + $20,000) / $1,410 ≈ 94.33

New Break-Even Point in Sales Dollars = 94.33 × $1,250 ≈ $117,912.50

d) To determine whether the company should increase advertising expenditure, we need to consider the additional sales generated by the increased advertising and compare it to the additional expense:

Contribution Margin per Unit: $770

Additional Units Sold: 50

Additional Sales Revenue: 50 × $1,250 = $62,500

Contribution from Additional Sales = Additional Units Sold × Contribution Margin per Unit = 50 × $770 = $38,500

Additional Advertising Expense: $31,000

Since the contribution from the additional sales ($38,500) exceeds the additional advertising expense ($31,000), it would be justified for the company to increase advertising expenditure as it would result in a positive contribution to profit.

Please note that these calculations are based on the provided data and assumptions, and actual results may vary.

learn more about "Revenue ":- https://brainly.com/question/25102079

#SPJ11

income from continuing operations before tax $ 155 loss on discontinued operation (pretax) 32 temporary differences (all related to operating income): accrued warranty expense in excess of expense included in operating income 10 depreciation deducted on tax return in excess of depreciation expense 25 permanent differences (all related to operating income): nondeductible portion of entertainment expense 5 the applicable enacted tax rate for all periods is 25%. how much tax expense on income from continuing operations would be reported in hobson's income statement

Answers

Tax expense on income from the continuing operations tthat would be reported in Hobson's income statement is $46.25.

Tax expense is the amount of income tax owed by a company or an individual for a given accounting period. It is reported as an expense on the income statement and represents the amount of tax liability that the company or individual is expected to pay to the government based on their taxable income for that period. The tax expense is calculated by applying the applicable tax rate to the taxable income. The tax expense can be affected by various factors, including temporary and permanent differences between accounting and tax rules, tax credits, tax exemptions, and tax carryforwards.

To calculate the tax expense on income from continuing operations for Hobson's income statement, we'll need to consider the relevant components of taxable income and the applicable tax rate.

1. Start with income from continuing operations before tax: $155

2. Determine the net temporary differences: accrued warranty expense in excess of operating income ($10) + excess depreciation expense ($25) = $35

3. Adjust the income from continuing operations for the temporary differences: $155 + $35 = $190

4. Adjust for permanent differences (nondeductible portion of entertainment expense): $190 - $5 = $185

5. Apply the enacted tax rate of 25% to the adjusted taxable income: $185 * 0.25 = $46.25

So, the tax expense on income from continuing operations that would be reported in Hobson's income statement is $46.25.

to learn more about Tax visit-

https://brainly.com/question/26316390

#SPJ11

The regular way ex date, for a dividend paid to stockholders of record on friday, june 15th, is:_____.

a monday, june 11th

b. tuesday, june 12th

c. wednesday, june 13th

d. thursday, june 14th

Answers

The ex-date is typically set to be one business day before the record date. The first day the stock trades without the value of the dividend is known as the ex-date. If the record date is Monday, June 11, the preceding business day is Friday, June 8. The trade will settle AFTER the record date, or on Tuesday, June 12th, so if someone buys the stock on Friday, they won't be eligible for the dividend.

What is a stockholder?An individual or legal entity that is registered by the corporation as the legal owner of shares of the share capital of a public or private corporation is referred to as a shareholder. Members of a corporation are sometimes referred to as shareholders. When a person or legal entity's name and other information are entered in a corporation's register of shareholders or members, that person or legal entity becomes a shareholder in the corporation.Unless required by law, the corporation is not required or allowed to inquire as to the beneficial ownership of the shares. In most cases, a corporation cannot own its stock.Who are the stockholders, exactly?Any individual, business, or organization that has stock in a corporation is a shareholder. A shareholder of a firm may own just one share. As residual claimants on a company's profits, shareholders may be subject to capital gains (or losses) and/or dividend payments.Learn more about stockholders here:

https://brainly.com/question/18523103

#SPJ4

After using your forecasting model for six months, you decide to test it using a tracking signal. Here are the forecast and actual demands for the six-month period:

PERIOD FORECAST ACTUAL

May 440 505

June 490 535

July 540 405

August 605 495

September 655 665

October 680 605

Find the tracking signal.

Answers

To calculate the tracking signal, we first need to calculate the cumulative forecast error (CFE) for each period, which is the sum of the forecast errors up to that point:

CFE May = 505 - 440 = 65

CFE June = CFE May + (535 - 490) = 110

CFE July = CFE June + (405 - 540) = -25

CFE August = CFE July + (495 - 605) = -135

CFE September = CFE August + (665 - 655) = -125

CFE October = CFE September + (605 - 680) = -200

Next, we need to calculate the mean absolute deviation (MAD), which is the average of the absolute forecast errors:

MAD = (|65| + |45| + |135| + |110| + |10| + |75|) / 6 = 75

Finally, we can calculate the tracking signal by dividing the CFE for the last period by the MAD:

Tracking signal = CFE October / MAD = -200 / 75 = -2.67

Therefore, the tracking signal for the six-month period is -2.67. A tracking signal of -2.67 indicates that the forecast is slightly pessimistic and may need to be adjusted upwards in the future.

Learn more about forecast error

https://brainly.com/question/23983032

#SPJ4

Marissa owns a Chichi's Chicken Restaurant franchise and is able to compete in her local market because the franchisor shares the cost of her advertising. This is an example of _____ advertising.

Answers

Answer:

Cooperative.

Explanation:

Franchise is a license consisting of a contractual arrangement between a parent company (franchiser or franchisor) and another (franchisee), that allows individuals or an organization access to its knowledge, processes, trademarks in order to provide a service.

One of the main advantages of a franchise is that, franchisers such as Chichi's Chicken Restaurant do not require additional capital and development expenses to have their businesses being situated in a foreign market or country, as they only required to issue licenses to franchisors who are interested in being part of their business by paying a fee.

Advertisement refers to the promotional multimedia messages designed and developed to make the products or services of a company known to its customers and potential customers.

In this scenario, Marissa owns a Chichi's Chicken Restaurant franchise and is able to compete in her local market due to the fact that the franchisor shares the cost of her advertising. This is an example of cooperative advertising.

A cooperative advertising can be defined as a cost-effective advertising partnership in which the cost of a locally placed advert is shared between two or more parties such as manufacturer, wholesaler, retailer, franchisor, franchisee, etc.

Answer:

Cooperative

Explanation:

This is an example of Cooperative advertising.

A cooperative is an association of persons (organization) that is owned and controlled by the people to meet their common economic, social, and/or cultural needs and aspirations through a jointly-owned and democratically controlled business (enterprise).

Suppose the government taxes the wealthy at a higher rate than it taxes the poor and then develops programs to redistribute the tax revenue from the wealthy to the poor. This redistribution of wealth.

Answers

This redistribution of wealth: Is more equal but less efficient for society.

By "taxing the wealthy, you decrease their incentives to work, which are already more sensitive than their lower income counterparts due to the large negative income effect."

This reduces efficiency in the economy but increases equality by reducing the wages of the wealthy and giving the money to those with lower incomes.

This is known as The Robin Hood effect. "The Robin Hood effect is the redistribution of wealth from the rich to the poor. The Robin Hood effect can be caused by a large variety of government interventions or normal economic activity."

To learn more about redistribution of wealth click below

brainly.com/question/13451597

#SPJ4

Decision Point: Using the Association to Grow the Business Several months after starting the advertising campaign, you meet with the director again. She says, "Our consumers are finally associating our cookie with a good-tasting experience over time. We see this in increased sales as well." She continues, "We feel that we can use this newly forged association in the consumer's mind between the cookie brand name and good taste in other ways to help grow our business, but we're not sure how. I'd like you to come up with some ideas." Which of the following options is the best choice to use the brand and its association in the consumer's mind with good taste? Select an option from the choices below and click Submit. License the brand to another company to use on a potato chip. Develop a line extension using the brand on a chocolate chip cookie. License the brand to a company that wants to use it on their lower cost baked goods.

Answers

The best choice to utilize the brand and its association with good taste in the consumer's mind would be to develop a line extension using the brand on a chocolate chip cookie. Option B.

By developing a line extension, the company can leverage the positive association consumers have between the brand name and good taste to introduce a new product variant that aligns with their existing offerings. Chocolate chip cookies are a natural fit as they maintain the core essence of the original cookie while adding a popular flavor variation.

This allows the company to tap into the existing customer base who already associate the brand with good taste and provide them with a new product option to explore.

Introducing a line extension also provides an opportunity for the company to expand its market reach and capture new customers who may be attracted to the brand's reputation for quality and taste. By leveraging the positive brand association, the company can differentiate its chocolate chip cookies from competitors and establish a strong presence in the market.

On the other hand, licensing the brand to another company to use on a potato chip or licensing it to a company that wants to use it on their lower-cost baked goods may dilute the brand's association with good taste. Associating the brand with lower-cost or unrelated products could create confusion among consumers and weaken the brand's overall image.

Therefore, developing a line extension with a chocolate chip cookie aligns with the brand's existing identity, capitalizes on the positive association with good taste, and provides the company with the opportunity to expand its product portfolio while maintaining brand consistency and consumer loyalty. So Option B is correct.

For more question on consumer's visit:

https://brainly.com/question/29649674

#SPJ8

You open a new bank account at Eastside Savings. You see FDIC stickers around the bank, and the teller specifically mentions that Eastside

Savings is "FDIC Insured". A few months later, you hear on the radio that Eastside Savings is struggling to stay in business. Your savings balance

Is $500. What would happen to that money if Eastside Savings failed?

A.You could lose $250 since FDIC Insurance only covers 50% of the money you have deposited.

B.You would lose all of your money.

C.You would receive $250,000 since FDIC Insurance provides each account at the bank with $250,000 regardless of how much they

have deposited

D.You would receive all the money you have deposited at Eastside Savings since FDIC insurance covers accounts up to $250,000.

Answers

Answer:

The correct option is D. You would receive all the money you have deposited at Eastside Savings since FDIC insurance covers accounts up to $250,000.

Explanation:

Based on the information given what would happen to that money in a situation where Eastside Savings failed is that such individual would receive all the money he/she have deposited at Eastside Savings reason been that FDIC which is fully known as FEDERAL DEPOSIT INSURANCE CORPORATE insurance covers accounts up to the amount of $250,000 and Secondly Eastside Savings is "FDIC Insured".

If a commercial property has an annual NOI of $116,000 and you purchase the property using a market rate of 6.25% what is the purchase price of the property.

Answers

Summary: The purchase price of a commercial property can be calculated using the annual net operating income (NOI) and the market rate. In this case, with an annual NOI of $116,000 and a market rate of 6.25%, the purchase price can be determined.

Explanation:

To calculate the purchase price of the property, we can use the formula:

Purchase Price = NOI / Market Rate

Substituting the given values:

Purchase Price = $116,000 / 0.0625

Simplifying the calculation:

Purchase Price = $1,856,000

Therefore, the purchase price of the property is $1,856,000.

The purchase price is determined by dividing the annual net operating income (NOI) by the market rate. The market rate represents the desired rate of return for the investor. In this case, the market rate is 6.25%. By dividing the annual NOI of $116,000 by the market rate (0.0625), we calculate the purchase price of $1,856,000. This means that at a 6.25% market rate, the property's expected annual income of $116,000 justifies the purchase price of $1,856,000.

Learn more about annual net operating here:

https://brainly.com/question/4423692

#SPJ11

a. Is the goal of Six Sigma realistic for services such as Blockbuster Video stores or Redbox DVD kiosks?

b. Business writer Tom Peters has suggested that in making process changes, we should "Try it, test it, and get on with it." How does this square with the DMAIC / continuous improvement philosophy?

200 words TOTAL

Answers

a. The goal of Six Sigma may not be realistic for service-based organizations like Blockbuster Video or Redbox DVD kiosks due to the higher degree of variability and human interaction involved.

b. Tom Peters' suggestion of "Try it, test it, and get on with it" may not fully align with the DMAIC/continuous improvement philosophy, as it emphasizes quick action over the structured and data-driven approach of DMAIC.

a. How realistic is Six Sigma for services?The goal of Six Sigma, which is to achieve near-perfect quality and efficiency by reducing process variation, may not be as realistic for services such as Blockbuster Video stores or Redbox DVD kiosks. Six Sigma was originally developed in the manufacturing industry, where it is easier to control and measure process variables. In services, the nature of the work often involves a higher degree of variability and human interaction, making it challenging to achieve the same level of precision.

While Six Sigma principles can still be applied to service-based organizations, the expectations and approach need to be adapted. Rather than striving for near-zero defects, the focus could be on improving customer satisfaction, reducing errors, and enhancing overall efficiency. Additionally, service organizations may need to consider factors such as customer preferences, employee training, and adaptability to changing demands, which are not as prevalent in manufacturing settings.

b. How does Tom Peters' approach differ from DMAIC?Tom Peters' suggestion of "Try it, test it, and get on with it" aligns with the spirit of experimentation and agility in business. It encourages organizations to quickly implement changes, gather feedback, and make adjustments based on the results. This approach can be beneficial for driving innovation, adapting to market dynamics, and seizing opportunities.

However, it may not fully align with the DMAIC (Define, Measure, Analyze, Improve, Control) methodology used in Six Sigma and continuous improvement. DMAIC emphasizes a structured and data-driven approach to problem-solving and process improvement. It involves thorough analysis, measurement, and control of processes to ensure sustainable improvements.

While "Try it, test it, and get on with it" promotes quick action, it may overlook the need for in-depth analysis and measurement of process performance. DMAIC, on the other hand, encourages a more systematic and rigorous approach to understand root causes, measure performance, and implement sustainable changes.

In summary, while Tom Peters' approach can be valuable for embracing agility and experimentation, it may need to be supplemented with the principles of DMAIC to ensure a comprehensive and data-driven continuous improvement philosophy.

Learn more about: Six Sigma

brainly.com/question/32721945

#SPJ11